Workers work at the construction site of Aowei street in Xiong'an New Area, north China's Hebei Province, April 28, 2022. Aowei street is a main street going from the east to the west in Xiong'an New Area. The project will be completed soon.Photo:Xinhua

Chinese local governments' special-purpose bond issues totaled 1.65 trillion yuan ($245 billion) from January to April, more than double the amount in the same period last year, data from China's Ministry of Finance (MOF) showed on Wednesday, as the country takes proactive fiscal policies to help stabilize economic growth amid growing downward pressure.Overall local government bonds issued across the country reached 2.11 trillion yuan in the first four months, including general bonds worth 457 billion yuan and special-purpose bonds worth 1.65 trillion yuan, according to the MOF.

In April, special-purpose bond issues totaled 189.8 billion yuan. Though they hit a speed bump in April mainly due to the Omicron resurgence, overall levels have been gaining speed, especially after the first two months of the year, Tian Yun, former vice director of the Beijing Economic Operation Association, told the Global Times on Wednesday.

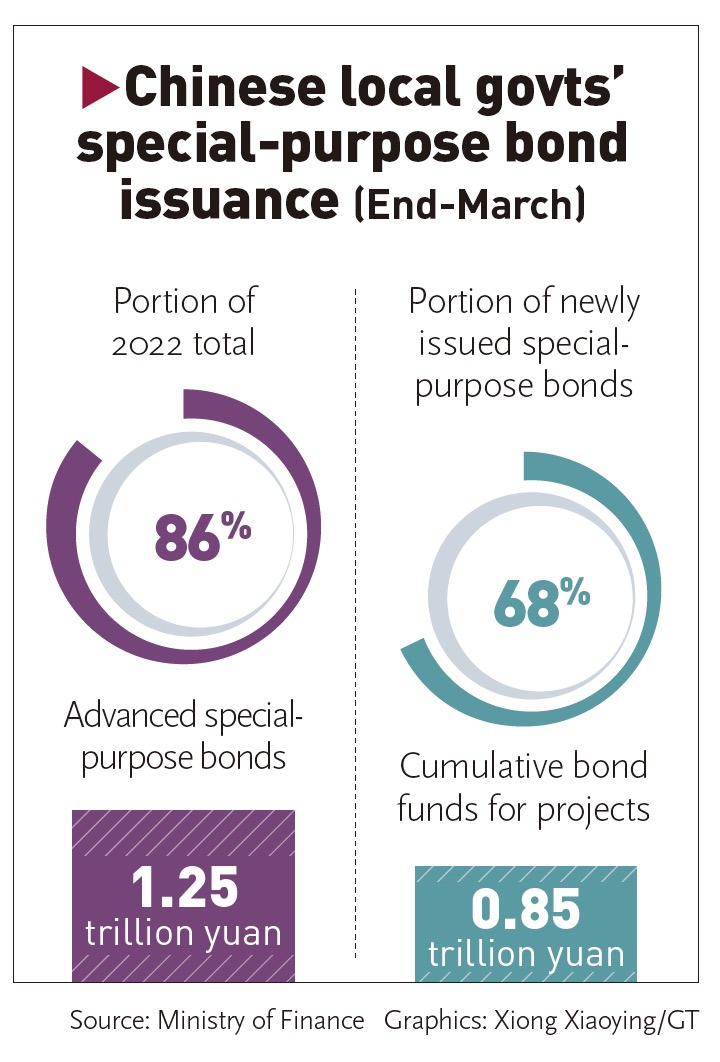

Graphic:GT

China plans to increase special-purpose bonds by 3.65 trillion yuan this year, of which 1.46 trillion yuan worth was allocated by the MOF in advance at the end of last year. As of the end of March, 86 percent of the quota that was allocated in advance had been completed, and the allocation of the remaining 2.19 trillion yuan will be completed before September, according to the State Council in March.

Against the backdrop of the COVID-19 pandemic, China has been promoting proactive fiscal policies so as to improve people's livelihoods and ensure a stable economic recovery. Local government special-purpose bonds are an important tool for implementing policies, and one of the most direct and effective policy tools for the government to stimulate investment, experts said.

Local governments have reserved 71,000 special-purpose bond projects, Vice Finance Minister Xu Hongcai said during a press conference on April 12. The bonds will continue to be used mainly in nine major areas, including transportation infrastructure, energy, and major national strategic projects for ecological and environmental protection.

The local debt situation has been in the spotlight in recent years. But, per MOF data, the outstanding debt of local governments nationwide had reached 32.29 trillion yuan by the end of April.

The debt level was within the 37.6 trillion yuan limit approved by the National People's Congress, China's top legislative body.

The local debt risk has decreased in recent years, Tian noted. Despite the epidemic, the economic fundamentals remain promising, with industrial upgrading being promoted across the country in recent years. The current key issue is to put the Omicron resurgence under control as soon as possible so as to resume supply chains and reboot the economy's vitality, Tian said.

In addition to local government bonds, there is still sufficient room left for China to increase national bond issues to cope with downward economic pressure, Tian stressed.

As long as normal economic activity resumes, the probability of local debt default would remain low, much less a wider systemic risk, according to Tian.

Local debt issues in China, especially implicit debt problems, have been closely watched in recent years. The MOF on Wednesday reported eight penalty cases relating to local governments' "hidden debts," and it reiterated its resolve to control and prevent financial risks, especially when the Chinese economy is facing a complex environment at home and abroad.

Global Times