The offshore yuan exchange rate falls below 6.73 intraday, while the onshore yuan exchange rate depreciates by more than 500 points intraday on May 6, 2022. Photo: IC

The allure of yuan-denominated assets has shown a pronounced rise over the past decade, with overseas investors having put upwards of $2 trillion into Chinese securities, as the country continues to open up its equity market, Wang Chunying, deputy head of the State Administration of Foreign Exchange (SAFE), said on Thursday.

The increased flexibility of the yuan that has over the past decade risen in prominence, with a bigger global role, also attests to the economy's financial fulfillments since the 18th National Congress of the Chinese Communist Party in 2012, according to Wang.

As the country continues a steady push for capital account opening, direct investment has been basically convertible and cross-border securities investment has achieved a multichannel and multilayered two-way opening-up, the SAFE deputy head told a press conference in Beijing.

Domestic residents have also gained access to more conduits for trades in overseas assets, she said.

In a sign of the rising appeal of yuan assets, overseas investors have put more than $2 trillion into Chinese securities, the SAFE official said.

Furthermore, the yuan's two-way fluctuations and its increased flexibility pave the way for the Chinese currency to be capable of promptly and effectively unplugging itself from external pressure, thereby helping to stabilize market expectations.

Meanwhile, the yuan's share of global foreign exchange reserves and international payments and settlements continued to rise, she continued.

The yuan remained the fifth most active currency for global payments in value terms in May, with a share of 2.15 percent. Yuan payments rose by 4.04 percent compared with April on the back of a 3.88 percent increase in all payment currencies, per the SWIFT's monthly yuan tracker on Thursday.

Also addressing the press conference on 10 years of financial sector progress, Chen Yulu, deputy governor of the People's Bank of China (PBC), the country's central bank, disclosed that overseas investors' holdings of domestic yuan-denominated financial assets have risen by 2.4 times compared with a decade ago.

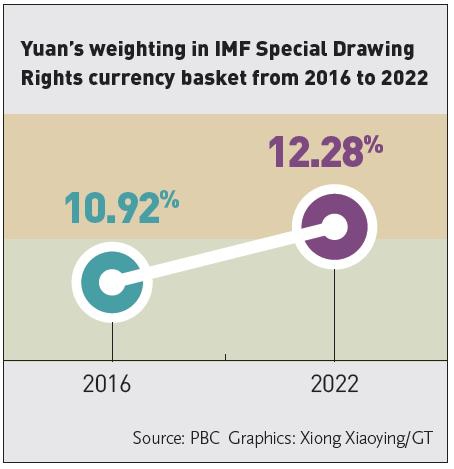

After being included in the IMF's Special Drawing Rights (SDR) currency basket, the yuan has become the third-largest SDR currency, with its weighting increasing to 12.28 percent from 10.92 percent.

Yuan's weighting in IMF Special Drawing Rights currency basket from 2016 to 2022 Graphic: GT

The US Federal Reserve-led cycle of rate hikes could weigh on yuan assets, as the yuan faces depreciation pressure amid the PBC's pursuit of monetary policy independence, Tan Yaling, head of the China Forex Investment Research Institute, told the Global Times on Thursday.

With interest rate differentials between China and the US narrowing and even inverting, the downward pressure could strengthen, Tan said.

However, the attraction of yuan assets over the longer term will depend on how successful China's economic rebalancing would be in years to come, especially when taking into account a rivalry with the US economy on multiple fronts, Tan noted.

The PBC's success in implementing a domestically centered monetary policy was also discussed at the Thursday press conference.

"We have held onto controlling the monetary sluice gate, refraining from flood irrigation-style [stimulus] and guarding ordinary people's purses," Chen of the PBC said.

Since 2012, M2 broad money supply has grown at an average annual rate of 10.8 percent, largely in line with average nominal GDP growth per annum, he revealed.

The country's macro leverage ratio, according to Chen, stood at 272.5 percent at the end of 2021, up 23.9 percentage points from the end of 2016, or an increase of 4.8 percentage points on average over the five years.

By comparison, China's annualized GDP averaged around 6 percent during the period, while its annual consumer price inflation gain averaged roughly 2 percent and the average addition of urban jobs exceeded 13 million annually.

This suggests the country has banked on a mild and controllable macro leverage ratio to achieve a mix of relatively high growth, low inflation and decent job creation, the deputy central bank chief remarked.

Since the COVID-19 outbreak, China has based a quick economic rebound on comparatively less new debt with an increase in the macro leverage ratio that was conspicuously lower than other major economies, Chen added.