Cycling in vogue across Chinese cities with healthy living in focus

Bike Culture Gear Change

Cyclists riding in Huhhot, North China's Inner Mongolia Autonomous Region. Photo: VCG

A sudden rejuvenation of the bicycle scene in some big cities in China is taking place as the COVID-19 epidemic enters its third year.

In Beijing, along the famous Changan Avenue, the sight of swarms of bikers dressed to the nines powering up exorbitantly priced bikes has quickly become the new normal.

A 20 something Beijing resident surnamed Wang said he is looking up bikes priced between 1,000 yuan ($149.4) to 100,000 yuan in the city's bike stores as well as online shops.

Fancy bikes, along with frisbee and camping, have become the summer 'must haves' for the Z-generation in the capital of the world's second largest economy in 2022.

Industry insiders say the new trend is deeply intertwined with the impact of the pandemic, Chinese people's rising income levels and living standards, and their pursuit of healthier lifestyles.

New fad

One major features of the current fad on wheels is that shoppers are eyeing off high-end product offerings, mostly sold by a string of foreign brands from the US and Europe, including Specialized, Trek and Brompton. The island of Taiwan also sport two popular brands - Giant and Merida.

Shi Pengsong, a former sales manager at Specialized, said there is a palpable increase in the interest in owning a bike in China's big cities.

Chinese consumers have shown a preference for premium bikes, Shi said, as "in here, it is as much as about bikes as about social identity."

"The average consumers in foreign countries are often content with bikes that are priced at 2,000 yuan, which is enough for a large range of fairly good bikes, consumers in China, however, have a tendency to go straight to the more expensive, sports-grade bikes," Shi said.

Now many people are inquiring bikes prices at 10,000 to 30,000 yuan, some even go for those selling at 70,000-80,000 or even 100,000 yuan, Shi noted. "This is something people outside China don't do."

Shi, now focusing at bike experiences for kids, said the underlying factors are Chinese people's increased sense on keeping a healthy body and the fact that many top tier cities are becoming more bike friendly as a result of urban planning.

The awareness of keeping fit has steadily increased among Chinese people in between the two Olympics hosted in the country, and the government is looking at further ratcheting up the number of people who regularly participate in sports activities to 37.2 percent of the population by 2025.

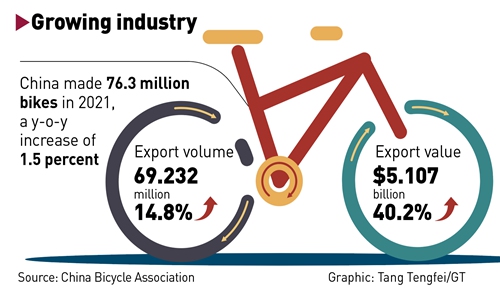

Graphic: Tang Tengfei/GT

Big opportunity

As bikes once again fall under the spotlight, brands have been scrambling to meet surging demand from China's vast middle-class.

Experts say the buzz around premium bikes in 2022 serves as a reminder to foreign brands about the potential dividends available from successfully marketing their products in China.

There is just one problem. They need to be able to churn out product to meet demand, something many brands are unprepared for in 2022.

Bike shops in big Chinese cities are beginning to run out of stock, according to media reports, as the global supply chain of high-end bikes face bottlenecks under the impact of the pandemic.

When the Global Times contacted two of Giant's shops in Beijing, staff confirmed that its best selling road bikes - the Escape series - are constantly running out of stock. Customers have to wait for up to several months.

A marketing department manager surnamed Wang from US high-end bike brand Trek told the Global Times over the weekend that the company did not feel a peculiar rise in demand from mainland customers but admitted that China is no different with the rest of world currently in a heightened interest in bikes in the wake of the pandemic.

Wang said Trek's supply in the Chinese market has also been affected by a global-scale supply chain snarl, which has also affected the US, Japan and South Koreas markets.

"Sports bikes have been recording double digit growth since 2015 and pandemic has increased their popularity," Wang said, noting that for Trek the best performing cities in terms of sales are first-tier cities such as Shanghai and Beijing and 1.5-tier cities such as Chengdu in Southwest China's Sichuan Province and Suzhou in East China's Jiangsu Province.

Experts pointed out that the problem centering on the bike production seems to be associated with a supply gap in shifting gears, which is highly concentrated among a few suppliers.

China is the world's largest maker of bikes, but the bike-making global supply chain involves many countries and the production of some key components is located in foreign countries.

Shimano Inc, one of key suppliers of shifting systems, said in its first quarter report that the global cycling boom had shown signs of cooling down, with market inventories of entry-class and middle-class bicycles approaching normal levels, while demand for high-end class bicycles remained high.

Zhang Yi, CEO of iiMedia Research Institute, told the Global Times over the weekend that the new fad is an opportunity for bike manufacturers, although a large part of the opportunity may have been squandered by the supply chain bottleneck that has slowed bike output.

Zhang said domestic brand bike makers should improve their design and quality in order to win future market. The gap in quality for key components such as shifting systems remains high, and domestic brands should not rest on strong online sales.

A June report by Xinhua claimed China's bike makers are eyeing a shift in strategy to extend their reach in mid- and high-end inventory, citing an executive from the China Bicycle Association.