China’s auto sector expects better H2 sales, as local govts move to boost consumption

Photo taken on July 6, 2019 shows a production line at a subsidiary of Beijing Electric Vehicle Co., Ltd. (BJEV), a new energy vehicle producer, in Huanghua City, Hebei Province.Photo: Xinhua

With local governments announcing measures to boost the COVID-hit auto market, car sales in China, the world's largest auto market, are expected to accelerate in the second half of the year, and full-year sales are unlikely to fall from the previous year, analysts said on Monday.As China is ramping up its green mobility drive amid a pledge to peak carbon emissions by 2030 and carbon neutrality by 2060, new-energy vehicles (NEVs), including plug-in hybrids and battery-only electric vehicles (EVs), will be the major beneficiaries in this round of stimulus packages, they said.

For example, in an action plan released on Sunday by the Shanghai municipal government to support its COVID-battered economy, the city said it will reduce some passenger car purchase taxes and increase the quota of license plates for passenger cars by 40,000 this year. A subsidy of 10,000 yuan ($1,503) will also be granted to people who buy pure EVs.

EV makers, including Nio, welcomed the policy. "In view of Shanghai's high-end EV market, the demand for additional or 'switch' purchases has existed for a long time. With the overall improvement of EVs, it is believed that more and more consumers will choose to buy smart EVs," said a Nio representative.

Despite the outbreak of COVID-19 that has hit Shanghai's auto sales hard in the past few weeks, Nio's orders in Shanghai have been doing well due to its mature online sales channels, and new orders even saw a significant increase in May, the person said.

In the first quarter of 2021, Shanghai's NEV registrations reached 58,000, an increase of 41.4 percent year-on-year, data from the China Passenger Car Association (CPCA) showed.

The local government in Shenzhen, the high-tech hub in South China's Guangdong Province, also announced policies for the vehicle sector. Buyers of qualified NEVs who register them in the city can get a subsidy of up to 10,000 yuan per vehicle.

"Shenzhen has responded quickly and vigorously to the national call to introduce policies to promote auto consumption. The policy will help promote NEV consumption and consolidate Shenzhen's leading position in the promotion of NEVs in the country," a representative of China's largest EV maker BYD Co told the Global Times on Monday.

"Policies announced by local governments to encourage auto consumption... can better release consumption potential and boost sales in the short term," Cui Dongshu, secretary general of the CPCA, told the Global Times.

Cui suggested that promotional campaigns aimed at rural areas should continue, as these could play a major role in bolstering the entire auto market. "Due to the outbreaks that started in March, such promotions have not been carried out effectively and smoothly in many places," he added.

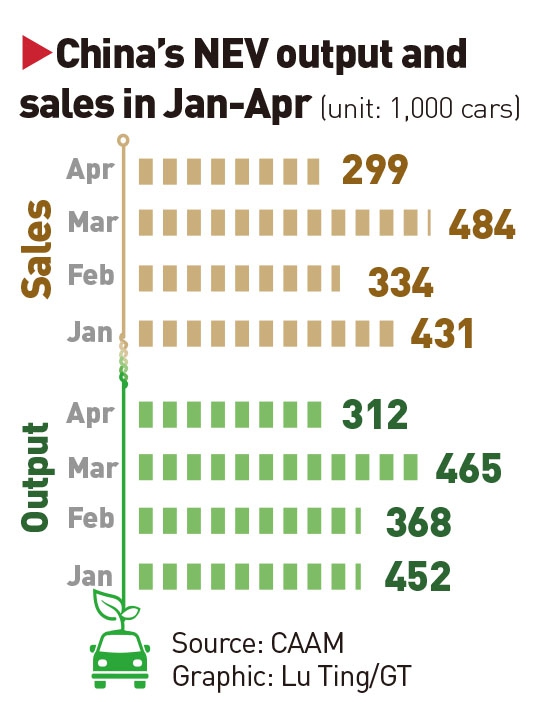

Although total vehicle sales plunged in April due to the epidemic, NEVs remained more resilient. NEV sales were up 44.6 percent year-on-year to 299,000, compared with a year-on-year 47.6 percent slump for all vehicle sales in the month, data from the China Association of Automobile Makers (CAAM) showed.

An industry analyst, who asked to remain anonymous, told the Global Times on Monday that support measures announced by governments at various levels will enable a recovery in the second half, and full-year sales are unlikely to fall from those of last year.

Total sales for 2021 reached 26.28 million units, up 3.8 percent from a year earlier, boosted partly by a jump of 1.5 times in sales of NEVs, according to the CAAM.

Graphic: Lu Ting/GT