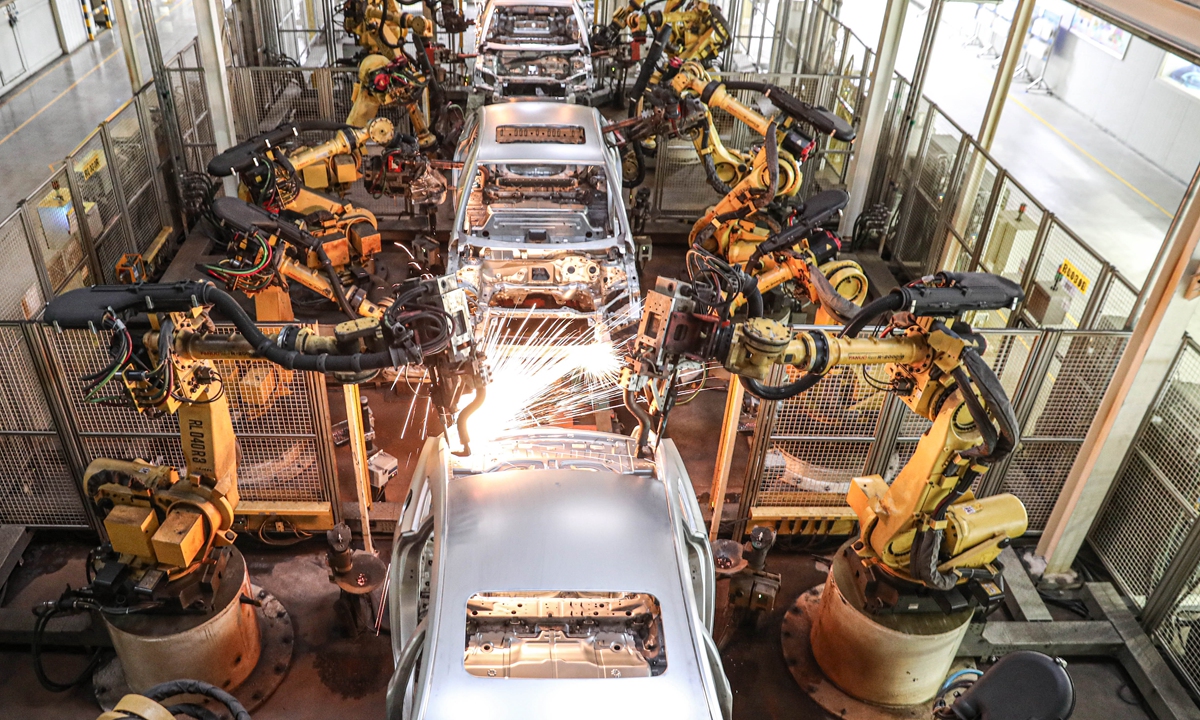

The automated production line at a car factory in Shenyang, Northeast China's Liaoning Province Photo: IC

The recent wave of Omicron outbreaks across China is sending shockwaves through vehicle industry chains, with auto parts manufacturers being forced to suspend some or all of their production lines to coordinate with the country's painstaking combat against the virus.

Their situation is leading car factories owned by both Chinese and overseas car brands like Nio and Tesla to halt production, industry sources and analysts told the Global Times. But analysts believe that the impact of the crisis will be limited on China's overall car consumption this year due to high demand.

According to Zhang Xiang, a research fellow at the Research Center of Automobile Industry Innovation of the North China University of Technology, Dublin-based APTIV told employees at one of its factories in Shanghai to go home for self-quarantine. The factory supplies products to leading carmakers, including Tesla and Ford.

APTIV didn't respond to a request for comment as of press time on Sunday.

Zhang also said that a number of auto parts makers in China have been forced by the coronavirus to halt production partly or entirely. The factories include a Bosch facility in Suzhou, which supplies millimeter wave radars, and a Webasto plant in Jilin, which supplies car sunroofs, he said.

The production halt has added to difficulties faced by car factories, as some have suspended work for lack of parts. For example, Chinese electric vehicle maker Nio said on Saturday that it had suspended production due to supply chain problems in different cities brought by the epidemic.

Mei Songlin, a senior auto industry analyst based in Shanghai, told the Global Times on Sunday that the auto industry is complicated, and without the presence of one component, deliveries cannot be completed.

"The current supply crisis has triggered more rethinking about the way cars are produced and assembled, such as whether it is practical for vehicle production to become more adaptable and flexible according to different situations, and whether some unnecessary decorations could be cut for the moment, then added after delivery," he said.

The situation became more complicated after Beijing detected coronavirus on some imported automobile parts on Saturday. Local authorities have carried out epidemiological investigations and close contact tracing of the infected and relevant products, officials announced.

Zhang said that the incident is unlikely to have much impact on China's car parts imports or relevant policies, as China's car parts import regulations, including the quarantine requirements, are already very "mature."

Besides being restricted by car parts supply shortages, car companies in coronavirus-affected areas are also shutting production lines to coordinate with local pandemic control policies.

For example, in Shanghai, which is still under citywide closed-loop management, US electric car giant Tesla has shut down production lines at its Shanghai plant for at least seven days so far. The company usually makes about 6,000 Model 3s and 10,000 Model Ys per week, Zhang said.

Tesla didn't offer information regarding its production status when contacted by the Global Times on Sunday.

Shanghai is home to a number of automobile plants, including Tesla, SAIC Volkswagen and Shanghai General Motors.

Some of those factories have tried to keep their production unbroken by using a closed-loop style, which means the employees remain in the factories to manufacture cars, Zhang said. Many workers were working extra hours, and some companies have booked hotels and kept their research work going for some time.

However, experts said that China's overall car sales won't be hurt much this year, because demand for electric cars is surging, and factories will be able to resume operations quickly, Wu Shuocheng, a veteran car analyst, told the Global Times.

Zhang predicted that the Omicron resurgence could cut car consumption in Shanghai and China by 5 percent and 2 percent, respectively, this year. Overall, car sales will still increase year-on-year because of strong demand, he said.