Biden’s first visit to Samsung ‘highlights chip alliance’, but final goal of US is to ‘strangle all competitors’ in semiconductor field

A pedestrian walks past a Samsung Electronics billboard in Seoul, South Korea, Aug. 24, 2012. (Xinhua/Park Jin-hee)

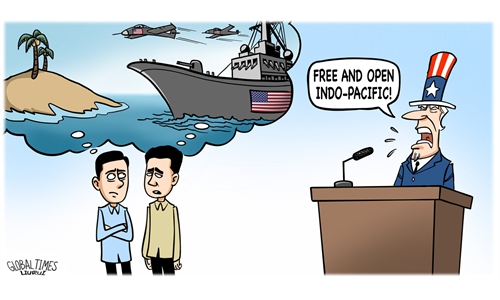

US President Joe Biden embarked on his first presidential trip to South Korea and Japan, taking Samsung's semiconductor factory on Friday as his first stop, which is widely regarded as a move to highlight the US-led semiconductor alliance excluding China.As the US has been sparing no efforts to strengthen high-tech supply chains across the world to contain China geopolitically and economically, Chinese observers said that "it is inevitable" to see a semiconductor industry chain war between China and the US, given the fact that the US has been searching to monopolize technological advantages and strengthen economic hegemony in the world.

The complex which Biden will visit is located in Pyeongtaek, south of Seoul, and home to the largest semiconductor plant in the world. Biden said the future would be written in the Indo-Pacific and now was the time for the US and like-minded partners to invest in each other, according to Reuters.

South Korean President Yoon Suk-yeol said Biden's visit to the plant highlighted how the decades-old US-South Korea alliance was growing and becoming more comprehensive through cooperation on microchips.

After experiencing supply chain disruptions caused by chip shortages over the past years, Biden has shown a keen interest in the US regaining control of chip manufacturing, and he has held a series of talks with business people about the supply chain, with Samsung, the world's largest memory chip maker, one of the key players.

In April last year, the White House convened a summit with top executives including Samsung on chip shortages, and Biden said the US will invest "aggressively" in the semiconductor sector and is ready to "lead the world again." Biden called on Congress to pass the CHIPS Act, a law that would provide chipmakers $52 billion in subsidies to advance semiconductor manufacturing in the US.

Samsung announced plans for new investments in the US late last year. The company has chosen Texas as the home of an advanced chip factory that will break ground this year with a $17 billion plan, with the goal of starting operations in the second half of 2024.

South Korean experts said that the continuous development of the semiconductor industry is very important since the South Korean economy is highly dependent on the semiconductor industry.

In order to continue to grow as a semiconductor manufacturing powerhouse, it is necessary to form a stable supply chain by joining the Indo-Pacific Economic Framework (IPEF), Lee Hyun-tai, an assistant professor at Incheon National University, told the Global Times on Friday.

Although the US proposed a "Chip 4" alliance with South Korea, Japan and the island of Taiwan to build a semiconductor supply chain, market watchers warned that the US is also taking different measures for a cutthroat competition with the South Korean semiconductor industry, for the ultimate goal of putting America first and weakening others.

Biden's visit to the Samsung facility is less likely to reshape the semiconductor rivalry between the US and South Korea, Han Xiaomin, general manager of Jiwei Consulting in Beijing, told the Global Times on Friday.

Samsung's chip strength mostly focuses on manufacturing, one of the three major components of the chip production process that also includes design, packaging and testing. As the world's largest memory chipmaker, Samsung goes head to head with US-based memory chipmaking giant Micron Technology.

Nonetheless, Samsung is heavily dependent on US semiconductor equipment supplies for its chipmaking, Han said.

South Korean chipmakers may not outright reject propositions, for instance, to ramp up building chip plants in the US, but they wouldn't give up on the Chinese market also, the veteran observer said.

He cited SK Hynix' recent announcement to build a new wafer manufacturing base in Dalian, Northeast China's Liaoning Province, expanding its footprint in the Chinese market after acquiring US chipmaker Intel's memory manufacturing facility in Dalian.

Looking ahead, it needs to be watchful of the US' possible cranking up of a semiconductor tie-up with Japan and the island province of Taiwan that goes beyond normal commercial partnerships, Han argued.

The US is also blocking the South Korean semiconductor industry and demanding Samsung, as well as Taiwan Semiconductor Manufacturing Co (TSMC), send "business secrets" such as research and development routes and supply chains data to the US, Zhang Xiaorong, director of the Beijing-based Cutting-Edge Technology Research Institute, told the Global Times on Friday.

Geopolitical and economic containment

"Biden's visit to Samsung's semiconductor factory is intended to show the influence of the 'US chip alliance'," Zhang said, adding that the US aims to strengthen the containment of China's chip industry by creating such a clique.

Supply chain issues are also on the agenda. As global international trade is under pressure brought by supply chain disruptions, the US and South Korea are seeking economic cooperation in specific areas, especially advanced technologies affected by supply chain disruptions.

Apart from its own acts and orders on supply chains, the US has initiated supply chain discussions with almost all its allies including the EU and Japan, and frameworks, including the NATO, AUKUS, and Indo-Pacific Strategy.

"The US wants to keep China down geopolitically and economically in the semiconductor industry," a Shenzhen-based industry analyst, who refused to be named, told the Global Times on Friday.

Analysts said that a supply chain "war" between China and the US is inevitable. "China wants to develop, but the US will not allow it. This is the fundamental contradiction, and China has no choice but to fight," they noted.

Market watchers said the US has consistently advocated uniting chipmakers with US technologies in an effort to isolate China, for the US has a two-pronged strategy: to develop the most advanced chipmaking processes and technologies, which are restricted to China; and crack down on China's mid- and low-end chip manufacturing.

Chip design and fabrication are two important links of the chip industrial chain. Some Chinese enterprises have achieved good development in chip designs, which means they project how to pack billions and billions of transistors into a fingernail-sized chip.

In terms of chip manufacturing, Chinese enterprises are catching up. But as long as there is little technological progress, they are suppressed by foreign countries and enterprises. And China lacks the equipment, talent and technology, said Zhang.

The Shenzhen-based anonymous industry analyst also said current high-end chip manufacturers, which are basically US, Japanese and South Korean companies, do not want someone else to share the market.

Samsung and TSMC have the most advanced chip manufacturing technology - 3-nanometer process - in the world. Samsung in April said the 3-nano chip will realize mass production in the second quarter of 2022, while TSMC announced mass production starting August.

Chinese mainland enterprises purchase 26.3 percent of the global chip equipment, but their product market share is less than 2 percent, according to industry statistics.

The 28-nanometer chip fabricated by Shanghai-based large semiconductor producer Semiconductor Manufacturing International, for example, is representative of the mainland's chip products, which can be widely used in various industries including automobiles, industry insiders said.

Analysts said that if China wants to cooperate with South Korea or Japan in the semiconductor field, it must guarantee de-Americanization in technology, which is currently unavailable. Otherwise, as long as Japanese and South Korean companies use US technology, they will have to play by US rules - export restrictions or even an embargo.

Semiconductors have a long and complex industrial chain. A lithography machine, for instance, has more than 100,000 components from 5,000 global suppliers, which needs about 40 containers to transport.

"Although it is very difficult, China has to advance with its own technology, equipment, and spend more than a decade to do what the US has done in decades to catch up," said the analyst from Shenzhen.