China’s FDI use surges 26.1% in Jan-Apr, a strong rebuttal to ‘capital withdrawal’ hype

Figure shows China’s key role for multinationals, global economy

Intl food producers attract Chinese consumers at CIIE.Photo:Li Hao/GT

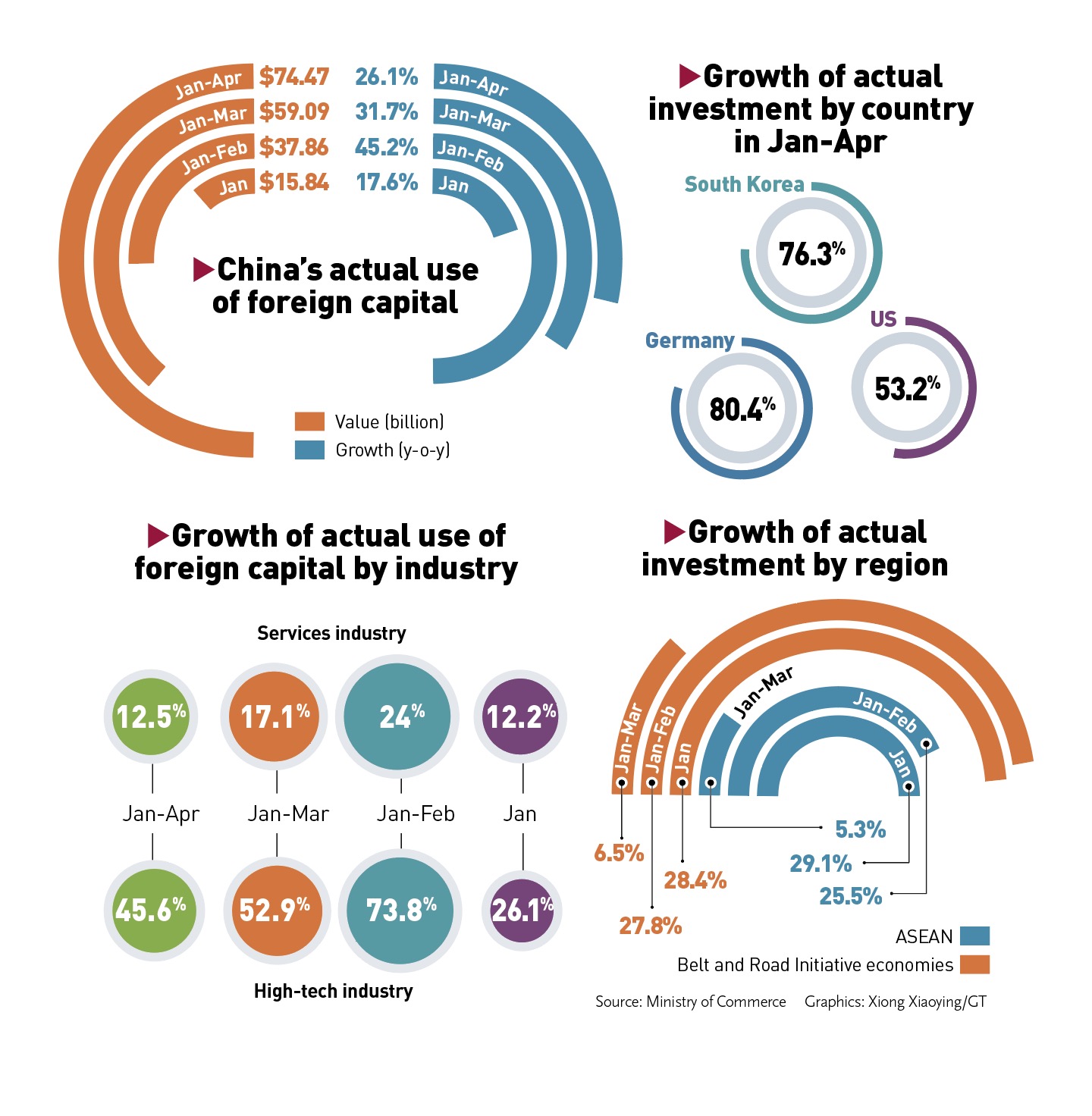

China's actual use of foreign capital recorded a significant jump of 26.1 percent on a yearly basis from January to April, reaching $74.47 billion, despite challenges posed by COVID-19 outbreaks in several major Chinese cities, according to official data on Thursday.

China's actual use of foreign capital Graphics: Xiong Xiaoying/GT

The better-than-expected figure serves as a strong rebuttal to some Western media's "capital withdrawal" hype, and demonstrates that temporary economic disruptions caused by the Omicron variant won't undermine the attractiveness of the Chinese market to foreign investors in the long run, observers said.

The rapid growth also comes on a high base last year, when China's actual use of foreign investment surged 38.6 percent in the first four months, Shu Jueting, a spokesperson for China's Commerce Ministry (MOFCOM), told a press conference on Thursday.

Investment from South Korea surged 76.3 percent, while investment from the US and Germany rose 53.2 percent and 80.4 percent, respectively, MOFCOM data showed.

Large projects have been running in a stable fashion, Shu said, adding that all localities have worked hard to overcome the impact of the epidemic and actively carry out investment promotion.

In the first four months, China added 185 large-scale projects with contracted foreign capital of more than $100 million, which is equivalent to an average of 1.5 large-scale foreign-funded projects landing every day, according to the official.

The continued rise in foreign investment flows into China is proof that the Chinese market has remained a bonanza for foreign investors, Cao Heping, an economist from Peking University, told the Global Times on Thursday.

"The country's COVID-19 containment policy is shown to have mobilized wide-ranging resources to imbue [society] with a sense of safety and security," Cao said.

In recent weeks, stringent anti-epidemic measures were adopted in some key Chinese cities, including Shanghai and Beijing, to curb the rapid spread of the Omicron variant and bring a sound rebound after temporary economic disruptions.

Yet some Western media outlets are exaggerating the situation, hyping the "investor flight" theory, warning that such measures will result in a large-scale retreat of foreign firms and undermine China's attractiveness in the long run, which Chinese experts and industry players have dismissed.

Last year, China was among the world's best-performing markets in terms of the attraction of foreign direct investment, according to Cao, who was upbeat about the abundance of opportunities in the areas of the sharing economy and platform economy.

China's actual use of foreign investment jumped 14.9 percent year-on-year to 1.15 trillion yuan in 2021, scaling an all-time high, official data showed.

"Noise" as regards fluctuations in foreign capital flows mostly indicates short-term speculative moves in the money and capital markets, Cao emphasized.

In a new sign that multinationals' confidence in the country's outlook won't be deterred by short-term difficulties, L'Oréal founded its first investment company in China, Shanghai Meicifang Investment Co, in Shanghai on May 8. The investment will be dedicated to promoting China's open innovation through investing in innovative beauty technology.

This groundbreaking move also further proves the vital position of the Chinese market in L'Oréal's global layout, the firm said in a statement it sent to the Global Times on Thursday.

In the first four months, multinationals such as Volkswagen of Germany, Posco of South Korea, Costco of the US, Hitachi of Japan and others have achieved good results of their investment in major projects in China, which has effectively driven the rapid growth of China's investment, Shu said.

"Multinationals are actively expanding their investment in China. We believe that this fully reflects the firm confidence of foreign investors in China's economic development prospects. It also fully reflects China's remarkable achievements in opening up to the outside world and optimizing the business environment," Shu said.

"It's increasingly the case that multinationals base their investment on not merely the sheer size of the Chinese market, but China's rising profile in the international division of industries, factoring its complete industrial system and future industrial and consumption upgrades," Bai Ming, deputy director of the International Market Research Institute at the Chinese Academy of International Trade and Economic Cooperation, told the Global Times.

Bai noted temporary challenges facing the foreign business community amid both domestic and global uncertainties, but said that would by no means crimp foreign investment flows into the country.

Shu noted that the door of China's opening-up will become wider and wider, and the environment for foreign investment will become better and better. The Chinese government will, as always, welcome investors from all over the world to invest in China and share the dividends of China's development, the spokesperson said.

The fundamentals of China's economy with strong resilience, ample potential, wide room for maneuver, and long-term improvement will not change, and will continue to provide strong momentum for the stabilization and recovery of the world economy, said Shu.