US’ economic diplomacy won’t disrupt China-ASEAN cooperation

More opportunities ahead in manufacturing, energy, agriculture

Aerial photo taken on Sept. 10, 2021 shows a view of the Nanning International Convention and Exhibition Center, the venue of the 18th China-ASEAN Expo and China-ASEAN Business and Investment Summit, and its neighboring buildings in Nanning, capital of south China's Guangxi Zhuang Autonomous Region. File photo:Xinhua

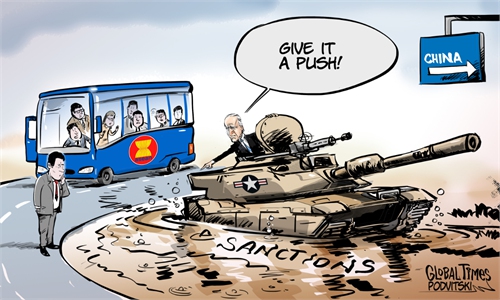

While the US is stepping up economic diplomacy in Southeast Asia, a region central to its Indo-Pacific Strategy, in order to contain China's development, business leaders and experts said the complementarity of Chinese and ASEAN industries and the US' financial limitations mean it can't disrupt sound China-ASEAN cooperation.

US President Joe Biden is due to host ASEAN leaders in Washington on Thursday and Friday, in what the US has described as a move to expand engagement with ASEAN on COVID-19 recovery, fight the climate crisis and stimulate economic growth, among other issues.

There is no doubt that the US will push for the signing of a joint statement with ASEAN following the summit so as to strengthen bilateral cooperation, including economic engagement, but it cannot signifcantly affect the close China-ASEAN economic and trade cooperation, Xu Ningning, executive president of the China-ASEAN Business Council, told the Global Times on Thursday.

A senior business executive from a Chinese company who is based in Vietnam said the spillover effect of the politically charged summit will take some time to affect day-to-day operations, if there's any impact at all.

"It is possible that efforts will be made to shortcut some Chinese projects in the region or that check-ups will be intensified on the ratio of Chinese components of products assembled in ASEAN countries, affecting Chinese companies that have relocated their production capacity abroad," said the executive.

But whatever happens, Chinese companies have confidence in facing the challenges head-on, the executive said.

Unlike the US' ulterior motive of containing China by courting ASEAN, the complementary nature of the Chinese and ASEAN economies means there is an intrinsic motive for China and ASEAN to promote genuine economic and trade cooperation, Xu said.

The industry and supply chains between China and ASEAN are closely connected thanks to institutional arrangements like the China-ASEAN Free Trade Area and the Regional Comprehensive Economic Partnership agreements, Xu said, noting that the China-proposed Belt and Road Initiative (BRI) has taken such cooperation to a higher level.

The US lacks a global program equivalent to the open and inclusive BRI, although the Group of Seven, including the US and its allies, proposed a seemingly unfeasible Build Back Better World initiative last June to help developing countries meet infrastructure needs.

"Constrained by its declining capability and financial limitations for more economic support to ASEAN, the US is finding it harder to win cooperation from ASEAN as a whole," Xu said, adding that the bloc's adherence to principles like a balance of power and building consensus through consultations means that the US can't get ASEAN to side with it to act against China.

"China's influence on ASEAN's economy is unlikely to fade over the next few years, since there is no basis for most Southeast Asian countries' industrial sectors to carry out in-depth economic cooperation with the US," Shi Kun, deputy director of the Chinese Enterprises Chamber in Myanmar, told the Global Times on Thursday.

China has been ASEAN's largest trade partner since 2009, with bilateral trade hitting a new record high of $878.2 billion in 2021, accounting for 14.5 percent of China's total foreign trade, data from China's Ministry of Commerce showed. ASEAN became China's largest trading partner in 2020 for the first time.

The shift of China's labor-intensive industries to Southeast Asian countries will drive exports of raw materials, while Southeast Asian businesses look to China's huge market for minerals and agricultural products, Shi said. This situation will support fast growth in China-ASEAN trade.

"The outlook for economic and trade cooperation between China and ASEAN is promising given their complementary advantages in population structure, and stages of economic development," Shi said, noting that there will be more cooperation opportunities in manufacturing, energy and agriculture.

China's Vice Minister of Commerce Sheng Qiuping said at a press briefing in March that China will further deepen trade and investment cooperation with ASEAN, striving to import agricultural goods worth $150 billion from the bloc over the next five years while expanding cooperation in new sectors including anti-pandemic response, the digital economy and low-carbon economy.

China will continuously boost the construction of land-sea trade corridors linking ASEAN so as to better support connectivity, economic and trade cooperation, as well as industry and supply chains, according to Sheng.

According to a survey by PwC, about 57 percent of Chinese companies have investment plans in ASEAN, whereas 45 percent of ASEAN companies welcome Chinese investment, with the most being from Thailand and Singapore.

Gabriel Wong, PwC China inbound/outbound leader, told the Global Times on Thursday that ASEAN is highly likely to remain China's largest trade partner over the next two years, with the region's great economic growth potential and consumption power continuing to attract Chinese companies.