US economy unexpectedly falls 1.4% annual pace in Q1, may continue poor performance amid inflation, rate hike woes

Wall Street Photo: AFP

In the first three months of 2022, the US posted its poorest quarterly economic performance since the recession triggered by the COVID-19 pandemic, as the headwinds from soaring inflation, interest rate hikes by the Federal Reserve and the pullback from Omicron weighing on growth momentum.

US GDP declined at an annualized 1.4 percent in the first quarter, the Commerce Department's preliminary estimate showed on Thursday, which is a significant slowdown from the 6.9 percent growth recorded in the fourth quarter of last year.

The slowdown reflected a record US international trade deficit, lower government expenditure, and a decline in inventory levels as more enterprises take a wait-and-see approach before stepping up inventory volumes, experts said.

The first quarter result was below economists' and institutions' forecasts. Economists polled by Reuters expected growth to slow to an annualized rate of 1.1 percent over the first three months. Goldman Sachs lowered its estimate to a 1.3 percent rate from a 1.5 percent pace, while JPMorgan slashed its forecast to a 0.7 percent pace from 1.1 percent.

"The US central bank is beefing up efforts to cool domestic inflation as prices rise at their fastest pace in more than four decades, which will directly restrict consumption and investment," said Tian Yun, former vice director of the Beijing Economic Operation Association.

Given the current impact on economy during the initial phase of rate hikes, it is hard to say whether the Fed could complete its follow-up rate hike moves and balance sheet reduction plan, Tian told the Global Times on Thursday.

Federal Reserve Chairman Jerome Powell affirmed the central bank's determination to bring down inflation and said on April 21 that aggressive rate hikes are possible as soon as next month, when "50 basis points will be on the table for the May meeting."

Consumption, which accounts for two-thirds of the US economic output, has not seen signs of consumer pulling back from goods even as food and gasoline prices soar.

If prices of commodities and energy continue increasing into the foreseeable future, they will eventually bite into consumer purchasing power, Tian said, noting that in the services consumption sector, activity has already been slowing.

The Biden administration is studying the inflationary impact of tariffs imposed on China by former US President Donald Trump's administration given a surge in consumer prices, Reuters reported on Monday.

In response, China's Ministry of Commerce (MOFCOM) said on Thursday that the US unilateral imposition of tariffs is not good for either country or the world.

"In the current situation of high inflation, it is in the fundamental interests of American companies and consumers to cancel the tariffs imposed on China. At present, the economic and trade teams of China and the US maintain normal communication," a spokesperson for the MOFCOM said.

Zhuang Rui, a professor at the University of International Business and Economics, told the Global Times on Thursday that the US' consumption-led growth should abandon trade protection policies adopted by the former Trump administration as it will eventually damage its own consumer market.

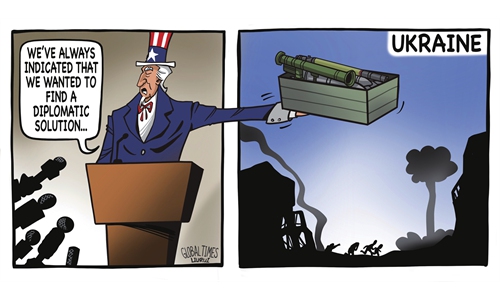

The ongoing Russia-Ukraine conflict has pushed up prices of international bulk commodities, energy and food. The US-led Western block announced a series of sanctions against Russia, shaking stocks, currencies and futures across global markets.

"The crisis has strengthened the US dollar, attracted global capital flows and benefited its military-industrial complex, but the other side of the coin is that it is actually cutting into the US growth, for example, harming exports," Tian noted.

The US trade deficit for goods jumped 17.8 percent to an all-time high of $125.3 billion in March, data from the Commerce Department showed Wednesday.

Tian forecast that the US economy was headed for a "soft landing," and the headwinds from rising inflation, interest rate hikes and the pullback from Omicron will continue to weigh on its growth momentum, despite recording an expansion of 5.7 percent for the whole 2021, the strongest in nearly four decades.

In comparison, China's economic growth is on a different trajectory after seeing at low point at the end quarter of last year, and is now on a track of steady growth, he noted.

China's GDP grew by 4.8 percent in the first quarter of 2022, topping market expectations and maintaining a stable growth even as the March economy faced unprecedented downward headwinds not seen since the first quarter of 2020 due to COVID-19 flare-ups, supply chain snags and external uncertainties arising from the Russia-Ukraine conflict.

With interest rates rising, the US economy faces a cooling-off period but no recession, according to an analysis report by S&P Global Market Intelligence, which forecast the US real GDP growth will likely slow from 5.7 percent in 2021 to 3.0 percent in 2022 and 2.8 percent in 2023.