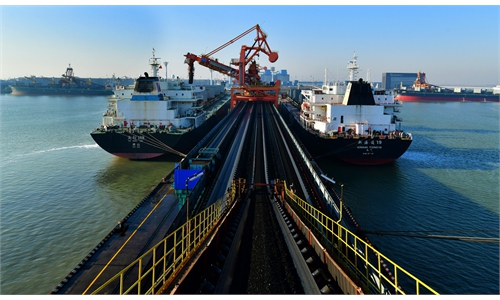

An oil tanker waits to unload at a port in Ningbo, East China's Zhejiang Province on Saturday. ." Photo: CFP

The value of China's energy imports showed continuous growth in the first four months of 2022, despite the continuous drop of import volumes, as global prices soared caused by geopolitical uncertainty, according to official data on Monday.Data from the General Administration of Customs (GAC) showed that the import value of coal, crude oil, natural gas and other bulk commodities saw a further increase from January to April, following a double-digit growth in import value in the first quarter.

In the first four months, China imported 171 million tons of crude oil, down 4.8 percent, with a value of $116 billion, up 49.7 percent year-on-year from 39.4 percent in the first quarter, the GAC data showed.

Meanwhile, the country bought 75.4 million tons of coal, down 16.2 percent, but the import value jumped 78.6 percent from last year. The import volume of natural gas reached 35.866 million tons, a decrease of 8.9 percent, with a value of $26.1 billion, up 59.9 percent.

Experts noted that higher commodity prices have pushed up the value of imports.

"The decrease in the volume of energy imports was mainly due to surging prices because of the Russia-Ukraine conflict, which has stressed the global supply chain," Han Xiaoping, chief analyst at energy industry website china5e.com, told the Global Times on Monday.

COVID-19 flare-ups in China also reduced demand, experts said.

"Global prices may continue to stay high for a while, as geopolitical uncertainty escalates," said Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University.

The resulting high prices of bulk commodities could lead to more serious imported inflation this year, given the country's high external dependence on oil, iron ore, non-ferrous metals and other important commodities, Lin said.

To stabilize domestic energy prices and clear away any clouds over the national economy, China's central and local governments have issued a series of measures, including increasing output, further exploring the domestic supply potential and ensuring the security of primary product supplies.

In one major move, the Ministry of Finance eliminated import tariffs on coal from May 1, 2022 to March 31, 2023. And the central government required coal providers to sign medium- and long-term contracts, while enhancing regulations on local prices.

In March, China's raw coal output reached 395.8 million tons, up 14.8 percent year-on-year, according to the National Bureau of Statistics.

"However, increasing energy supply is not a long-term solution. Authorities should seek and develop substitutes like renewable and clean energies, especially as China highly relies on crude oil imports with a 70-percent external dependence," Lin noted.