China launches chip stock index to guide more investment into crucial sector

Move offers investors more options to boost sector

File photo shows the exterior view of Shanghai Stock Exchange at Pudong New Area in Shanghai, east China. (Xinhua)

China formally released the STAR Chip Index on Monday to track the performances of leading firms in such fields as semiconductor materials and equipment, chip design, and chip packaging and testing, aiming to attract more capital investment into the increasingly crucial industry amid broadening US' crackdown campaign.

Experts said that the rollout of the index will further diversify investors' options and actual investment, guiding more capital into the country's up-and-coming integrated circuit industry, which represents an important direction of development set in multiple national strategic plans.

According to the Shanghai Stock Exchange (SSE), up to 50 listed companies with large market capitalizations were selected as the constituents of the index, including Semiconductor Manufacturing International Corp (SMIC), Montage Technology Co and National Silicon Industry Group Co.

Buoyed by the move, SMIC's shares in Shanghai inched up 0.77 percent to 45.74 yuan ($6.8) on Monday.

"As another major sub-index of the STAR Market, the rollout of the STAR Chip Index underlines the growing importance of the chip industry for China, especially amid the US' accelerated tech decoupling push," an anonymous capital market insider told the Global Times on Monday.

The move will offer investors better knowledge of the overall performance of leading Chinese chip companies so that chipmakers can raise funds at a reasonable price to step up research and development (R&D), and expand their businesses, the insider said. "There is no doubt that more capital will flow into the strategically important sector under market forces."

As one of the key areas supported by the STAR Market, the chip-related industries have seen 57 technologically innovative companies listed on the board. A group of leading companies in the chip sector have achieved breakthroughs in key technologies, according to the SSE.

While some Western countries have imposed technological blockades and sought to restrict chip product exports to China, many firms are striving for breakthroughs in various areas.

For example, Shanghai-listed silicon carbide substrates producer SICC Co independently developed semi-insulating silicon carbide substrate materials, achieving self-reliance and control of the core material, and effectively ensuring domestic supply to maintain the stable development of the industry chain in China.

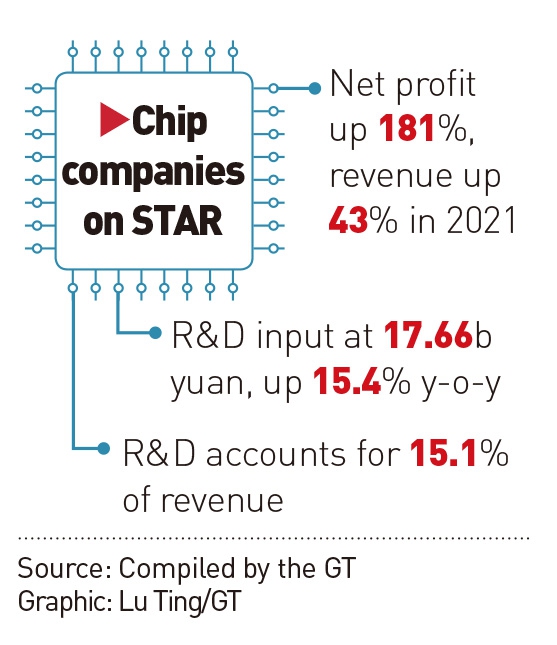

Chip-related companies on the STAR Market recorded outstanding growth in 2021, posting year-on-year increases of up to 181 percent in profit, according to their annual reports. Their R&D investment expanded 15.4 percent to 17.66 billion yuan, ranking high among A-share companies in the same industry and providing strong support for the high-quality development of the industry chain.

The progress in the domestic semiconductor sector comes as China strives for scientific and technological self-reliance and domestic replacement products to ensure national security, as the US has made the sector a new battleground in its strategic containment of China.

US-based news outlet The Information reported in May that the US Department of Commerce was weighing a ban on US firms selling advanced chipmaking equipment to Chinese companies, with the rules to affect more Chinese companies, including Hua Hong Semiconductor and ChangXin Memory Technologies. It said the potential ban could take months to draft.

"Although the Biden administration tries to build a semiconductor industry alliance with South Korea, Japan and the island of Taiwan to contain the rapid development of the industry in China, the US is doomed to fail in squeezing China out of the global industry and supply chains, given the latter's large application market," said Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China.

China held the largest market for semiconductor equipment for the second time in 2021, with sales expanding 58 percent year-on-year to $29.6 billion, the fourth consecutive year of growth, according to a report from industry association SEMI in April.

In support China's technology strategies, the SSE is a market for the allocation of financial resources. Its listing rules state that companies that are not yet profitable or have accumulated deficits are allowed to be listed on the STAR Market, Dong said, noting that government direction in turn promotes the role of the capital markets.

On June 6, Shenzhen, South China's Guangdong Province released a document, proposing to accelerate the improvement of integrated circuit (IC) design, manufacturing, packaging and testing on the industry chain. It urged technological breakthroughs in electronic design automation tools, semiconductor materials and high-end chip design, among other aspects, aiming to develop into a city aggregating the IC industry and talent.

Graphic: GT