Illustration: Chen Xia/Global Times

There are clearer signs now that persistently high inflation linger in large swaths of the world and may stretch to the end of this year or even longer, eroding the living standards of billions of middle and low-income families. People often fret and agonize over the surging prices of many commodities, groceries and services, but they seldom seek answers as to what causes the hefty price rises.In most cases, inflation is self-correcting, meaning price swings in one segment, such as crude oil or grain, won't spill over to impact other sectors and form broader inflation trends.

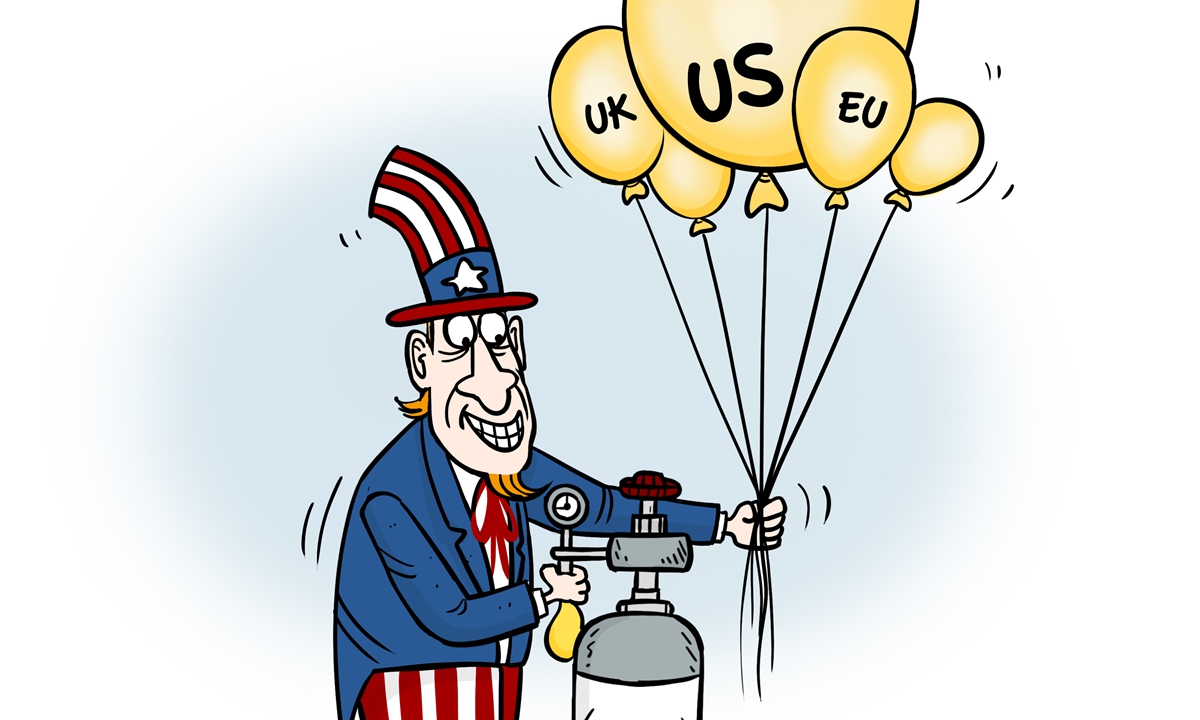

But the current round of global inflation is something different - it started in the US in the first half of 2021, triggered by the Biden administration's profligate $1.7 trillion fiscal spending plan, aggravated by the Federal Reserve's quantitative easing monetary policy, and being brought to and infected the world's other economies via the dollar-dominated global trade and financial settlement regime.

If economists look back at this century, they would find out a precedence of this type of global-level financial distress.

About 14 years ago, the highly irresponsible low-interest policy of former Fed chairman Alan Greenspan ignited the US' subprime loans meltdown and led to the 2008-09 global financial crisis, which imploded capital markets across continents, destroyed trillions in family savings and drove many major economies into the abyss.

However, policy-makers in the US seldom draw "bloodshed" lessons from the past, as they are always fond of indulging themselves in exuberance - creating financial market bubbles with ultra-low interest rates, together with trillions of dollars of printed money.

As the world's most important central bank, the Federal Reserve should have adopted a set of very prudent policy guidelines to manage the viability of the dollar, so that it won't cause financial quakes and send shockwaves to or trigger tsunamis to inundate other economies that are closely connected to the US'.

The fact is the Fed has kept pressing down the gas pedal over the past several years by sticking to the near-zero rates policy, hoping to achieve a quick economic recovery in the US from the COVID19 pandemic. The central bank also purchased a wide range of Treasury bonds and other securities-backed assets, pumping extraordinarily volumes of liquidity into financial markets, which has left a large imprint on the Fed's balance sheet - which has exploded to $9 trillion from less than $5 trillion five years ago.

As a result, inflation in the US started to raise its ugly head in early 2021 while Biden pushed Congress to approve his giant fiscal stimulus plans one after another. Since then the price hike has been inflamed by his administration. Last month, the US inflation surged to a fresh four-decade high of 8.5 percent from the same month a year ago. And, the country's rising prices have been unrelenting, with six straight months of inflation above 6 percent, well above the Fed's average two percent target.

To make things worse, the producer price index or PPI, which measures the prices of material supplies at factory gates, soared 11.2 percent last month, the fastest pace in 12 years, according to the US Department of Labor. Skyrocketing PPI has dented hopes that the inflation peaked in March, because PPI inflation will transmit to broader consumer market inflation one to two months later.

Exactly like the financial tsunami in 2008, the surge of inflation also began in the US and then spread to other parts of the globe, with the US dollar, the world's premium reserve currency, acting as the major medium. European Union member states average inflation hit 7.5 percent in March, up from 5.9 percent in February. Now, nearly all the world's developed economies and emerging markets are facing the assault of severe and protracted inflation, from Mexico and Brazil in Latin America to South Korea, Singapore and Australia in Asia-Pacific. Inflation is now over 5 percent in about 58 percent of all advanced economies.

An incomplete statistics showed that up to 70 percent of the countries and regions in the world are now experiencing inflation, with the price of food, energy, house rent, used cars, airplane flights, hotel rooms and other services all cranking up wildly. As a result, the livelihood of billions of people has become more difficult.

And, there are other man-made factors that have contributed to the global inflation, and they are originated in the US, too.

The US government's bid to contain China's economic growth by imposing high tariffs on $360 billion Chinese goods, and Washington's strict restrictions to curb semiconductors production in China has led to rising commodity prices, while at the same time caused a serious disruption of the world's supply chain. Bottlenecks in the supply of semiconductors have rippled far and wide as they occurred in items at the start of production chains, as the industrial microchips are needed to produce many other consumer goods.

And ironically, the current cycle of high and rising inflation readings have ramped up pressure on the US Federal Reserve to keep lifting interest rates in 2022 to dampen persistent price rises. The Fed is anticipated to raise rates by half a percentage point in May. The prospect of 200 or more basis-point rates hike in the US has already frightened other economies, because the Fed's sudden financial policy tightening will inevitably lure global capital back to the US. As a result, many developing economies will be severely battered.

But many governments cannot do anything. Because of the dollar's predominance in global financial system, many countries will have to follow the paradigm of the US, with their economies always swinging between a boom-bust cycle created by Washington.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn