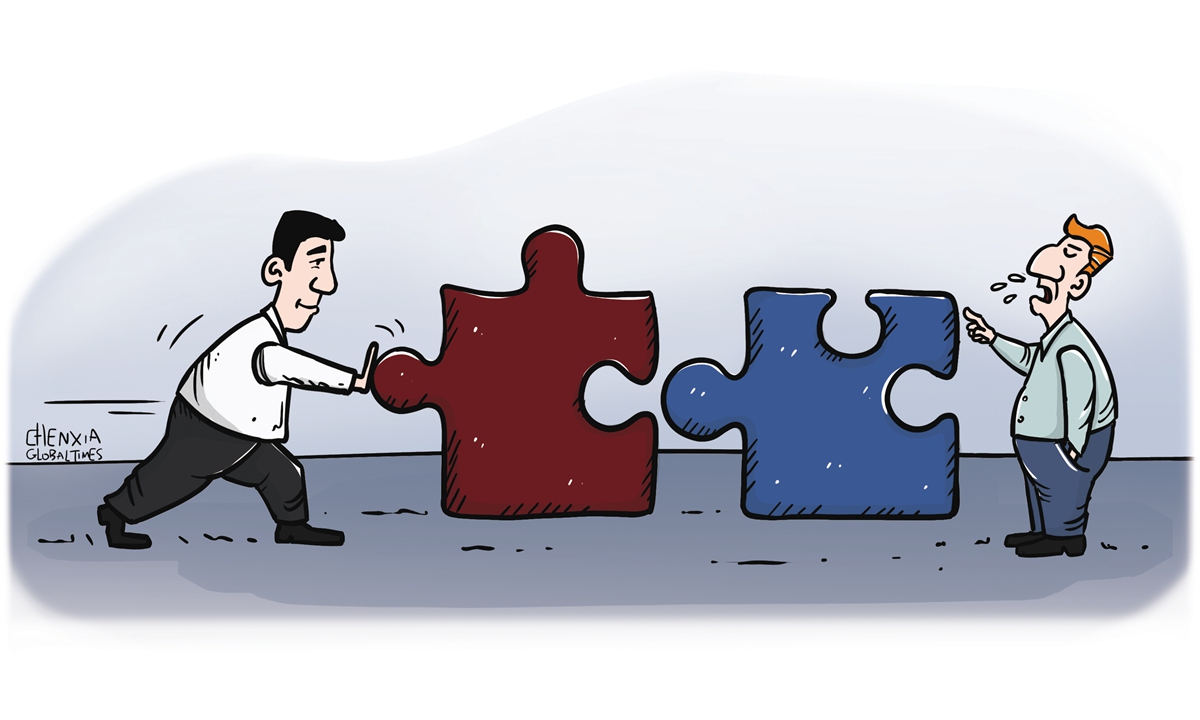

Illustration: Chen Xia/Global Times

Just as a glimmer of hope emerges for talks between Chinese and US regulators to address auditing issues that has greatly lifted market sentiment, the US again sent new mixed signals regarding US-listed Chinese companies.The US Securities and Exchange Commission (SEC) on Wednesday added Weibo Corp, a leading Chinese social media platform, to its notorious watch list of companies that may be forced to delist, citing the so-called Holding Foreign Companies Accountable Act, which passed last year.

Weibo is now the sixth Chinese company that has been added to the list and faces delisting risks, and more Chinese businesses could face similar US actions ahead of April earnings season. Needless to say, this is rather a dissonant move that may cast a shadow over the ongoing efforts to resolve the dispute in a mutually beneficial way.

China has taken a constructive attitude toward promoting dialogue and cooperation in resolving the issue. At a key meeting on March 16, the State Council's Financial Stability and Development Committee noted that Chinese and US regulators have maintained positive communication and has made positive progress in reaching a cooperation plan. Since that meeting, Chinese regulators have also struck similar tones on the China-US audit talks.

However, China's positive approach toward addressing an issue of mutual interests should not be viewed as leverage for the US. To resolve this issue, which affects not only Chinese firms but also US investors, Washington must also show good faith in working with China to find a reasonable solution, instead of further escalating tension.

Some in the US have been promoting a so-called financial decoupling, but such a politically motivated attempt is not in the US' own interests. Despite its massive financial market, the US also needs leading Chinese enterprises to list there, which boosts US markets and benefits US investors. Increasing US investment into Chinese stocks fully reflects this.

Despite rising hurdles and a recent slump in prices, some US financial institutions have doubled down on investing in Chinese stocks. For instance, Bridgewater Associates continued to increase its holdings of Chinese stocks in the fourth quarter of 2021, with its holdings of Pinduoduo, JD.com and Alibaba increasing by about 30 percent.

From another perspective, the losses in share prices of Chinese companies as a result of the US' crackdown also mean losses for US investors. Some Chinese companies have seen their share prices fall as much as 50 percent since 2021, not because of their business conditions but because of the regulatory risks. It is hard to believe that such a scenario is happening in the world's leading financial market, which has been flaunting its inclusive.

Meanwhile, as US investors are obviously bearing the brunt of nose-diving Chinese stocks, Chinese companies are believed to have learned a lesson with regard to listing overseas. In order to avoid future political risks, Chinese firms are advised by some financial institutions to explore other listing options. Such a trend is also certainly not good for the long-term development of US stock markets.

The bottom line is: A China-US "financial decoupling" is in no one's interests. Fortunately, there still appears to be willingness from both sides to continue dialogue and find a solution to the auditing dispute. It is hoped that the two sides can refrain from further escalating tensions and meet each other half way to make a suitable arrangement.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn