File Photo: VCG

Technology giants from the Chinese mainland listed in Hong Kong's stock market reversed the recent plummet and rebounded sharply on Wednesday's trading after a special meeting, held by China's Financial Stability and Development Committee under the State Council, released positive signals to restore market confidence.

In response to recent concerns of delisting Chinese companies listed in the US, the meeting stressed that the relevant Chinese and US regulators have maintained good communication and made progress on specific cooperation schemes to resolve the problem while the Chinese government continues to support all types of enterprises to get listed overseas.

Buoyed by the news, Hong Kong's Hang Seng Tech index, which is closely linked to the US-traded Chinese share indicator, Nasdaq Golden Dragon China Index, gained as much as 22.2 percent on Wednesday. Alibaba in Hong Kong's market added 27.3 percent and JD.com raised 35.64 percent.

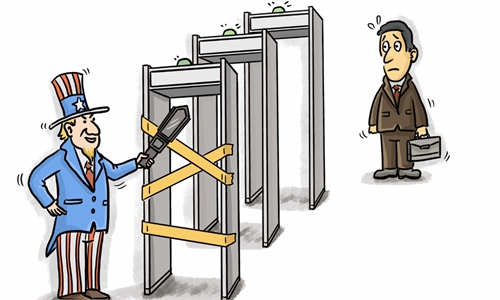

These stocks had suffered heavy losses over a sell-off triggered by an recent announcement of the US Securities and Exchange Commission (SEC), in which the US regulator named five Chinese companies that could face delisting if they do not hand over detailed audit documents.

As China-US tensions escalated due to Washington's unilateral moves in recent years, the US has been pushing tensions into the financial sector. While some politicians threatened with tougher rules or even a ban on Chinese companies from listing in the US, Washington has been demanding complete access to the books of US-listed Chinese companies.

A report by the US Public Company Accounting Oversight Board (PCAOB) last December claimed it "cannot inspect companies headquartered in the Chinese mainland and the Hong Kong Special Administrative Region."

In addition to the continuous arbitrary moves from the US regulator and politicians, US investment institutions and media outlets are also intensifying attacks on US-listed Chinese companies, all largely dimming the investment and listing outlook.

For instance, after JPMorgan Chase downgraded 28 Chinese internet stocks, including Alibaba, Tencent Holdings and Meituan, calling them "uninvestable," Chinese tech stocks plummet further deepened on Wednesday, with Hang Seng Tech index dropping 8.1 percent.

Responding to the false claims of PCAOB report, China's securities regulator in December stressed the country's stance and its efforts on China-US audit regulations and cooperation, noting that China is ready to communicate with the US on the issue at any time. It is believed that both sides will be able to find a cooperation path that meets each other's regulatory needs.

In response to the core concerns on this decline of China's stock market and US-listed Chinese stocks, the meeting of China's top financial affairs watchdog on Wednesday once again refuted rumors of financial decoupling between China and the US. The meeting also touched on the supervision over platform companies, which provides strong supports to the market confidence.

Many senior investors at home and abroad have said that this sharp decline in Chinese stocks is unexpected. They believe that despite the risk control trend from investors due to the conflict between Russia and Ukraine and the withdrawal of foreign capital, the recent sell-off is much worse than expected.

The latest decline in Chinese stocks is indeed rare and has seriously deviated from the solid fundamentals of the Chinese economy. With the support policies from relevant departments, the easing of uncertainties and China's continuous efforts to vigorously promote the development of the digital economy, Chinese tech listings will surely recover. The era of Chinese tech listings stocks is far from over.

For Wall Street, Chinese stocks have not only provided them with valuable listing resources, but also made significant contributions to their prosperity. Clamor from US politicians is only interrupting the pragmatic cooperation between Chinese companies and Wall Street. They should stop their disruption of normal market mechanisms. It is hoped that US regulators can maintain communication with the Chinese side to reach solutions instead of taking more actions that may cause confusion in the market.