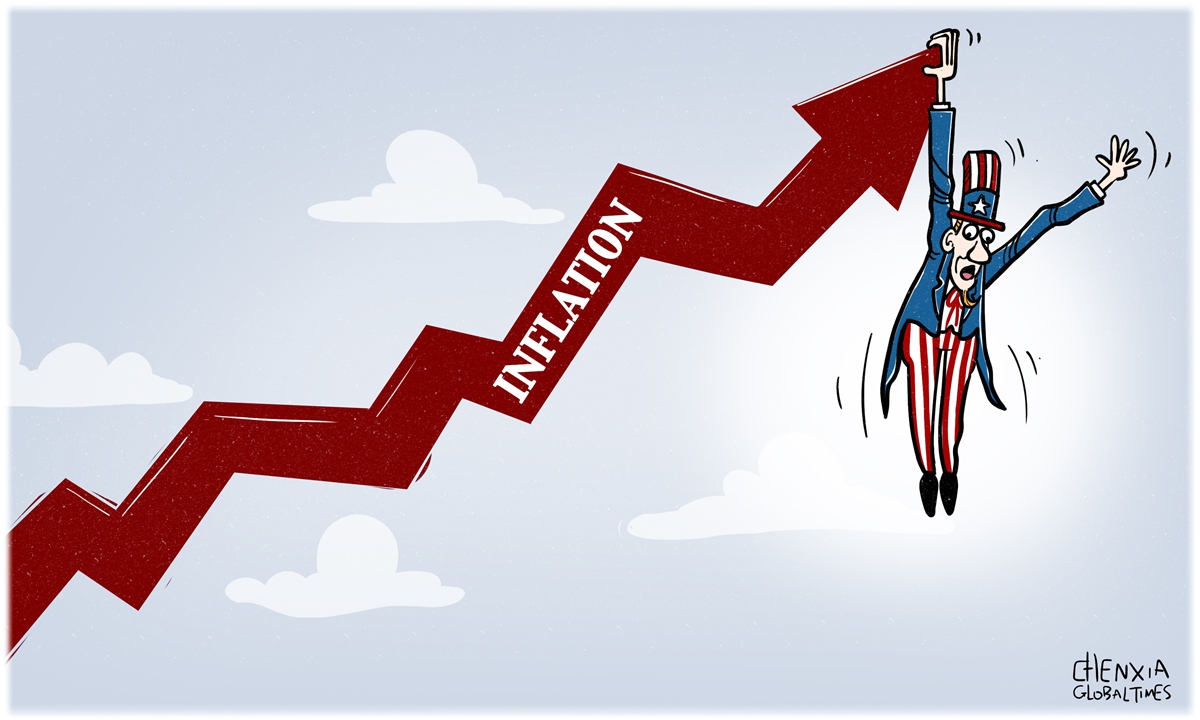

Illustration: Chen Xia/Global Times

To stop his approval ratings among American voters from cratering, US President Joe Biden will visit Saudi Arabia to persuade Riyadh to pump more crude oil and bring down elevated inflation in the US, according to a report by the New York Times. The White House said now it is time to reengage with Riyadh as the US has "important interests interwoven with Saudi Arabia," a country Biden once considered as a "pariah."If it weren't the consistently surging inflation - which has increasingly become an entrenched ailment harming the US economic system, the Biden administration wouldn't have lowered its "imperial head" before Riyadh.

Also to help ease price rises, a rising number of columnists for American newspapers, including the Washington Post and the Wall Street Journal, are asking the White House to put an end to Trump's trade war with China and eliminate the tariffs imposed on Chinese imports, because the tariffs have proved to be a form of punishing taxation on tens of millions of American households. How soon the Biden administration will complete its review of Trump's tariffs and make a decision to scrap them is not known yet. An uncertainty is correlated with the so-called China hawks in Washington who stubbornly believe that China is a strategic adversary of the US.

And the Biden administration is expected to continue to suppress Russia, by imposing unprecedented economic sanctions on Moscow, although the sanctions have created acute self-inflicted pain in the US and the West, by disrupting the global supply chain of crucial fuel, major raw materials and foodstuffs, driving up inflation worldwide.

Last week, Biden told American voters that controlling inflation is his "top domestic priority," as the rising cost of living has become a leading political issue as the US prepares for November's midterm congressional elections - which Biden and his fellow Democrats are feared to lose to their Republican opponents. If history is any guide when Americans struggle to afford necessities including food, fuel and shelter, they are most likely to vote the incumbent political party out.

According to opinion polls, public support for Biden on handling the US economy has plunged with the steady surge in the cost of living.

Inflation in April rose 8.3 percent from a year before, close to the 40-year high reached in March. Food prices went up by 9.4 percent from one year earlier. An index for meat, poultry, fish and eggs rose 14.3 percent, the largest annual increase since 1979. And energy prices were 30.3 percent higher than 12 months before, more than three times the rate of overall inflation. Last week, a poll revealed more than 70 percent of Americans believe that the US economy is "getting worse" and 78 percent are dissatisfied with the direction the country is heading in.

Price hikes have outpaced the coronavirus pandemic as the most discussed kitchen table topic in the US. Inflation is a regressive tax which disproportionately pummels low income groups and retirees. A deposit of $10,000 in 2021 is now worth only about $9,300, and next year it could be worth less than $9,000 - crystallizing example of the erosive effect of inflation.

Then, whose fault is it? Economists close to Biden and Democrats blame inflation on Russia, alleging the conflict in Ukraine and subsequent Western sanctions on Moscow has caused skyrocketing oil and natural gas prices. Some place the blame on pandemic-induced global supply chain disruptions.

But the root cause lies with the Biden administration.

In May 2021, several weeks after Biden signed the $1.9 trillion pandemic rescue spending bill into law, I wrote an essay for The Global Times entitled "Will Biden's fiscal largesse cause inflation and implode the bubble?" In the essay, I said, Biden's fiscal stimulus, or American Rescue Plan (ARP), would likely open Pandora's Box. "In essence, fiscal spending is inflationary, which is more so, coupled with the Federal Reserve's extraordinary loose monetary policy," I wrote, placing the cause of inflation squarely on the Biden administration and the US central bank. I predicted that "it won't be long - the end of 2021 or start of 2022 - before the Federal Reserve is forced to take action" by upending an overly loose monetary policy and raise interest rates.

Throughout much of 2021, the White House, in tandem with the Federal Reserve, had narrated that "there is nobody suggesting there's unchecked inflation on the way, no serious economist," and, "inflation will only be transitory."

But, it will last, becoming an underlying irritant shadowing the broad US economy.

American domestic shortages of manufactured goods is unlikely to improve as the Biden administration continues to disrupt free trade, impose sanctions on America's trade partners, and erect higher barriers for technology export, to serve its ill-guided attempt at de-globalization. The pandemic remains ongoing in the US, permanently stretching the labor force while the American baby boom generation is retiring, which will restrict the number of Americans available for companies to hire and consistently push up wages. Also, skyrocketing rental costs will sustain due to the US' dearth of affordable housing.

With these underlying structural problems, US inflation is unlikely to cool down in the short term, unless the Federal Reserve takes drastic measures by rapidly raising interest rates, which threatens to bring the economy to a painful and prolonged hard landing.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn