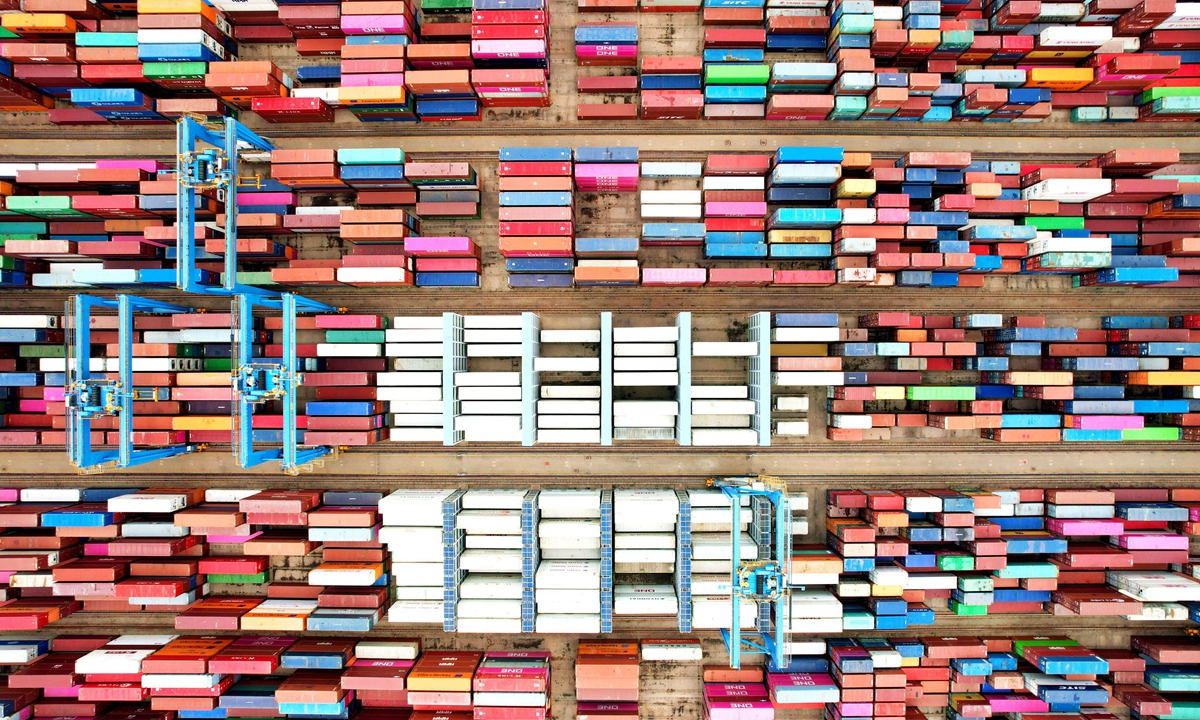

Containers pile up at Qingdao port in East China's Shandong Province on June 9, 2022. Chinese customs revealed that imports and exports in the first five months increased 8.3 percent year on year. Photo: cnsphoto

The better-than-expected growth also showed that the country's economic recovery has been picking up amid the waning impact of the pandemic on multiple economic fronts, especially industrial and supply chains.

Thanks to the effective control of the coronavirus outbreak and the government's efforts in boosting market supply and demand, the country is confident to sustain the current momentum and inject impetus into the sluggish world economic recovery, experts said.In May, China's exports stood at $308.25 billion, up by 16.9 percent on a yearly basis, significantly rebounding from the 3.9 percent growth in April, data from the General Administration of Customs (GAC) showed on Thursday. The figure far outpaces forecasts of around 8 percent.

The sharp rebound falls within expectations, as domestic factories have accelerated resumption and disrupted logistics have been smooth after the latest outbreaks in major cities, including Shanghai and Beijing, have been effectively contained, said Bai Ming, deputy director of the international market research institute at the Chinese Academy of International Trade and Economic Cooperation.

According to the GAC, the country's imports rose by 4.1 percent year-on-year to $229.49 billion in May, expanding for the first time in three months. China's trade grew 11.1 percent year-on-year last month, posting a trade surplus of $78.76 billion, expanding 82.3 percent year-on-year.

"The growing trade surplus adds to encouraging evidence of global reliance on Chinese products, highlighting the irreplaceable role of China in global supply chains," Bai said.

In the first five months, China's foreign trade with major partners including ASEAN, the EU and the US displayed growth. ASEAN remains China's largest trade partner, with trade standing at 2.37 trillion yuan ($354.32 billion), up 8.1 percent, accounting for 14.8 percent of China's total foreign trade volume. During this period, China-US trade increased by 10.1 percent to 2 trillion yuan.

A State Council executive meeting on Wednesday pledged more measures to further stabilize foreign trade and investment and promote the opening-up of the country.

More should be done to increase tax-refund support for export companies and expand high-quality product imports, enhance port services including transshipment and customs clearance, and keep international industrial and supply chains stable, the meeting said.

Despite mounting headwinds of rising international commodity prices and declining overseas demand amid high inflation, China's exports will still maintain double-digit growth in June, further bolstering overall economic recovery, experts noted.

As most provinces and cities have rolled out detailed measures to stabilize the economy in late May, the exports in June are expected to be further strengthened and accelerated, Tao Chuan, an economist with Soochow Securities told the Global Times on Thursday.

"The supply chain will accelerate the recovery in June after more policies are in place. As the trade surplus widens, the driving force of foreign trade on GDP in the second quarter is expected to increase," he said.

Fast track of recovery

"The Chinese economy has walked out of the darkest moment," said Zhong Zhengsheng, chief economist at PingAn Securities. He said the implementation of proactive fiscal policies, easing of property restrictions as well as policies to stimulate consumption will stabilize the economy, predicting the country's GDP growth will expand in the second quarter.

Faced with mounting economic downward pressure since May, the Chinese government immediately took a series of measures to spur domestic demand, ensure smooth logistics and stabilize industrial and supply chains, contributing to accelerated production and business resumption.

While China is stepping up efforts to bolster its economy after largely putting the outbreak under control, Western media outlets take any chance to badmouth China's economic outlook.

CNBC recently reported that China's road to recovery was slow and bumpy this year, with its theory being that the country faces a far more transmissible virus variant, overall weaker growth and less government stimulus.

In May, the country's official manufacturing Purchasing Manager Index (PMI) and non-manufacturing business activity index all rose despite still below the 50-point mark that separates contraction from growth. The official manufacturing PMI rose to 49.6 in May from 47.4 in April, marking the highest in three months while non-manufacturing business activity index up 5.9 percentage points month-on-month to 47.8, sending a clear signal of a rebound in economic activities.

Shanghai's move toward a lifting of lockdown also laid a solid foundation for the stellar recovery of foreign trade in May, experts said.

"Improved logistics, faster customs clearance rates, as well as coming back of industrial production have all provided fundamental support for the strong foreign trade data," Tao said.

According to data from the Ministry of Transport, the daily container throughput of Shanghai Port increased by 7 percent month-on-month in May. By the end of May, the average production capacity of Shanghai's auto industry had recovered to close to 80 percent of the pre-epidemic level, according to auto information service platform gasgoo.com.

Tesla's Shanghai Gigafactory has seen a robust output since the factory resumed operations in April thanks to a strong resilience in Chinese manufacturing capacity, the US carmaker told the Global Times on Thursday.

The factory has been running at full speed to boost its production with the capacity utilization rate recovering to 100 percent, the company said. It handed over 30,000 units in May and more than 40,000 vehicles rolling off production lines since the work resumption.

Consumption in the luxury sector also experienced growth after major Chinese cities such as Shanghai and Beijing eased COVID-19 restrictions.

At a luxury store in Shanghai, dozens of people were seen standing in line for their turn to enter stores on Wednesday and leave the mall with multiple bags. "The impact of the COVID-19 has been short-lived and we are still optimistic on the purchasing power of Chinese consumers," a sales representative told the Global Times on Wednesday.

Multiple facts have illustrated that China's economy enjoys strong resilience with positive fundamentals sustaining China's steady and long-term economic growth, Chinese Foreign Ministry spokesperson Zhao Lijian said at a regular press briefing on Thursday. "Sound pandemic control is the foundation of economic and social development, which is of the greatest benefit," he said.

"The business environment is a shiny name card that China shows to foreign enterprises," Zhao said, noting that a recent report by the China Council for the Promotion of International Trade showed that over 50 percent of foreign enterprises surveyed consider China their top investment destination.

Despite the recovery momentum, China's economy still faces internal and external risks and challenges, Zhong said. He said the recovery of the employment market lags behind that of the country's overall economy, household consumption recovery lacks momentum, and rising risks of imported inflation and mounting pressure in fiscal spending, among others.

The World Bank on Wednesday projected that China's GDP will slow to 4.3 percent in 2022, down 0.8 percentage points from its previous forecast in December, largely reflecting the economic damage caused by the persistence of COVID-19 outbreaks.

In a fresh move to bolster the economy, the State Council recently announced a basket of 33 measures, including increasing government procurement support for small businesses, enhancing financial support for infrastructure construction and major projects, and promoting the consumption of big-ticket items such as automobiles and home appliances, vowing to stabilize the national economy during the second quarter.

Aside from accelerating the implementation of the 33 measures, Zhong suggested stepping up efforts to stabilize employment for key groups such as fresh graduates, increasing targeted financial support for pandemic-hit industries, and optimizing property market restrictions.

Zhou Maohua, a macroeconomic analyst at Everbright Bank, told the Global Times that the growth of the world's second-largest economy will inject confidence and new vitality into the global recovery.

"China serves as a ballast stone in stabilizing global industrial chains against the backdrop of declining global trade and sluggish supply chains. The recovery of China's foreign trade will boost global trade and investment, stabilize employment around the world, and curb high inflation globally with sufficient supply," Zhou said.