Syngenta Group

A decision by the Italian government to block the purchase of an Italian seed producer by a Chinese-owned firm undermines win-win cooperation among businesses from the two countries, Chinese experts said on Thursday.

The comment came after an Italian administrative court ruled that a government veto of the purchase of Italian vegetable seed producer Verisem by Switzerland-based Chinese-owned Syngenta was valid, according to a Reuters report.

The proposed acquisition was blocked last October by Italian Prime Minister Mario Draghi, using the special "golden power" rules that apply to attempts by non-EU groups to buy strategic companies, including banks and insurers.

Italian agriculture lobby Coldiretti said that Sygenta's move would have shifted to Asia the world's strategic balance in the control of seeds for vegetable and herb production, the Reuters reported.

Syngenta, which was bought by Chinese state-owned ChemChina for $43 billion in 2017, appealed in January to the administrative court after Italian government's blockage.

"We are disappointed by the court's decision… This decision does not impact Syngenta's existing business in Italy, where Syngenta maintains local teams and has been working with Italian growers for many years," the company said in the Reuters report.

Syngenta had not responded to the Global Times' enquiry as of press time.

China's seed research and development (R&D) capabilities have improved and its market share has steadily increased, but there is still a huge gap between domestic and foreign seed giants, so there should be no concern that China's catching up could pose any threat, experts said.

Li Xinhai, director of the Institute of Biology under the Academy of Agricultural Science, told the Global Times that China's seed enterprises have accelerated their overseas layout both technologically and industrially in recent years, with more than 20 enterprises having set up R&D institutions abroad.

"However, we still lack a commercialized seed breeding mechanism and a technological innovation system with clear intellectual property rights," Li noted.

China's seed industry is basically a duopoly formed by Syngenta and Yuan Longping High-Tech Agriculture Co, both ranking in the world's top 10 in terms of global sales.

The Syngenta takeover bid was not fully convincing backed with sufficient evidence, Zhao Junjie, a research fellow at the Chinese Academy of Social Sciences' Institute of European Studies, told the Global Times on Thursday.

"Normal business operations were engulfed in geopolitical pressure. There has been tightening scrutiny of Chinese firms' merger and acquisition bids," said Zhao.

Italy, being a big economy within the EU, is seen increasingly shielding its strategic assets from foreign acquisitions in recent years.

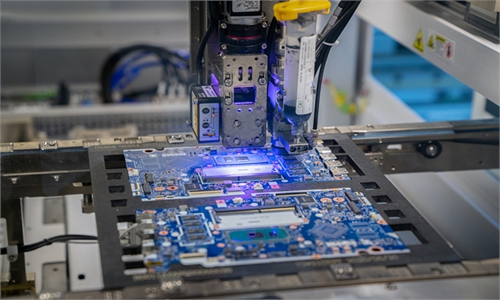

In April 2021, Rome prevented Chinese company Shenzhen Investment Holdings Co from buying a controlling stake in a Milan-based firm, producing semiconductor equipment.

"For Italian companies with multiple intellectual property rights that lack funds, it is a natural market choice to choose to cooperate with Chinese companies to explore the market potential," said Zhao, noting that could be a win-win result for both sides.