Chinese EV makers eye Southeast Asia to seize opportunities against weakened Japanese rivals

Cars ready for export in Yantai, East China's Shandong Province Photo: VCG

As Southeast Asian countries aim to seize the opportunity provided by the new-energy vehicle (NEV) industry with a series of favorable policies to attract foreign investment, Chinese NEV makers are leading to pack when it comes to driving new growth.

With advanced technologies and complete industrial chains, the entry of more Chinese NEV brands into Southeast Asia will offer more choice for local consumers with more cutting-edge vehicles entering the market, experts noted.

On Friday, Chinese electric vehicle maker BYD debuted its ATTO 3 electric vehicle in Singapore.

"BYD has introduced NEVs including taxis, buses and trucks into Singapore since it entered the market nearly 10 years ago… and will introduce more vehicles to the 'garden city,'" Liu Xueliang, managing director of BYD Asia Pacific, said in a press release on the company's WeChat account.

With Singapore seen as a major market, BYD will gradually enter Southeast Asian market to provide more environment-friendly vehicles, Liu said.

Meanwhile, Chinese carmaker Great Wall Motor (GWM) announced last week the creation of a subsidiary in Malaysia, reinforcing its presence in the region.

GWM will continue to expand its Malaysian market operation by increasing investment in the country and carrying out localized assembly through cooperation with domestic companies, according to a company statement.

In addition, a handful of other Chinese carmakers have stepped up investment in Southeast Asia over recent years, including electric vehicle start-up WM Motor, Chery Automobile Co and SAIC-GM-Wuling Automobile.

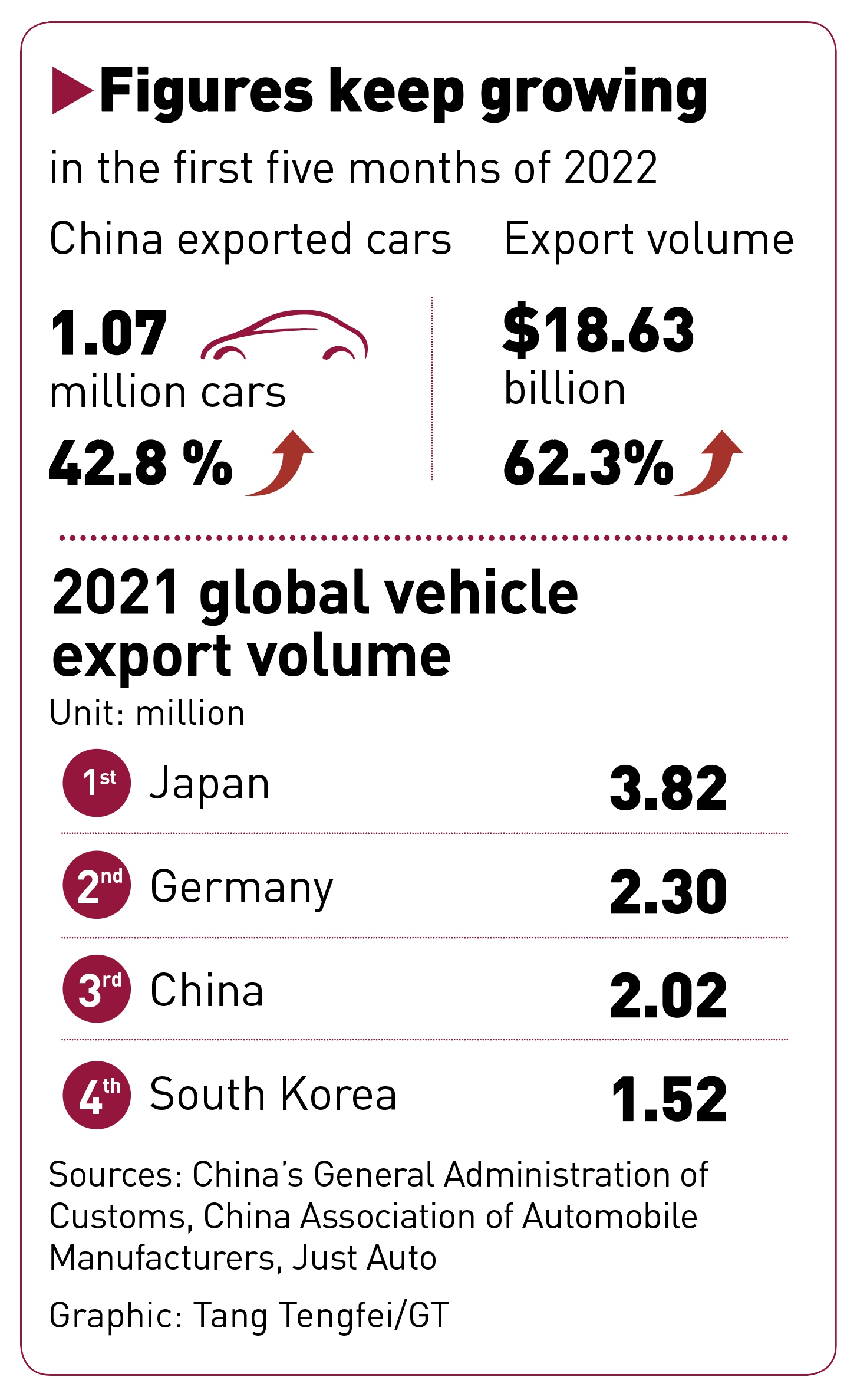

Robust demand in Southeast Asia also drove up China's automobile exports. According to data from the General Administration of Customs, China's exports of electric passenger vehicles surged 123.6 percent year-on-year to 41.83 billion yuan ($6.23 billion) in the first five months of 2022.

While auto production in countries such as the US and Japan has declined due to a global shortage of chips and raw materials, China has made up for this global shortfall with increased product competitiveness, according to Cui Dongshu, secretary general of the China Passenger Car Association.

Graphic: Tang Tengfei/GT

Policy support

The NEV market in Southeast Asia is still in a nascent phase of innovation, with the government playing a key role in boosting market growth, for example, through subsidies and tax rebates,said Mei Songlin, an auto industry analyst based in Shanghai.

Over recent years, Southeast Asian countries rolled out a series of policies to boost the development of the NEV sector and relevant facilities, building a solid foundation for the development of local market.

In order to attract investment to maintain its status as an auto production hub in the region, Thailand proposed a goal of ensuring 30 percent of its total auto production output is electric vehicles by 2030 and all new cars to be electric vehicles by 2035, according to a statement issued by the country's Board of Investment in November 2021.

In April, the investment promotion agency further expanded incentives to boost the development of the sector by announcing that smaller charging stations will be eligible for three-year tax benefits, on top of a five-year corporate income tax exemption for charging stations with at least 40 chargers.

According to a forecast by the International Renewable Energy Agency, the NEV market will grow to around 10 million units in Southeast Asia by 2025, media reported.

Industrial layout

Currently, the competition for the emerging market is fierce, with Japanese car brands dominating Southeast Asia's combustion vehicle market with a share of around 90 percent, while US electric carmaker Tesla has also been gaining popularity in the region.

Amid increasing challenges, Chinese NEV brands should adjust their strategies from two aspects, Mei said. "On one hand, Chinese companies should build a unified brand image, for example, sleek design, advanced smart technologies, and good value for money. On the other hand, they should strive to become one of the NEV technology leaders like Tesla to win local consumers' recognition through superior quality," he said.

In order to seize the opportunity created by Japan's lagging NEV sector, Chinese brands have begun to accelerate their industrial layout in Southeast Asia, including sourcing raw materials, research and development, production as well as after-sales services.

CATL, one of China's leading electric vehicle battery manufacturers, said in April that one of its units will partner with PT Aneka Tambang and PT Industri Baterai Indonesia on a nearly $6 billion project that spans from nickel mining to battery materials and recycling in Indonesia.

Experts noted that the Regional Comprehensive Economic Partnership (RCEP) - the world's largest trade pact - that took effect in January will further strengthen automobile industrial and supply chain cooperation among members, creating large opportunities for Chinese carmakers to compete in the Southeast Asian market.