China expands foreign debt program for smaller high-tech firms in push for economic stabilization

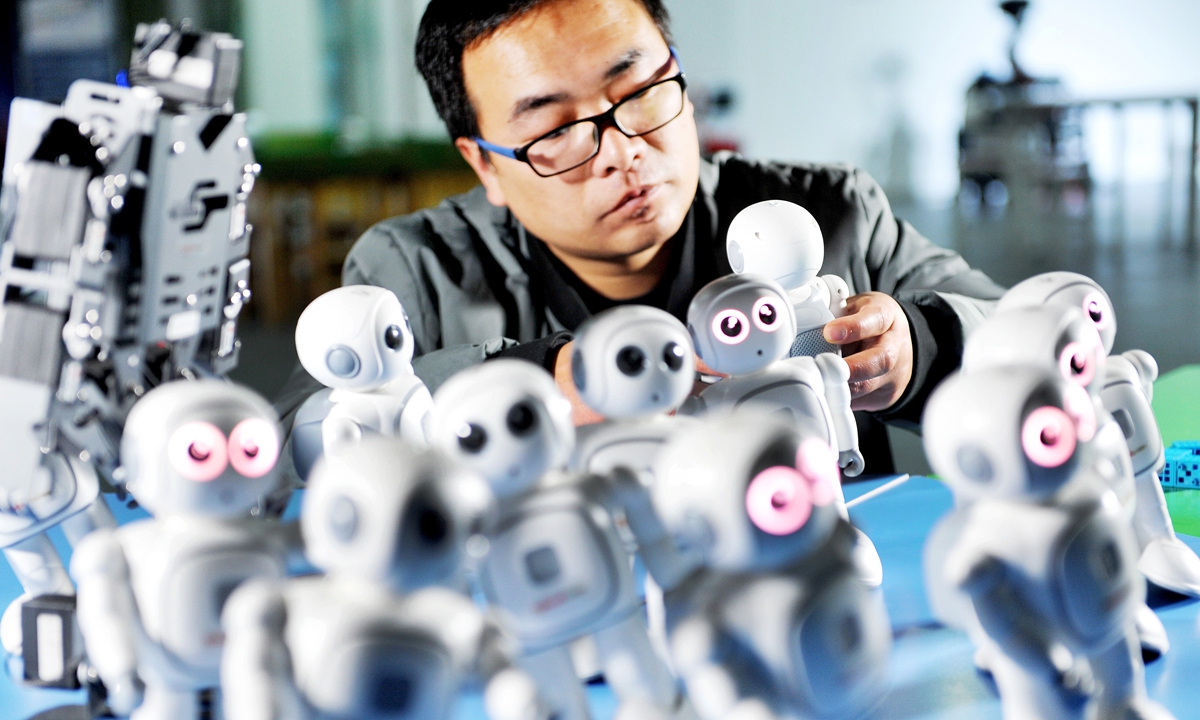

A technician debugs robots at the Yingtan High-tech Industrial Development Zone in East China's Jiangxi Province. The zone has attracted more than 200 leading companies from the Internet of Things sector, pledging to become an intelligent town boasting broadband wireless mobile communications networks. Photo: cnsphoto

The State Administration of Foreign Exchange (SAFE), the country's forex regulator, on Tuesday announced the expansion of a cross-border financing program for smaller high-tech firms, in the latest push to bolster the economy amid the COVID-19 fallout.

The pilot program that allows micro-, small and medium sized high-tech firms to access foreign debt would cover an additional eight provinces and cities including Tianjin municipality and East China's Shandong Province, bringing the total number of regions accessible to the trial to 17, per the SAFE announcement, effective immediately.

Other than the firms categorized as high-tech businesses, those falling under the country's push for specialized, refined and new small and medium sized enterprises (SME) would also be eligible for foreign borrowings.

The Tuesday announcement was intended to implement a raft of pro-growth policy measures by the State Council, the country's cabinet, and prop up the real economy, according to the SAFE.

Eligible businesses from the nine provinces and cities that had been covered by the pilot program prior to the expansion are granted an independent foreign debt quota of $10 million. The quota for businesses from the newly added regions is capped at $5 million.

In an effort to ensure that foreign debt financing is truly tapped for real economic development, the forex regulator stipulated that businesses must be registered in the pilot regions and be operational for at least one year. Only non-financial firms - property developers and businesses with local government financing vehicles are excluded - that are accredited by national or local authorities as high-tech or the aforementioned specialized, refined and new SMEs would qualify for the program.

In addition, qualified businesses' access to foreign debt is banned from securities investment, real estate purchases, and investment in property developers and local governments' financing vehicles.

The cross-border funding program was initiated by the SAFE in the Zhongguancun national innovation demonstration zone, Beijing's tech hub in March 2018 before being expanded to cover the nine regions including Shanghai, South China's Guangdong Province and South China's Hainan Province.

Global Times