As BRICS summit kicks off, calls grow for parallel payment system to counter US hegemony

Emerging markets need parallel system to counter West’s dominance: Russian banker

Aerial photo taken on June 17, 2022 shows the headquarters building of the New Development Bank (NDB), also known as the BRICS bank, in east China's Shanghai.(Photo: Xinhua)

In a keynote speech at the opening ceremony of the BRICS Business Forum on Wednesday, Chinese President Xi Jinping called on the BRICS business community to expand cooperation on cross-border e-commerce, logistics and local currencies.

As the 14th summit of the BRICS, a group of major emerging market economies comprising Brazil, Russia, India, China and South Africa, kicked off on Wednesday, there are growing calls from bankers and economists in BRICS countries, especially Russia, for the bloc to expand national currency settlements and lending to counter the US' weaponization of the dollar.

Russian President Vladimir Putin said in a welcome address to BRICS Business Forum participants on Wednesday that the issue of creating an international reserve currency based on a basket of currencies is under review, Russian news agency TASS reported.

"The BRICS and other interested nations need to talk about setting up their own independent global financial system - whether it would be based on the Chinese currency or they will agree on something different. They need to debate this," Sergey Storchak, chief banker of Russian bank VEB.RF, told the Global Times in a video interview on Tuesday.

Storchak said that he hopes during China's presidency of this year's BRICS summit, member countries have open discussions on what really needs to be done.

VEB.RF is a major financial development institution in Russia that has been excluded from the SWIFT system.

There has been an ongoing discussion within the BRICS to accelerate payments in national currencies for years, and the need is becoming particularly urgent after the US removed some Russian banks from the SWIFT global interbank payments system and forced other economies to pay for its economic problems with sizeable financial tightening.

"If the voices of emerging markets are not being heard in the coming years, we need to think very seriously about setting up a parallel regional system, or maybe a global system," he said.

The impact of being pushed out of the SWIFT system is quite large, Storchak said. "The biggest issue is the transfer of money and information, and we need to come to the issue of the wide utilization of national currencies. It would mean that we would not need to use the banking system of either the US or the EU," he said.

Such calls for an independent payment system are growing within the BRICS.

Marco Fernandes, a Brazil researcher at the Tricontinental Institute for Social Research, also called on the BRICS to focus on creating an alternative to the US dollar's hegemony in global transactions at a conference at the Chongyang Institute for Financial Studies of the Renmin University of China on Tuesday.

"After confiscating tens of billions of dollars in reserves and assets from countries like Iran, Venezuela and Afghanistan, the seizure by the US and the EU of more than $300 billion of Russia's reserves, triggered a global alert, reaffirming the urgency of alternatives to the dollar's dominance," Fernandes said.

Analysts noted that the US' increasing use of the dollar as a political weapon in recent years - through sanctions or conditional loans - prompts countries to seek other currencies for commercial transactions and in the composition of their foreign reserves.

To shrug off pressure from the US to join in its sanctions against Russia, India was exploring the possibility of using the Chinese yuan as a reference currency in an India-Russia payment settlement mechanism for its oil trade with Russia, Indian news outlet Livemint reported in May.

In addition, former Kremlin economic adviser Sergey Glazyev has proposed a new global financial system - via an association between the Eurasian Economic Union and China - that would be underpinned by digital currency and backed by a basket of new foreign currencies and natural resources of the member countries, according to website The Cradle, which mainly covers West Asian geopolitics.

Cao Heping, an economist at Peking University, said that there are other bilateral or multilateral global settlement systems for cross-border financial services, including China's Cross-border Interbank Payment System (CIPS).

The CIPS processed around 80 trillion yuan ($11.91 trillion) in 2021, up more than 75 percent year-on-year. According to data from SWIFT, the yuan retained its position as the fifth most active currency for global payments by value in April, with a share of 2.14 percent.

Cao suggested that BRICS members step up cooperation in investment and financing in major sectors such as strategic emerging industries and digital innovation in a bid to boost the use of local currencies in trade and investment settlement.

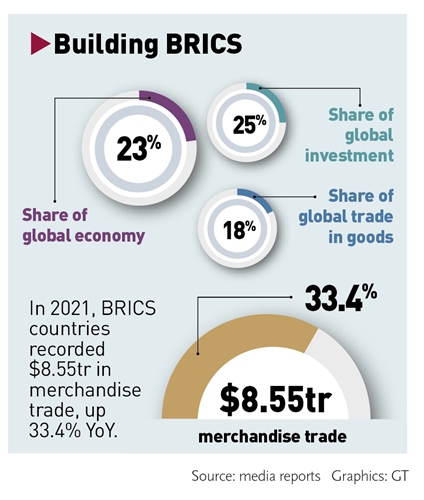

BRICS countries are an important driving force for regional and global economic and trade growth. Despite the prolonged impact of COVID-19, the total volume of trade in goods of BRICS countries reached nearly $8.55 trillion in 2021, up 33.4 percent year-on-year, official data showed.

The bloc accounts for 18 percent of trade in goods and 25 percent of foreign investment globally, statistics show.

"Along with the development of the mobile internet, digital payment has also become a tool for cross-border transactions. More opportunities are expected in this regard," Cao said.