China’s CPI rises 2.1% in April, but overall inflation still ‘controllable’

Inflation ‘generally controllable’ thanks to govt efforts

CPI Photo: VCG

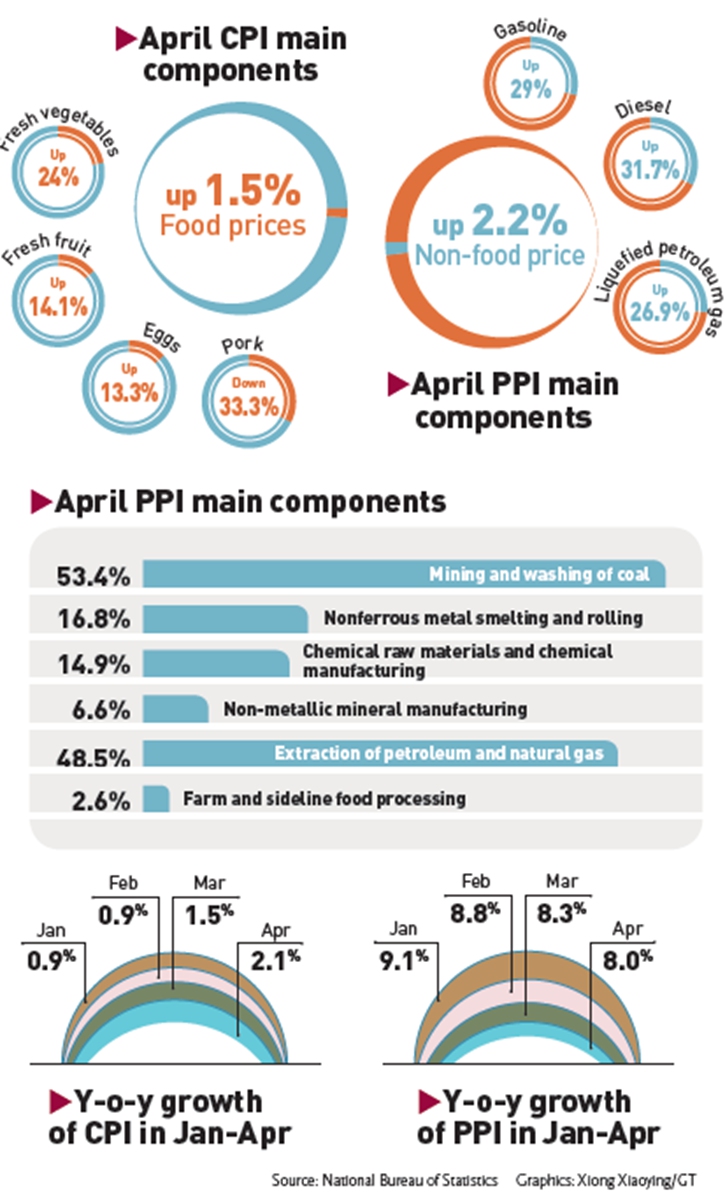

China's CPI and PPI

China's consumer price index rose by its fastest annual pace in five months in April, amid domestic COVID-19 flare-ups and rising inter-national commodity prices, according to official data on Wednesday.

Though consumer prices may further increase due to both domestic and external factors, China's inflation remains generally controllable, especially when compared to sky-high inflation in many major econo-mies around the world, thanks to the country's measures to ensure supplies and stabilize prices, analysts noted.

China's April consumer price index (CPI) rose 2.1 percent year-on-year, up from 1.5 percent in March, the National Bureau of Statistics (NBS) said on Wednesday.

The figure beat some market expectations of a 1.8-percent growth. The increase was mainly caused by rising food and oil prices, NBS data showed.

Month-on-month, food prices swung to a gain in April from a decline in March due to rising logistics costs amid the epidemic and increased demand for stockpiling, Dong Lijuan, a statistician at the NBS, said.

Food prices rose 0.9 percent month-on-month in April, compared with a 1.2-percent decline in March, contributing about 0.17 percentage points to the CPI increase, the NBS said.

Specifically, egg prices rose by 7.1 percent and fruit prices were up 5.2 percent. Pork prices rose 1.5 percent after a 9.3-percent drop in the previous month due to the restored production capacity of hogs and releases from the central reserves.

Suring global oil prices also pushed up China's gasoline prices by 2.8 percent and diesel prices by 3 percent from the previous month, ac-cording to the NBS.

Analysts said that China's consumer prices will continue to rise mod-erately but overall inflation will be controllable.

The latest COVID-19 outbreaks, combined with volatile energy costs, rising pork prices and the low base effect, will drive up inflation in the short term, Zhou Maohua, a macroeconomic analyst at Everbright Bank, told the Global Times on Wednesday.

But as the epidemic is gradually brought under control and the gov-ernment takes measures to ensure supplies, stabilize prices and unclog logistics, agricultural and industrial products will return to normal lev-els, Zhou said.

However, in the short term, the impact of international geopolitics and the global pandemic will persist, and the risk of imported inflation needs to be prevented, Zhou added.

Since the beginning of the year, inflation has been high in many major world economies. In comparison, China's consumer prices have been at a generally reasonable level with an average of 1.1 percent in the first quarter, acting as a stabilizer for the world economy.

Wu Chaoming, vice president of the Chasing International Economic Institute, also expects that consumer prices will continue to climb.

"The services sector is expected to recover moderately as the epidemic eases. Policies for stable employment, ensuring people's livelihood and promoting consumption will be intensified," Wu told the Global Times on Wednesday, predicting the CPI will rise 2.1 percent year-on-year in May.

Meanwhile, producer price growth continued to moderate in April for a sixth straight month. The producer price index (PPI) increased 8 per-cent from a year earlier, slower than the 8.3-percent rise in March but higher than the expected rate of 7.8 percent.

Growth in the PPI will continue to ease this year amid increased do-mestic efforts to stabilize energy supply and prices, Zhou said.

Chinese officials are paying close attention to inflation and the eco-nomic difficulties faced by China's industrial economy, including lo-gistics woes and high bulk commodity prices.

China's central bank, the People's Bank of China, said in its monetary policy report for the first quarter realized on Monday that it will pay close attention to price trends, support grain and energy production to ensure supply, and maintain overall price stability.