Graphic:Deng Zijun/GT

China's GDP grew by 4.8 percent in the first quarter of 2022, topping market expectations and maintaining a stable growth even as the March economy was faced with "unprecedented downward headwinds since the first quarter of 2020" due to COVID-19 flare-ups, supply chain snags and external uncertainties arising from the Russia-Ukraine conflict.

Economic expansion in the first three months accelerated from the 4-percent growth in the fourth quarter of 2021, partly buoyed by manufacturing backbone and stratospheric infrastructure and property investment - a bright spot that had buffered subdued consumption and weakened factory output in the first quarter and is expected to buttress the full-year growth of the world's second-largest economy.

Observers estimated that if China's main financial center Shanghai "paused" for a month, its situation and knock-on effect on most vibrant manufacturing base Yangtze River Delta would likely undercut the country's annual GDP growth by 0.4 percentage points. They believe that the effect on growth could further deteriorate in April and May, with a rebound likely in June and the second half after the epidemic is brought under effective control and a raft of pro-growth measures, including the latest measures from the central bank to bolster the financial support to virus-affected regions and sectors, yield effect.

While Western media has been hyping the data to pack another punch against China's dynamic zero COVID-19 approach, economists and officials stressed short-term "static management" in metropolises like Shanghai won't translate into an everlasting shock. Though economic growth numbers in the first and second quarters are likely to cruise at around 5 percent, China's engine is "sailing on a voyage" with authorities mulling an all-out effort to anchor the annual goal of 5.5 percent in 2022.

In the first quarter, China's GDP reached 27 trillion yuan ($4.24 trillion), rising 1.3 percent on a quarter-on-quarter basis, according to data released by the National Bureau of Statistics (NBS) on Monday.

Other major economies have yet to release their first quarter GDP. The Federal Reserve Bank of Atlanta, based on its GDPNow model, estimated on April 14 that the US' real GDP growth in the first quarter was 1.1 percent on a quarter-to-quarter basis.

Graphic:Deng Zijun/GT

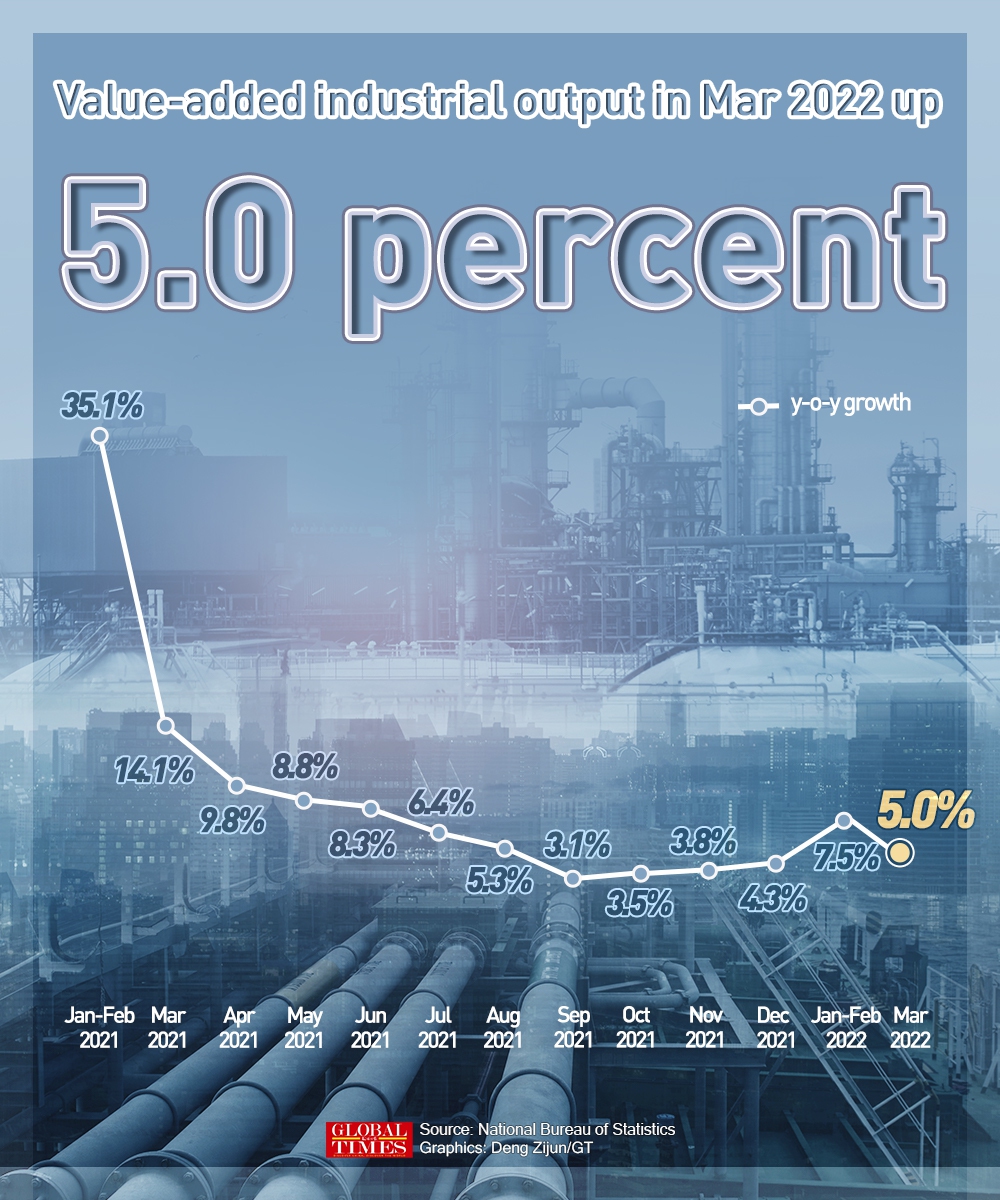

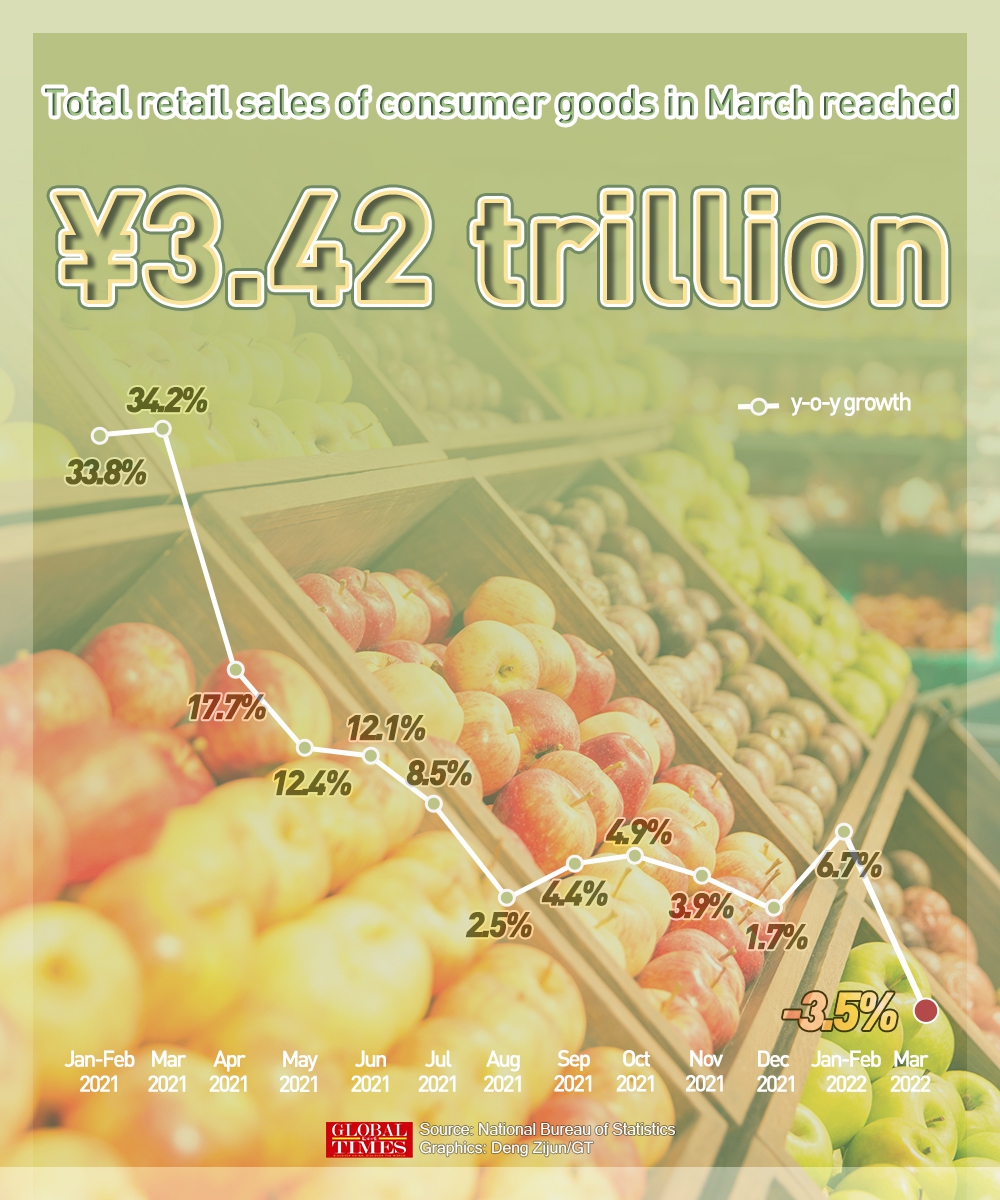

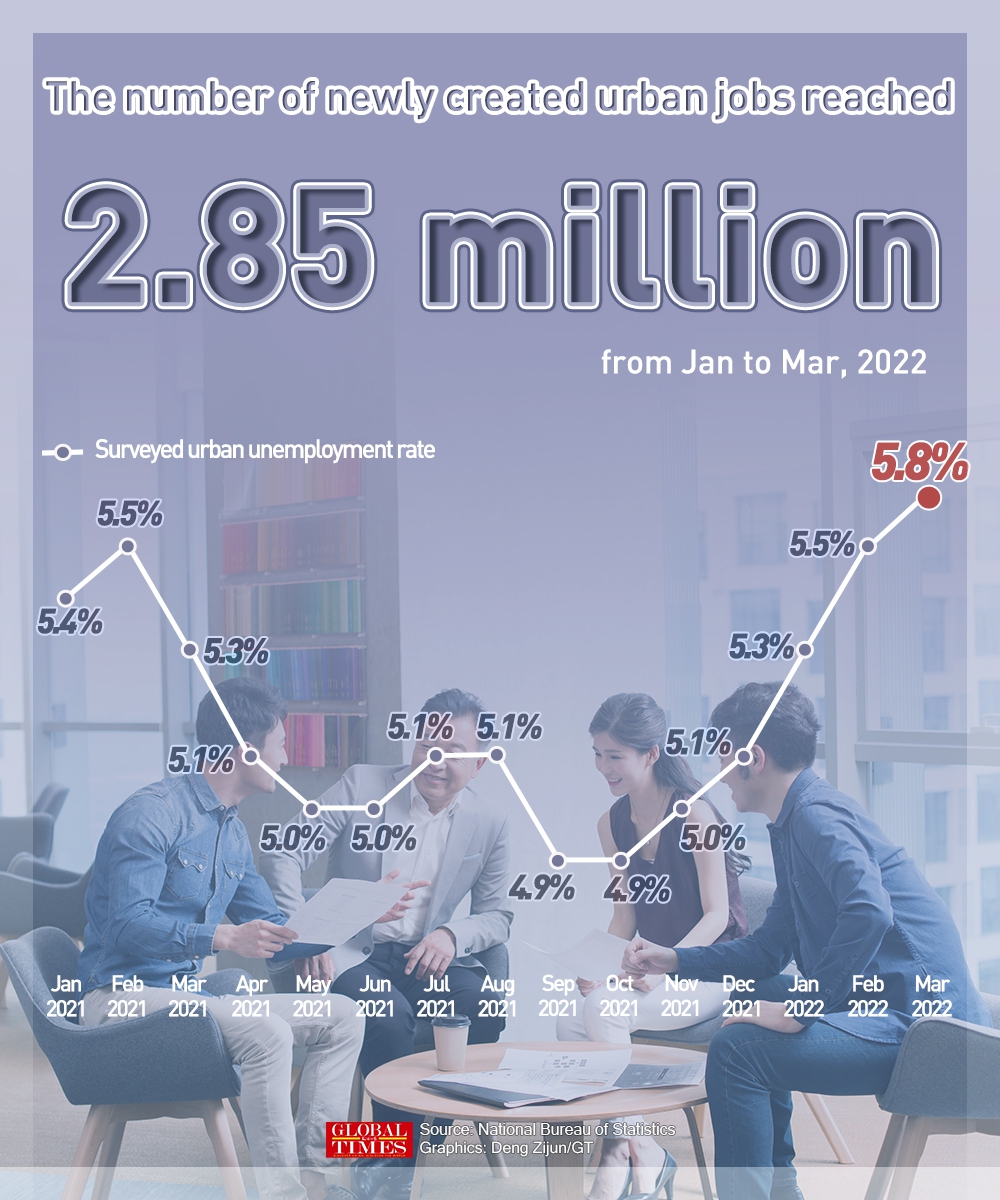

In March, China's industrial production rose by 5 percent, beating market expectations and slowing down from the 7.5 percent recorded in the January-February period. Retail sales, a main gauge of consumption, fell 3.5 percent in March from a year ago, the first contraction since August 2020, reversing a 6.7 percent rise in the January-February period.

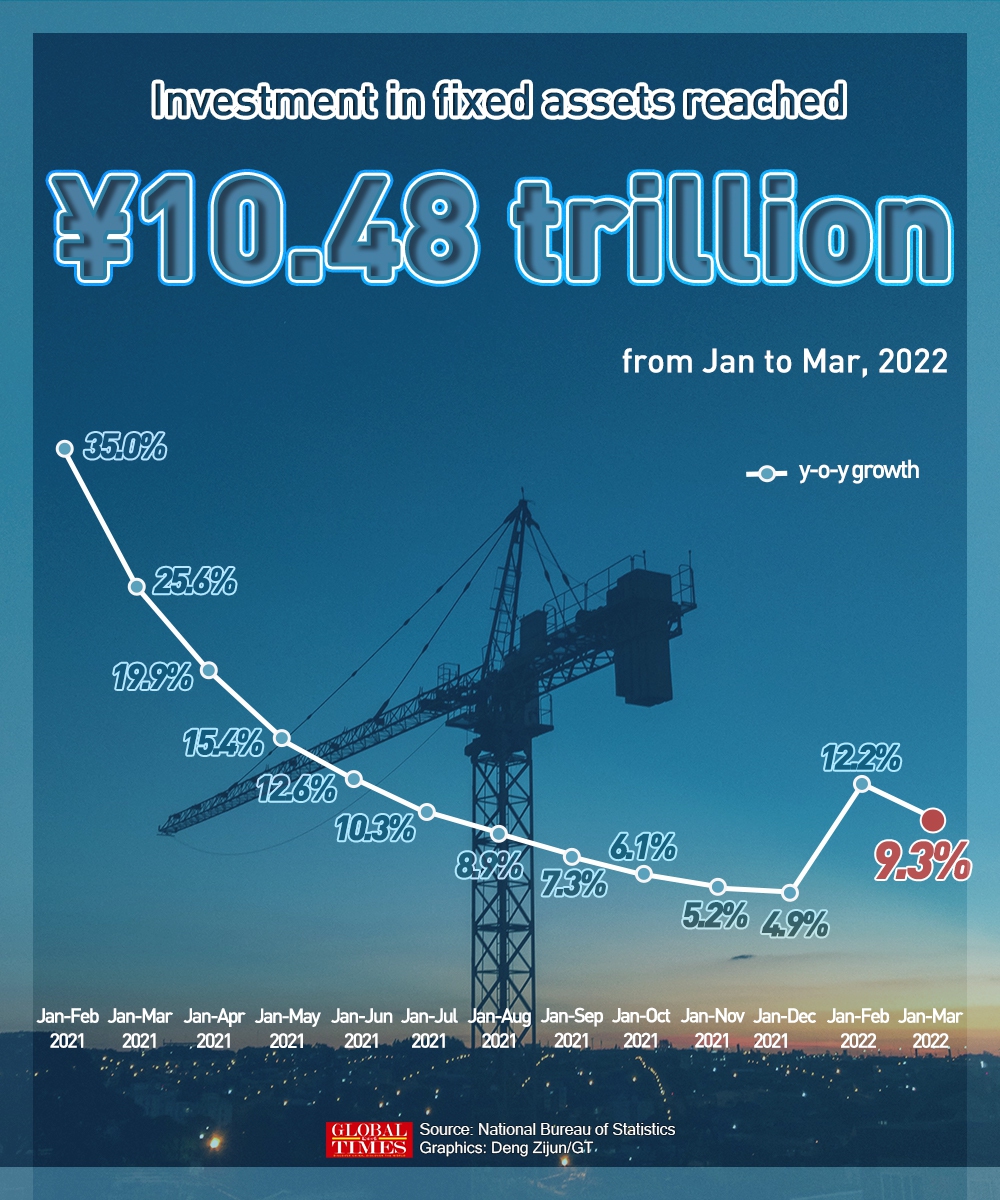

Growth in fixed-asset investment was 9.3 percent in the first three months, compared with a 12.2-percent jump in the January-February period, NBS data showed.

NBS spokesperson Fu Linghui acknowledged at a press briefing of the State Council Information Office on Monday that certain major economic indexes softened in March, underscoring growing downward pressure China faced since March amid a complicated global situation, domestic virus flare-ups, and some unforeseen factors.

"But China's long-term good economic fundamentals have not changed, and China has the capacity and conditions to overcome difficulties to achieve the sustainable and sound economic development," Fu said.

He stressed that China will coordinate the efforts of COVID-19 prevention and control and economic and social development, "make economic stability our top priority and pursue progress while ensuring stability."

Despite a sharp slide in March, Chinese economists said that gauging from certain indexes, the first quarter data showed signs of improvement from the last three months of 2021.

Graphic:Deng Zijun/GT

"Fixed-asset investment jumped significantly on a quarterly basis, thanks to adjustments in the property policy and a pick-up in manufacturing investment," Tian Yun, former vice director of the Beijing Economic Operation Association, told the Global Times on Monday, adding that the bandwagon will likely secure a much-needed boost to China's full-year growth.

Lian Ping, head of the Zhixin Investment Research Institute, told the Global Times that it is expected that the investment in infrastructure will have a double-digit increase.

Mounting pressure

China's economy had set off a stellar opening in the first two months of the year. However, entering the third month, China's tech hub, Shenzhen in South China's Guangdong Province, was under strict anti-epidemic measures for a week, and Shanghai, the financial, trade and manufacturing hub, also entered "static management" at the end of March as COVID-19 cases spiked.

Xing Zhaopeng, Senior China Strategist at Australia and New Zealand Banking Group (ANZ), told the Global Times on Monday that he expects the impact on annual GDP growth to be 0.4 percentage points lower if Shanghai is under static management for a month. Most services activities will be affected, especially transportation and tourism.

"The pause in two of Chinese mega cities certainly dented March's economic growth. The temporary factory closure and logistics impediment snarled supply chains, while weakened expectations on income and stay-at-home policies hindered consumption," Cao Heping, an economist from Peking University, told the Global Times, adding that the Ukraine crisis further amplified supply chain challenges and fueled global bulk commodity price hikes.

Tian said that the downward pressure the world's second-largest economy faced in March is "unprecedented" and "the biggest" since the first quarter of 2020, when the COVID-19 outbreak first hit Wuhan, Central China's Hubei Province.

Graphic:Deng Zijun/GT

"The March figures only reflect part of the fallout of the situation in Shanghai and the Yangtze River Delta, which is set to be much greater than that of Shenzhen as the supply chain in the Yangtze River Delta - accounting for one-fourth of China's GDP - is deeply intertwined," Tian said.

He pointed out that the COVID-19 flare-up in Shanghai likely erased a 0.5 percentage point gain in China's first quarter GDP, and its impact on the economy could stretch into April and May. But should the epidemic be curtailed by the end of May, economic order will be restored, and the country's economic engines will start roaring again in late May, he added.

The current impact of virus flare-ups won't last a long time, Lian said, citing the nation's rich experience in rolling out effective measures to fight the virus and adjusting its governance flexibly. He forecasts that consumption could also rebound in May.

On Monday, some of Shanghai largest industrial enterprises resumed operations under closed-loop management, marking a trailblazing step in normalizing economic activities.

"This is a race against time, to minimize supply chain disruptions so that the manufacturing powerhouse could reboot in the next two weeks, ahead of the next rate hikes by the US Federal Reserve possibly in May, which could affect foreign trade, capital flows and the yuan's exchange rate," Tian said. He added that the second quarter is a critical period that draws the "bottom" for the Chinese economy.

Analysts said if the situation ameliorated soon, China could expect a restorative growth, and it is estimated that the second-quarter GDP will stay flat, or even slightly higher than the first-quarter.

Graphic:Deng Zijun/GT

'Necessary cost'

Fu said China will strive to achieve its annual GDP target of 5.5 percent, and the government will scale up the strength of macro policies to stabilize the fundamentals of the macro economy.

The comment comes after some financial organizations and Western media expressed doubts about China's 2022 GDP goal, saying that the cost of the dynamic zero approach "derailed Beijing's ambitious target."

Analysts said China's GDP target is "achievable," as a steady economic growth, underscored multiple times by the central leadership, remains the bottom line mindset for China's economic work regardless of increasing external and internal uncertainties.

Yao Jingyuan, special researcher of the Counselors' Office of the State Council, told the Global Times on Monday that "we have accumulated rich and active experience in battling the pandemic since winning the war against the coronavirus in Wuhan in the first half of 2020. So the pandemic's impact on economic recovery should not be exaggerated."

China has in recent months dialed up support to bolster and shore up its economy. On Friday, China's central bank announced a long-expected 25 basis point reduction in the banks' reserve requirement ratio (RRR), as policymakers tap into the monetary policy to help boost economic growth.

On Monday, China's central bank and the State Administration of Foreign Exchange jointly announced 23 policy measures to offer financial support for regions, sectors and business affected by virus, including the reuse of 400-billion-yuan relending quota that supports inclusive financing.

"Next, the fiscal policy needs to be synchronized with the monetary policy, which requires strong and uncompromising support from credit and social financing," Lian said.

Cao also suggested further RRR cuts soon, deriving from China's sufficient ways to shore up the economy.

Economists also stressed that the short-term cost on the economy is a "necessary sacrifice" to protect people's lives, and it won't deviate the nation from its sound economic fundamentals and the pace of national development.

Xing said although it is difficult to [implement] the zero-tolerance approach, it remains effective in China. "We expect the authorities to fine-tune it further, rather than to abandon it."

While some Western media also hyped supply chain relocation out of China or foreign capital withdrawal, Yao said that although there are short-term shockwaves across the industrial chain, the advantage of the world's second largest economy in terms of supply and industrial chain still stands out compared with other countries.

"In economic theory, if impact is controlled within 90 days, it won't become a long-term repercussion," Cao said, adding that the zero-tolerance approach fueled certainty and predictability into people's lives.