Aerial photo taken on Oct. 17, 2020 shows a cotton harvesting machine working in a field in Manas County, Hui Autonomous Prefecture of Changji, northwest China's Xinjiang Uygur Autonomous Region. File photo: Xinhua

Sales of cotton produced in Northwest China's Xinjiang Uygur Autonomous Region have dropped this year due to the joint effect of constrained domestic consumption and delayed export orders following the latest round of COVID-19 outbreak, while the US sanctions have only had a slight impact, companies and industry insiders said on Monday.

The South China Morning Post reported on Monday that about 3 million tons of unsold cotton are piled up at mills in Xinjiang, which it claimed was due to the US' so-called Uygur Forced Labor Prevention Act. The law prohibits the imports of goods made in the region unless US importers could show that there is no "forced labor" involved.

In the name of "human rights," the US has engaged in unilateralism, protectionism and bullying, which seriously undermined market principles and violated WTO rules, said a spokesperson of the Ministry of Commerce on Tuesday, noting that China is firmly opposed to the US ban on Xinjiang-related products and that China will take necessary actions.

"What the US has done is a typical act of economic coercion. It seriously harms the vital interests of businesses and consumers in both China and the US. It is not conducive to the stability of global industrial and supply chains, the easing of global inflation or the recovery of the world economy," said the spokesperson.

A cotton industry source in Xinjiang's Aksu Prefecture surnamed Luo told the Global Times on Tuesday that he learned from ginnery owners that some cotton yarn manufactured by local cotton mills last year has not been sold.

"The cotton price has kept climbing since September 2021, and processing factories bought it at near-record highs of 23,000 yuan ($3,430) to 25,000 yuan a ton. But since February 2022, the cotton price has plunged, prompting downstream plants to adopt a wait-and-see attitude on expectations of a future price rebound, which also delays cotton sales," Luo said.

Industry insiders said that US sanctions only played a "marginal" impact in local cotton stockpiles, as local farmers are relying on domestic sales channels.

Zhang Jie, who runs a textile plant in Xinjiang and a clothing export company in Shanghai, told the Global Times on Tuesday that the recent epidemic flare-ups in megacities including Shanghai and Beijing sapped Chinese consumers' purchases of products including clothes, leading to rising clothes stockpiles that reduced manufacturers' demand for cotton and cotton fabric.

"Raw material exports to third-country markets have also been affected by delayed logistics networks and port congestion, which weighed on upstream chains," Zhang said, but the situation is expected to improve in the coming months.

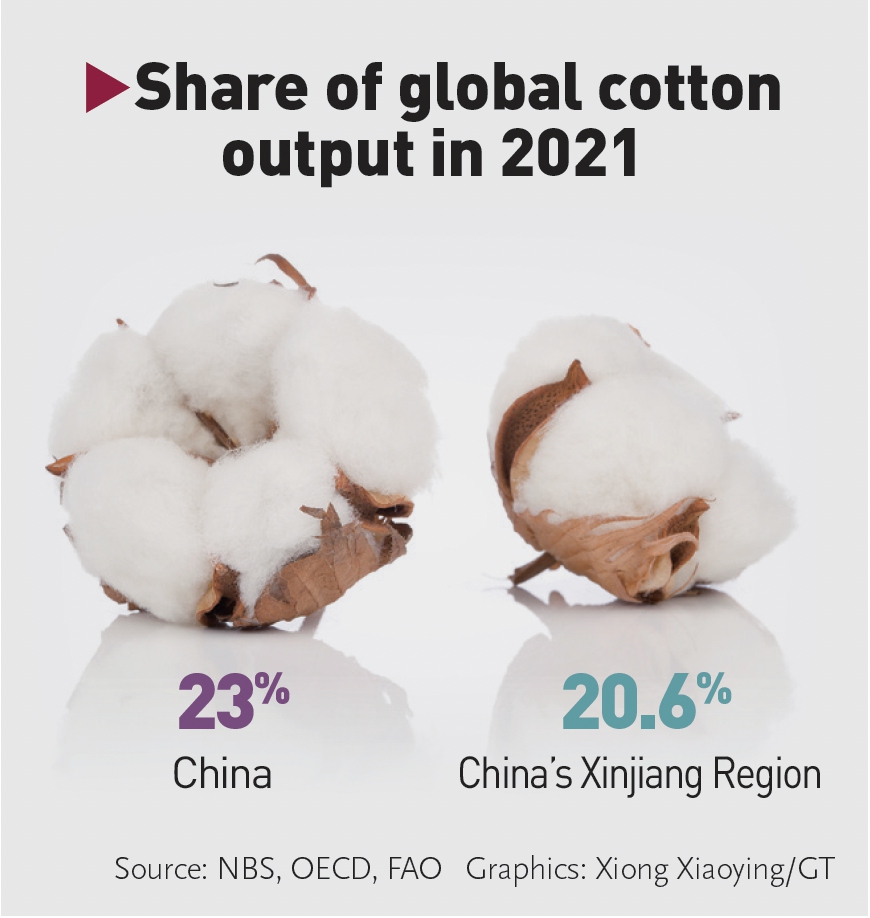

According to the National Bureau of Statistics, the cotton output in Xinjiang accounted for 89.5 percent of the country's total in 2021, with the region's output and planting area ranking top in China for more than 20 years in a row.

Xinjiang's cotton output accounts for nearly 90% of China's total By Jin Jianyu and Xia Qing

On May 30, the Xinjiang regional government held a meeting on promoting the stable and sound development of the cotton industry. The meeting proposed to accelerate the establishment of cotton and yarn transaction centers and digital platforms to enhance the digitalization of the industry, while inducing large textile firms to increase jobs as well as their economic contribution, according to a press release on the local government website.

An owner of a cotton mill, who declined to be named, told the Global Times that US sanctions on Xinjiang cotton would deal a blow to global industrial and supply chains.

"Other countries couldn't fill the supply gap," he said, noting that the US produces only four million tons of cotton every year, while Southeast Asia also needs a large quantity.

Share of cotton production of China and China's Xinjiang Region in the world in 2021 Graphic: GT

As a result, cotton prices in such major producing countries as India having started surging. Due to a demand-supply mismatch, cotton prices have gained nearly 40 percent in 2022 to hit an 11-year high, hurting cotton yarn spinners and cotton-based textile and garments manufacturers, CNBC reported in May.