China moves to strengthen coal pricing regulation by clarifying reasonable long-term and spot price fluctuation range

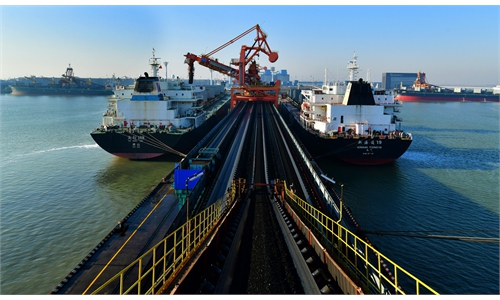

A vessel docks at Huanghua port, North China's Hebei Province to load coal in December 2021. Photo: cnsphoto

Chinese authorities moved to further regulate coal prices by clarifying the reasonable fluctuation range of coal's spot price at a meeting, representing a fresh move of a coherent approach to contain soaring coal prices - key to China's energy safety and sound economic operations - amid the global shortage and mounting uncertainties.

The meeting, which was convened by the price department of the National Development and Reform Commission (NDRC) recently, reasserted the content of two documents the government rolled out recently to stabilize coal prices and prevent price gouging.

Officials agreed at the meeting that coal is an important primary product vital to the national wellbeing and people's livelihood. It is necessary that China should take measures to stabilize coal prices, and further stabilize electricity prices and companies' energy use costs to provide powerful sup-port for stable economic growth.

The meeting again specified coal's reasonable price range in terms of medium and long-term transaction and spot prices, and prices beyond this range should be considered as price gouging if without justification.

For example, the reasonable medium and long-term price for coal in North China's Shanxi Province should be at or below 570 yuan ($85.40) per ton, while the spot price should be at or below 855 yuan.

The NDRC would also pay close attention to price changes and the supply/demand situation in the coal markets, as well as strengthen supervision on coal's medium and long-term contracts to make sure coal's price is running within a reasonable range.

If the coal price fluctuates beyond the reasonable range, authorities would hold talks with relevant parties and direct the price back to the normal range by means of investigations and other methods.

"Compared to oil and natural gas which China re-lies heavily on imports, the self-sufficiency rate of coal reached 90 percent. As such, it is of critical importance to ensure stable coal prices and supply in the domestic market amid the global energy shortage that drives every energy price to record highs," Han Xiaoping, chief analyst at energy industry website china5e.com, told the Global Times on Friday.

China has sufficient coal resources but the distribution is quite dispersed, analysts said, and a unified coal pricing range will be effective in controlling prices nationwide and prevent local interests from eroding the profitability of downstream enterprises.

Analysts also suggest China expand its coal producing ability, especially import-reliant coking coal used in the metallurgical industry such as steel-making.

China's central bank announced a plan on Wednesday to provide 100 billion yuan in re-lending facilities to support coal development and energy storage. The country also scrapped tariffs on coal imports from May 1 to March 31, 2023.

Global Times