Illustration: Xia Qing/Global Times

General Motors (GM) witnessed a year-on-year fall of 35.5 percent in sales during the second quarter of 2022 in the Chinese market, according to media reports. The US automaker reportedly said it sold 484,200 vehicles from April through June in China, its largest market globally.Some in the West overstated existing problems and tried to depict GM as a tragic victim of China's dynamic-zero strategy. CNBC emphasized that GM saw its worst quarterly sales in China since the beginning of the coronavirus pandemic, and attributed its sales drop to the resurgence of COVID-19 in China and ongoing global supply chain problems.

Chinese news site caijing.com reported Wednesday that GM's sales of renewable energy products saw year-on-year growth of 12.5 percent during the second quarter of 2022 in China, but these positive signs were sadly unreported by many Western media outlets, overlooked by investors in the West. It would be unhelpful for global investors to have a real and comprehensive picture of China, the world's largest automobile market.

There is no denying that the latest round of COVID-19 outbreak in China has created some economic headwinds, but this can only be deemed as a short-term factor that has a limited effect on long-term production and practice of enterprises. After weeks of hard work, China has brought its worst outbreak of COVID-19 under control. Blaming the resurgence of the COVID-19 is simply a lazy excuse for GM's falling sales.

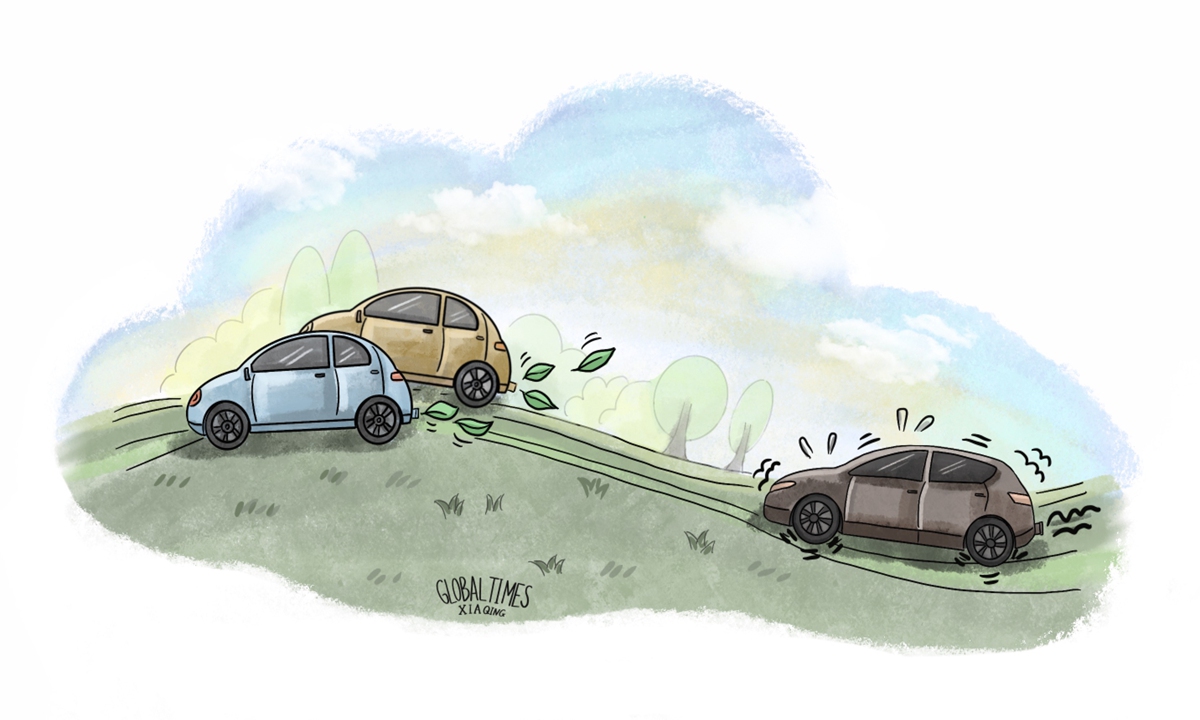

The Chinese auto market is undergoing rapid and dramatic changes. As China is ramping up its green mobility drive amid a pledge to peak carbon emissions by 2030, new-energy vehicles (NEVs), including plug-in hybrids and battery-only electric vehicles (EVs), are gaining popularity in the Chinese market. In 2021, China's auto sales rose 3.8 percent year-on-year to 26.28 million units, among which NEVs recorded an outstanding performance, surging about 160 percent to 3.52 million units, data from the China Association of Automobile Manufacturers (CAAM) showed. For both domestic and foreign-invested automakers, only by getting a competitive edge in the NEV sector can those firms dominate the future auto market.

The Financial Times reported Tuesday that Chinese electric vehicle maker BYD has dethroned Tesla as the world's biggest electric vehicle producer by sales. BYD's success is a result of its good performance in the Chinese market. Despite the outbreak of COVID-19 that viewed by Western media as a factor resulting auto sales decline, BYD's NEV sales were up 162.7 percent year-on-year in June, according to media reports. If traditional automakers, GM included, could have done better in the NEV market, then potentially these companies wouldn't have been hit so hard by the pandemic and would have reported a better-than-expected performance in the past few months.

GM has announced big investment in NEVs and has done a better job than many other foreign brands. However, traditional automakers' transition to an electric lineup is no easy thing. Competition is fierce in China's NEV market, and foreign traditional automakers have to think about how to maintain their market share and influence in this new landscape.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn