China's national carbon market celebrates one year anniversary, becoming world's largest

Carbon trading is a key measure to deal with climate change: experts

Windmills rotate alongside a lake in Longji town, East China's Jiangsu Province on Tuesday. The project, which has 38 turbines, has a capacity of 98.1 megawatts. It has generated 633 million kilowatt-hours of electricity over the past six years, reducing carbon dioxide emissions by 1 million tons. Photo: VCG

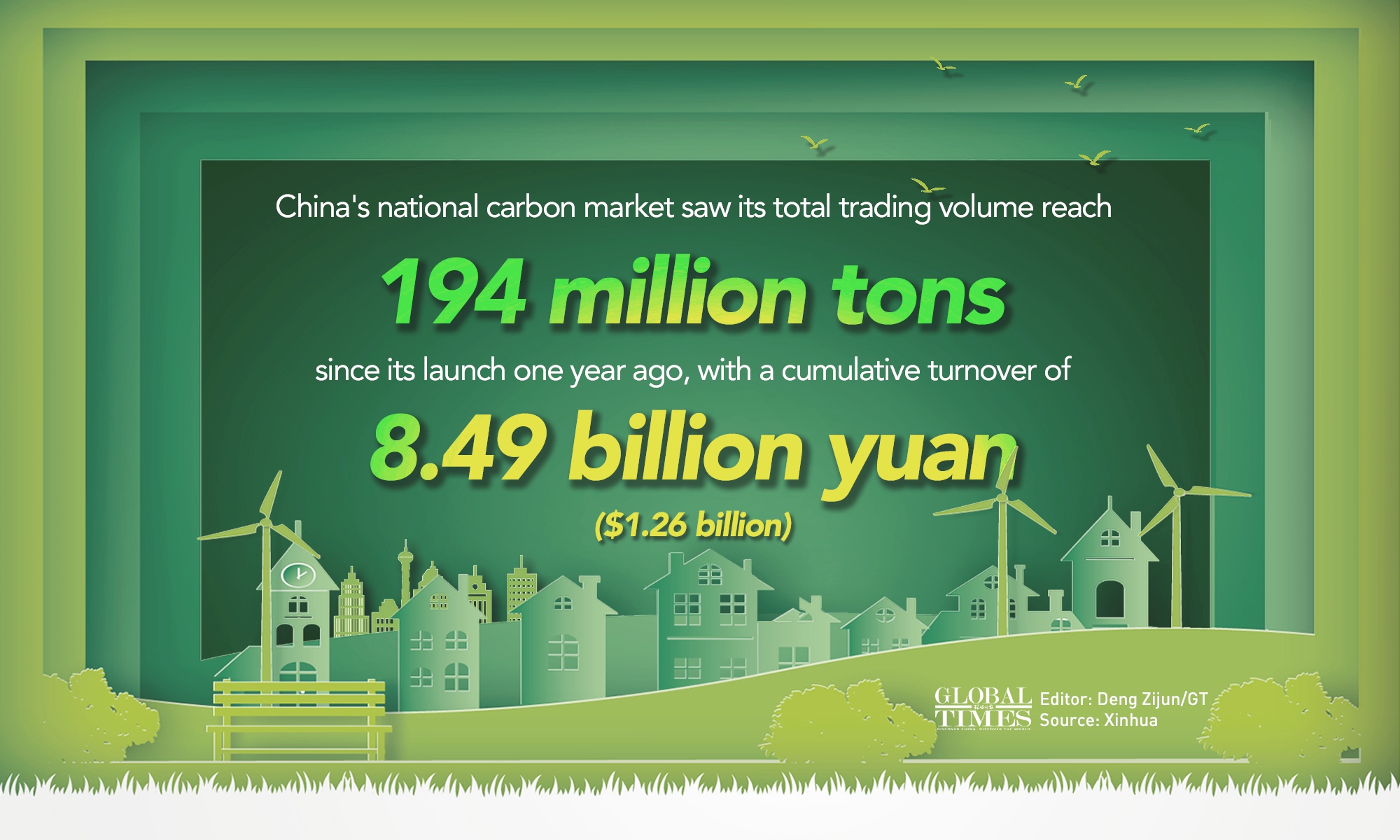

It has been a year since China's national carbon market started online trading in Shanghai on July 16, 2021. As of Friday, the cumulative trading volume of the carbon market reached 194 million tons, with a cumulative turnover of 8.49 billion yuan ($1.26 billion), according to data released by the Shanghai Environment and Energy Exchange (SEEE).

One year on, the smooth operation of the carbon market reflects the significant progress made by the country to promote reduction of carbon emission. It has helped to form the function of carbon pricing, Ma Jun, director of the Beijing-based Institute of Public and Environmental Affairs, told the Global Times on Saturday.

China's emissions trading system is already the world's largest carbon spot market, financial news site stcn.com reported on Saturday.

Carbon trading is the process of buying and selling permits to emit carbon dioxide or other greenhouse gases. Ma said that this type of high-efficiency market-oriented approach is needed to reach peak carbon dioxide emissions by 2030 and achieve carbon neutrality by 2060.

As a core step to realize carbon neutrality, carbon trading has the function of reflecting the cost of carbon. With a higher sensibility over carbon cost, industrial players would be more active in implementing low-carbon production measures, Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University, told the Global Times on Sunday.

On the other hand, carbon trading also helps optimize resource allocation without changing total carbon emissions, Lin said.

Greenhouse gas emissions have become an urgent challenge facing all countries around the world. China, as the world's largest developing country, has been actively contributing to global efforts to address climate change.

Carbon market and carbon pricing mechanism are important measures to deal with global climate change, China's special climate envoy Xie Zhenhua said at the China International Carbon Trading Conference jointly held by SEEE and Shanghai United Assets and Equity Exchange on Saturday to celebrate the one year anniversary.

As early as in 2011, China has launched attempts to establish up carbon trading markets. From 2013 to 2014, China initiated several trial markets in Beijing, Tianjin, Shanghai and other cities.

After 10 years regional trials and preparation, China's national carbon market started online trading on July 16, 2021 at the SEEE with the opening price for the carbon quota at 48 yuan per ton.

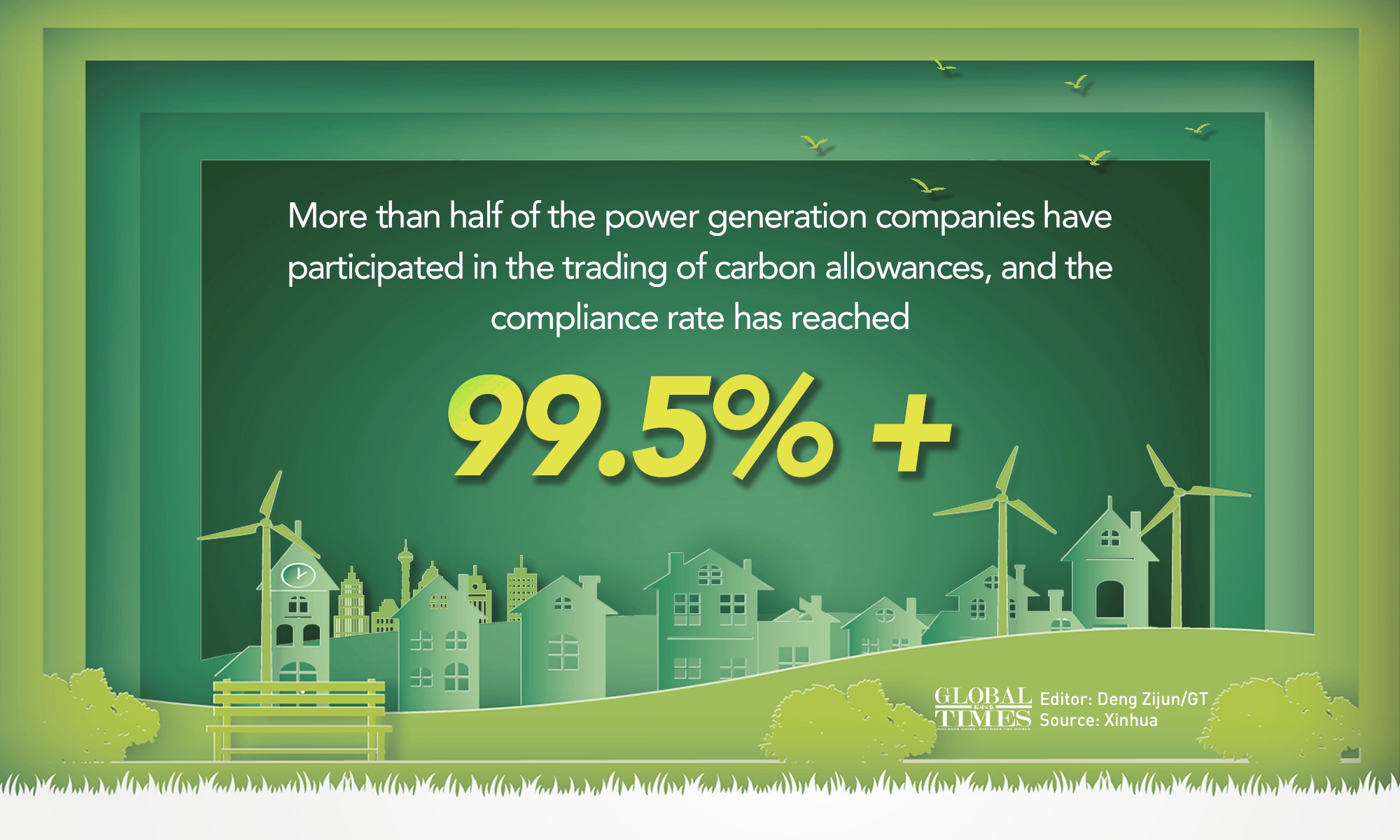

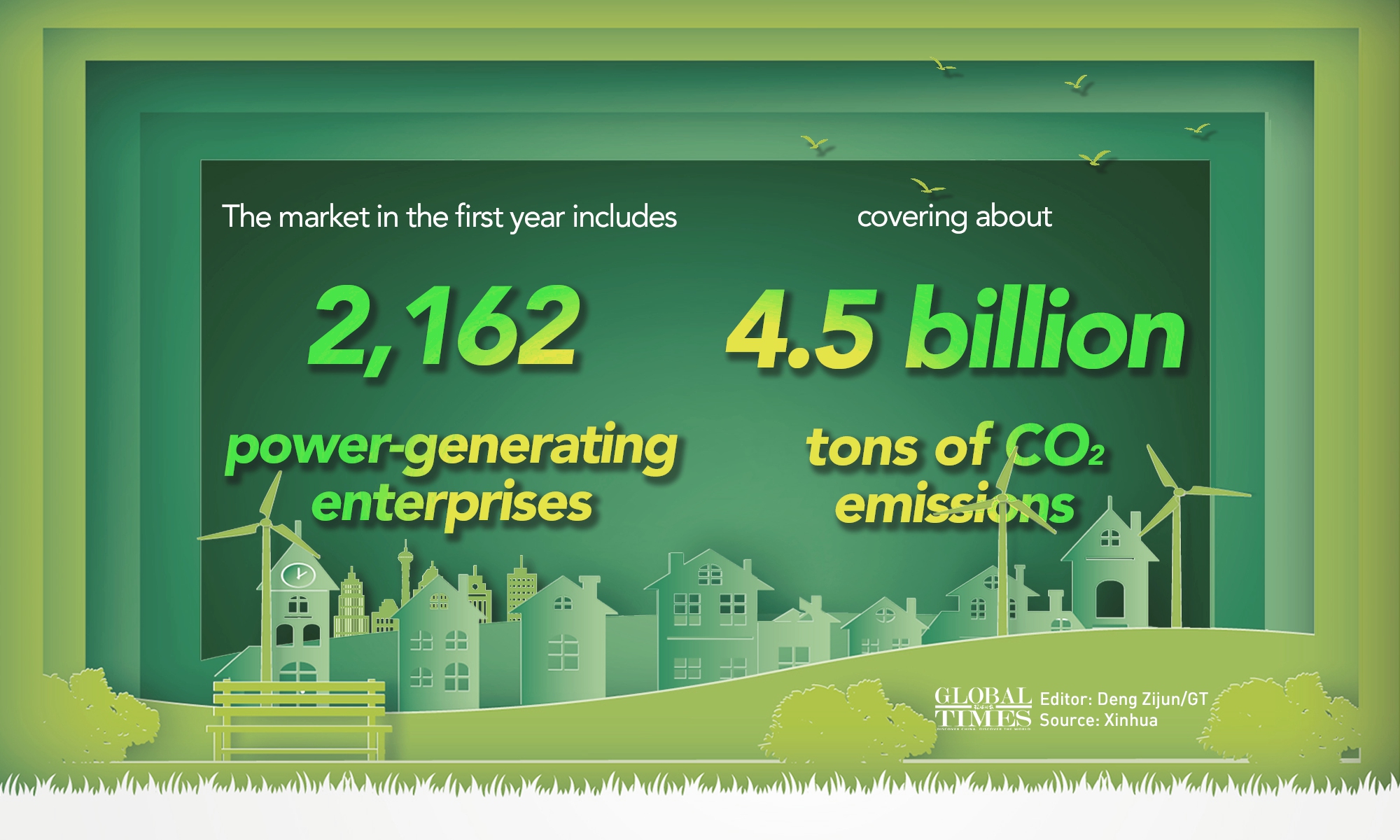

As a first step, 2,162 power companies were included in the trading system, a group representing total emissions of about 4.5 billion tons each year. By trading in the carbon market, companies can calculate their carbon emissions more effectively and precisely, following by disclosure progress which is of great significance to further promote the reduction of carbon emission, Ma said.

Graphic: Deng Zijun/GT

Graphic: Deng Zijun/GT

Graphic: Deng Zijun/GT

Graphic: Deng Zijun/GT

Shortcomings still remain

Though the carbon market has made great progress during the past year, there are shortcomings that need to be addressed, experts have said.

For instance, the trading activities were not frequent enough and there were some problems involving data quality and other operational issues, Ma pointed out.

It is expected that more industries could be concluded in the system so as to boost the trading activities, he added.

According to a plan published by China's Ministry of Ecology and Environment, during the 14th Five-Year Plan period (2021-2025), the national carbon market will gradually cover eight energy-intensive industries including power generation, iron and steel, building materials, non-ferrous metals, petrochemical, chemical, paper and aviation. About 8,500 large carbon-emitting enterprises will be included in the trading system, covering about 70 percent of the country's total energy-related carbon emissions, stcn.com reported.

Another major problem regarding the carbon trading in China is the low price, especially compared to other major markets, such as the European market, Lin said.

During the trading of last year, the daily closing price at the carbon market ranged between 41.46 to 61.38 yuan per ton. The latest price stood at 58.24 yuan per ton.

The relatively low prices are not effective enough to incentivize more companies to conserve energy and reduce emissions, experts have claimed, noting that it is understandable since the national carbon market is only one year old.

In addition, experts also suggest to step up efforts to improve financial innovation in the carbon trading market. It is important to promote the cooperation and coordinated development of the financial markets and the carbon trading markets, they noted.

Ma also added that the improvement of related laws and regulations is a key aspect that needs to be enhanced in the future. Interim regulations on the administration of carbon market trading have been put on the legislative plan list in 2022 of the State Council, China's cabinet, stcn.com reported.