US protectionism dulls global interest in dollar assets after steep rate hike

Chinese market becomes safe haven amid foreign economic volatility

US dollar assets are increasingly losing their appeal with global investors, as China and Japan's holdings of US Treasuries in April fell to years-low while the US stock market is undergoing sharp volatility in recent days, a phenomenon which coincides with its volatile policies and underlined by its troubled economy and a hawkish stance on other countries it sees as competitors or rivals.

Such policies, whether in the form of sharp interest rate hikes, unilateral sanctions, trade punitive measures against China or setting up an exclusive supply chain alliance in Asia, are not only causing economic turbulence in the US and around the globe, but are undermining the reputation and credibility of the US globally and frightening investors to seek assets of more stable yields, analysts said.

In April, China's holdings of US Treasuries tumbled to their lowest level since May 2010, according to data published by the US Treasury Department. Chinese holdings of US Treasury securities dropped to $1.003 trillion in April, compared with $1.039 trillion in March and $1.096 trillion in April 2021. Japan, which is currently the largest non-US holder of US Treasuries, also decreased holdings in April to their lowest level since January 2020.

The US stock market is also undergoing drastic fluctuations. After the US markets experienced a sharp selloff on what media called Black Monday this week, share prices also plunged sharply after opening time on Thursday. The Dow Jones edged down 2.24 percent as of 10:18 pm, while NASDAQ was down 3.42 percent.

The selling off trend is quickening at a time when the US Federal Reserve is kick-starting an aggressive cycle of interest rate hikes after the US consumer price index rose by an annual 8.6 percent in May, the largest yearly increase since 1981.

According to an article published by staff from the price monitoring center of the National Development and Reform Commission recently, US protectionism policies are the source for the inflation, as trade protectionism has driven up supply costs and commodity prices.

"Trade war is the start, the pandemic and geo-political tensions is the catalyst, loose monetary policies provide ample 'bullets' for inflation, Wall Street and big Western companies add fuel to the fire to gain windfall profits from inflation. These factors have collectively driven up inflation levels surrounding protectionism," the article said.

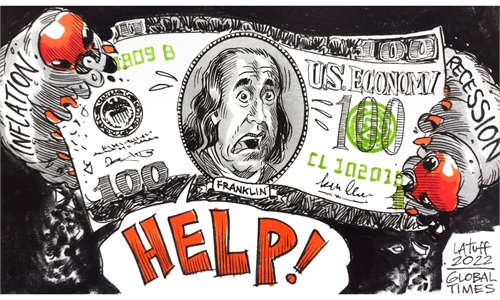

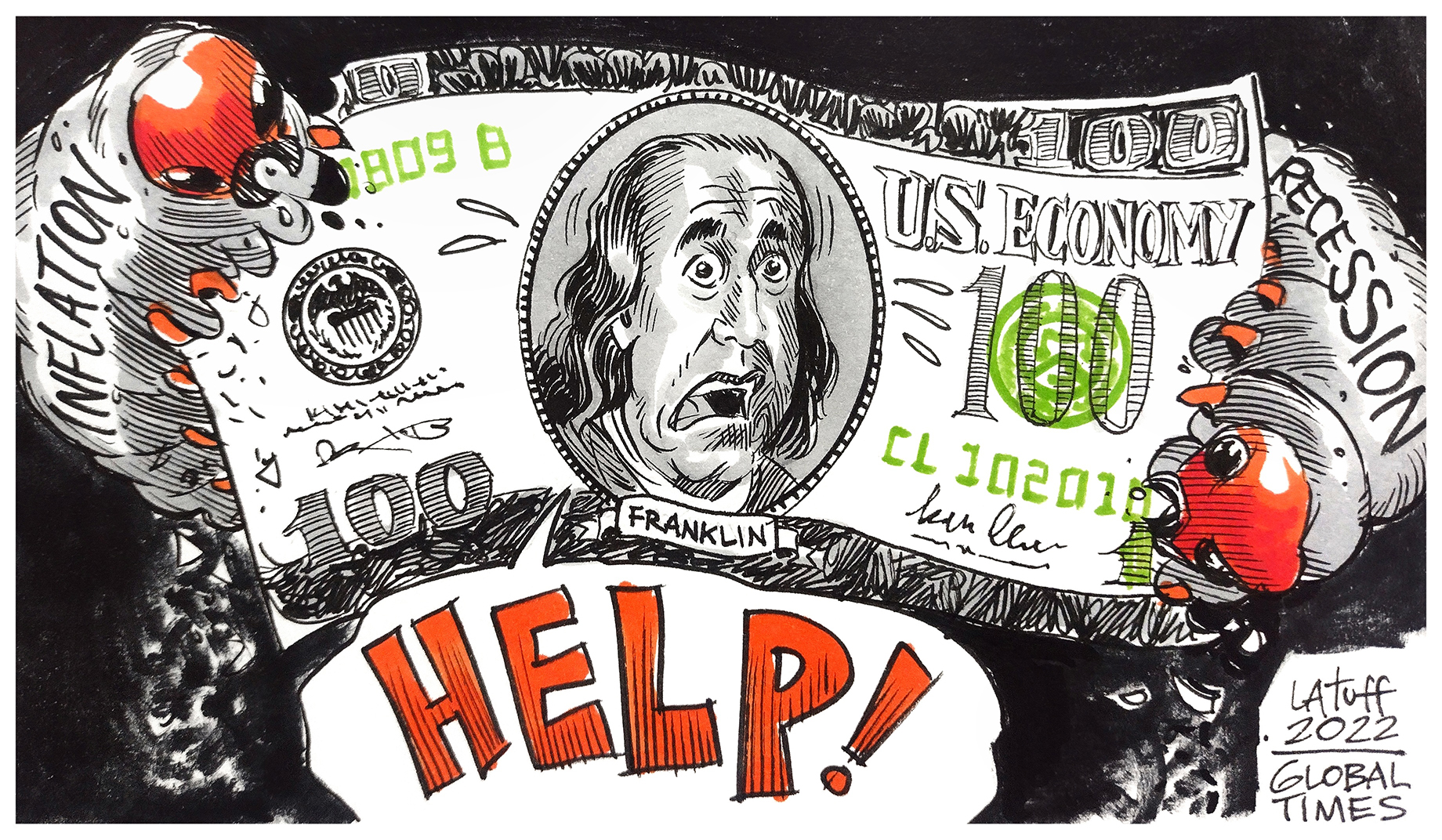

US faces dual risks of inflation, recession Illustration: Carlos Latuff

Policy aftermath

The US Federal Reserve on Wednesday raised its benchmark interest rate by 75 basis points, marking not only the third interest rate hike this year but the most aggressive hike since 1994. Fed Chairman Jerome Powell also said in a news conference that he expects the July meeting to see an increase of 50 or 75 basis points, according to a CNBC report.

The anticipation for more interest rate hikes would prompt global investors to sell Treasuries to stem losses as Treasury bill prices fall, said Xi Junyang, a professor at Shanghai University of Finance and Economics.

But a more crucial stimulus for the situation should be internal US policies, whether in terms of irresponsible, volatile monetary policies that create a negative impact on global markets, or hawkish, suppressive policies toward its competitors like China, that are ruining the US government's credibility around the world by making other nations feel insecure about holding US dollar assets in large quantities, experts said.

"Seeing what the US did to many countries by rolling out crackdown measures, such as financial sanctions on Russia and suppressing measures against Chinese tech companies, many countries would naturally fear the risks of relying on US dollar assets too much, as they fear a similar dilemma if the US sanction stick falls on them," Xi told the Global Times on Thursday.

Furthermore, US protectionist policies are not only spreading economic instability to other countries, but also triggering global anticipation for a US economic decline as well, experts noted.

Xi said that the US' recent launch of the Indo-Pacific Economic Framework for Prosperity (IPEF), an initiative that is seen by many as intending to isolate and suppress China, will make investors worry about more economic instability in Asia and in the US as well, hurting their confidence in US dollar assets.

The drastic turn in US monetary policies will also bring about negative economic consequences to the world. According to Liang Haiming, dean of the Belt and Road Institute at Hainan University, the Fed interest rate hikes might trigger debt risks and even financial crises in emerging economies.

"The Fed's capricious policies, kick-starting an interest rate hike cycle after flooding liquidity, has already caused irresponsible blows to emerging economies. If emerging markets are always tortured by such cycles of 'bubbles and busting,' their economies might suffer internal injuries that can't be cured in the long term," Liang told the Global Times.

Independent trend

In the midst of volatile US policies and the financial shockwaves it caused, China's financial markets have shown a steady, improving trend, a phenomenon which experts attributed mostly to China's "internal circulation" with robust market demand.

One reflection of this is the stable performance of China's stock markets despite drastic fluctuations in US stock markets. Chinese shares had outperformed most markets on Tuesday following an overnight US stock bloodshed, with the Shanghai market rising 1.02 percent. Mainland shares were also stable on Thursday, with both the Shenzhen market and the ChiNext board edging up slightly, following a rebound in the US stock market on Wednesday.

Market observers stressed that China is one of the most stable markets with the lowest risk globally, offering a hedging advantage to international investors who are seeking safe havens thanks to the nation's stable political and economic environment amid the effective containment of domestic COVID-19 flare-ups.

"The Chinese market is independent of US and Western markets, and will not resonate with them, which can balance the volatility of the international market caused by the fluctuations in the US stock market," Dong Dengxin, director of the Finance and Securities Institute of the Wuhan University of Science and Technology, told the Global Times on Thursday.

The high-quality of China's capital market significantly relies on its internal circulation with a robust market demand, as Chinese enterprises have been ramping up efforts to upgrade their innovative technologies to elevate services and product quality, Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at the Renmin University of China, told the Global Times on Thursday.

China's assets, especially yuan assets, have become more attractive to foreign investors with its long-term value preservation and stability following the country's continuous efforts at expanding foreign investment channels and deepening opening, analysts said.

According to a white paper targeting yuan's internationalization in 2021 released by Bank of China on June 2, 61.3 percent of the surveyed foreign financial institutions said that they would increase their allocation of yuan-denominated financial assets, up 9 percent compared to 2020. Two-thirds of foreign financial institutions in the securities, investment banking and fund management categories noted that they would be willing to increase their holdings of yuan assets.

Liang Haiming also noted that at a time when Fed policies are bringing instability to emerging markets and developing economies, the yuan could decrease the vulnerability of global financial system if it can exert the function of stabilizing exchange rate.

"Countries' confidence in the yuan will strengthen, and their interest will grow further to cooperate with China in economic areas. This would not only further push the yuan's internationalization, but will boost China's cooperation with other countries under the Belt and Road Initiative," he said.