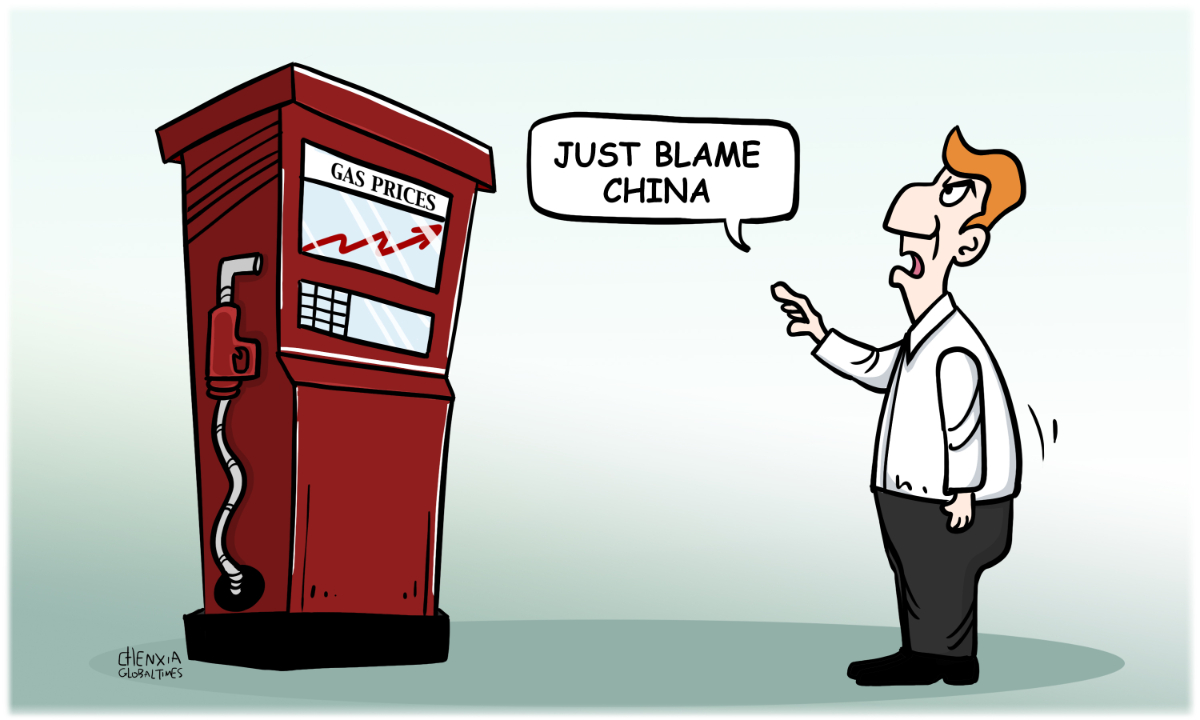

Illustration: Chen Xia/Global Times

Several Western media outlets have in recent weeks published articles playing up the impact of China's dynamic zero-COVID policy on the global economy, with some suggesting that strict anti-epidemic measures may intensify global inflation. However, this concern is overblown.

On Tuesday, the BBC said COVID-19 lockdowns in some of China's biggest cities have created a disruptive effect on the country's economy, and it means consumers across the world, including the UK, are facing price increases. India's ANI News Agency said the zero-COVID policy is posing a significant threat to the world as "witless" rules have left hundreds of cargo ships stranded on the ports, which "will impact freight costs and global inflation."

As some media outlets are keen on playing up the disruptions China's dynamic zero-COVID policy will bring to the global economy, latest economic data paints a different picture. Although inflation is soaring around the world, consumer prices in the world's second-largest economy have held steady. The National Bureau of Statistics (NBS) said on Wednesday that China's April consumer price index (CPI) rose 0.4 percent from the previous month when the country started to fiercely combat its worst COVID-19 outbreak since 2020.

The increase of CPI was mainly caused by rising food and oil prices, NBS data showed. April's core CPI, the index for all items excluding food and energy, rose only 0.9 percent year-on-year, following a 1.1-percent increase the prior month, suggesting a decline of 0.2 percentage points.

Analysts expect a moderate price pick-up over the coming months but believe hyperinflation is unlikely, as China's measures to ensure supply and stabilize prices continue to exert force.

By contrast, the annual rate of inflation worldwide, as measured by the CPI, accelerated to 9.2 percent in March, according to the International Labour Organization. As inflation soars around the world, China has kept it at bay. It is ridiculous to induce people to believe that China is exporting inflation risk to the world economy.

There is no denying that recent COVID-19 outbreaks in China have caused some economic headwinds. However, as the epidemic is gradually brought under control and the country continues rolling out measures to tackle obstacles in supply chains, economic activity hit by COVID-19 pandemic is gradually returning back to normal levels.

China is not an exporter of inflation; on the contrary, China is a victim of global inflation. The recent upward trend in international commodity prices has caused an inflationary calamity and China is among the first to feel the impact.

Data from the General Administration of Customs (GAC) suggested how much the prices of imported commodities have soared. In the first four months, China bought 171 million tons of crude oil and 75.4 million tons of coal, down 4.8 percent and 16.2 percent respectively, but the import value jumped 49.7 percent and 78.6 percent year-on-year.

China has a pivotal position throughout global supply chains, with most global manufacturers having a presence in China. Their products produced in China are sold through the global distribution and retail networks to their home markets. Inflationary pressure caused by the upward trend in international commodity prices is then transferred to various economies through the global industrial chain.

Inflation is likely to remain elevated in many countries such as the US. Now, US inflation is at its highest rate in four decades, reaching 8.5 percent in March from a year ago. High inflation can be the result of multiple factors. Blaming China won't help them solving the real problems and cutting inflation.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn