China's State Council stresses support for real economy as outlook dimmed by COVID-19

GDP Photo:VCG

With the resurgence of COVID-19 outbreaks across China since March weighing on the outlook for economic growth, Chinese officials and experts on Wednesday called for more robust fiscal and monetary support and other measures to help affected businesses and stabilize economic operations.

Economists have maintained confidence in the country's dynamic zero-COVID policy, and they expect the fallout of the new flare-ups on full-year growth to be well under control. Still, the government could consider a stronger aid package for the worst-hit parts of the economy, they said, suggesting delayed loan payments, among other measures.

Keeping the economic operation within a reasonable range means basic stability of employment and price levels, according to a State Council executive meeting on Wednesday.

Monetary policy tools would be deployed at an opportune time to more effectively prop up real economic development, the meeting said. It called on all government departments to consider policy preparedness plans and roll out measures to stabilize market expectations.

The National Development and Reform Commission (NDRC), the country's top economic planner, recently held a video symposium on the first-quarter economic situation, where experts and industry associations offered input on the economic hardships and measures used to respond to the current challenges, the Economic Information Daily reported on Wednesday.

Local development and reform commissions held similar meetings, which signaled the economy got off to a good start in the first quarter, despite facing substantial pressure in economic stabilization due to the COVID-19 flare-ups and external factors, the daily reported. Efforts to ensure steady growth of the factory sector, stabilize investment and support businesses will top the agenda, it said.

First-quarter GDP growth undoubtedly took a hit from virus-battling efforts in Shanghai, Shenzhen and other economically weighty cities and regions, Tian Yun, a Beijing-based economist, told the Global Times on Wednesday.

Major economic indicators, including exports and imports, investment and retail sales, beat market estimates for the first two months, official data showed. The evolution of the pandemic throughout March and external uncertainties such as the Ukraine situation, nonetheless, dampened the recovery prospects for the economy.

In a fresh sign of the pandemic's shockwaves throughout the economy, the Caixin China General Services Business Activity Index was announced on Wednesday to have shrunk to 42 in March from 50.2 in February. The March reading was the weakest since February 2020.

"Both supply and demand in the services sector contracted sharply after the latest wave of COVID-19 outbreaks started to take off in early March," Wang Zhe, senior economist at Caixin Insight Group, said in a statement sent to the Global Times on Wednesday.

If the epidemic situation in the country's financial hub can be brought under control within this month, it's estimated that the outbreaks will erode full-year GDP growth by 0.2 percentage points, Tian said.

The World Bank on Monday ratcheted down its 2022 growth projection for East Asia and the Pacific, including China, to 5 percent, lower than its 5.4 percent forecast in October.

China, making up 86 percent of regional output, "is projected to grow 5 percent in the baseline and 4 percent in the downside scenario," said the Washington-based lender, citing the viral resurgence.

Between March 1 and April 5, the country's cumulative confirmed domestic infections hit 176,455, involving 29 provincial level regions, data from the National Health Commission (NHC) showed on Wednesday.

Along with the effective implementation of COVID-19 containment measures since mid-March, three of the five severely hit locations - South China's Guangdong Province, East China's Shandong Province and North China's Hebei Province - have seen signs of a turn for the better. The situation remains in progress in Shanghai and Northeast China's Jilin Province, according to the NHC.

The caseload in Shanghai is at peak times, with cumulative infections topping 90,000, the NHC disclosed, calling attention to the spillover of the city's cases to multiple other provinces and cities.

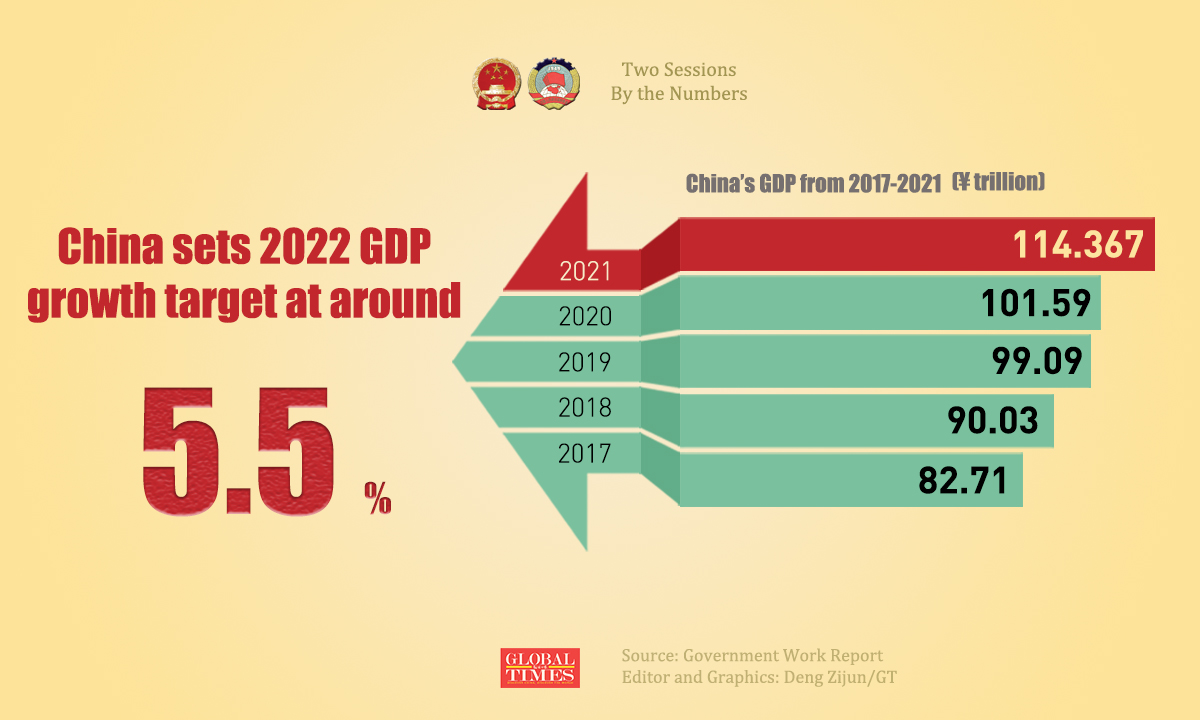

As the country holds to a dynamic zero-COVID approach, if the annual GDP growth target of around 5.5 percent is to be achieved, more vigorous fiscal and monetary support should be in the pipeline, Tian advised, noting that the country still has sufficient leeway in easing fiscal and monetary policies.

China sets 2022 GDP growth target at around 5.5 pct

General fiscal revenues grew 10.5 percent year-on-year to 4.62 trillion yuan ($726.1 billion) in the first two months, per data from the Ministry of Finance. Meanwhile, general public expenditures were up 7 percent to 3.82 trillion yuan, implying a fiscal surplus.

Besides abundant fiscal ammunition in the forms of central government and local government bonds and special-purpose bonds, the country has thus far been restrained in monetary easing, economists said.

While it makes sense to maintain a prudent monetary policy amid the ongoing cycle of rate hikes by the US Federal Reserve, real interest-rate differentials ought to make the case for China to announce a cut in reserve requirements as soon as possible, Tian said.

China's consumer inflation is unlikely to have exceeded 1 percent during the first quarter, while the US inflation rate almost certainly surpassed 7 percent for the first quarter, he said.

Reduced reserve requirements can pave the way for banks to offer more help to embattled consumers and businesses.

Households and companies hard hit by the pandemic deserve deferrals of loan repayments, Tang Jianwei, chief researcher at the Financial Research Center of Bank of Communications in Shanghai, told the Global Times on Wednesday.

Also, the government should boost investment in infrastructure projects, including renewable energy facilities to weather the headwinds, Tang said. The bank maintained its 2022 growth forecast for the Chinese economy at 5 percent.

Other helpful measures include the allocation of funds by local governments to stimulate consumption and increased government procurement from smaller businesses in fields including anti-virus medical supplies to ensure their survival, Tian proposed.

Some Chinese banks have allowed people in areas severely affected by the epidemic to delay mortgage loan payments and offered credit support, while other banks have accepted requests from clients and are waiting further decisions, according to some media reports on Wednesday.