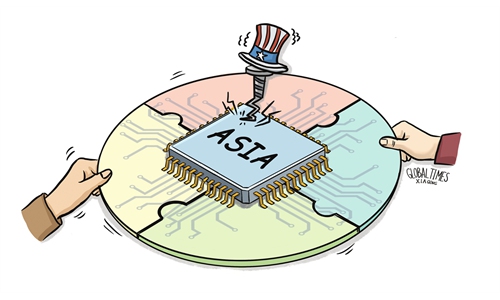

S.Korea attempts to assure China on supply chain amid US pressuring over exclusive ‘chip alliance’

chip Photo:VCG

South Korea faces a dilemma of whether to join the US-led semiconductor alliance "Chip 4" or not, as President Yoon Suk-yeol has called for "active diplomacy" with China to ensure there are no misunderstandings regarding its possible participation, the Yonhap News Agency reported.

Yoon's prudence on the topic indicated South Korea's careful calculations over gains, if any, against losses from possible participation, as South Korea's export-centered economy would be hit hard if it blindly joins the US' technology choking-off of China, South Korea's largest trading partner, observers said.

If South Korea blindly follows the US, its chip exports will suffer a huge blow, harming its $40- $50 billion chip trade per year with China, Han Xiaomin, general manager of Jiwei Insights in Beijing, told the Global Times on Friday.

South Korea's chip trade with other countries is about $150 billion per year, and chip trade with China accounts for around 30 percent.

Cooperation between China and South Korea in the field of chips is very close, and they are almost "inseparable," Ma Jihua, a veteran technology analyst, told the Global Times on Friday.

Ma said that South Korea is in the upstream in most fields, but now, some South Korean chip companies have a large number of manufacturers in China for production as well as research and development, and the chips used by some South Korean companies are also made in China.

SK Hynix announced in May plans to build a new wafer manufacturing base in Dalian, Northeast China's Liaoning Province, further expanding its business in China after acquiring US chip giant Intel's assets in the region.

The NAND flash memory chips made by Samsung Electronics' Xi'an factory account for more than 40 percent of its NAND flash memory output, while 45 percent of SK Hynix's total DRAM chip output is produced in Wuxi, East China's Jiangsu Province, according to South Korean media outlets.

Samsung's first-quarter fiscal report for 2022 showed the company's net revenue in China amounted to 10.46 trillion won ($7.98 billion), 13 percent of the total.

"South Korea's and China's chip industries have become intertwined in the past 20 years, and it is almost impossible to separate the two bluntly," Ma said.

Workers make semiconductors at a company in Guiyang, Southwest China's Guizhou Province. Photo: cnsphoto

Who is behind?

In March, the US proposed the idea of "Chip 4" and sent invitations to Japan, South Korea and China's Taiwan island. But four months later, South Korea has not yet given a clear answer.

According to South Korean media, without negotiations and coordination in advance, the US unilaterally informed South Korea that it is scheduled to hold a meeting on the issue at the end of August.

Adding to the pressure, US Treasury Secretary Janet Yellen showed up in Seoul on Tuesday, claiming to end the US' "undue dependence" on rare earths, solar panels and other key goods from China, according to Reuters.

Upholding the idea of "America first," the US will definitely be the biggest beneficiary of such an alliance, while Japan and South Korea will be the victims, Ma said, citing precedents in history.

Japan's semiconductor industry saw rapid development both in terms of design and manufacturing two decades ago, becoming a "threat" to the US' chip sector. The US then imposed several rounds of extra tariffs on Japanese products, while giving South Korea preferences to develop its semiconductor industry.

"Oppressing one country while supporting another is a typical practice of the US," Ma said.

The biggest loss of Japan's chip industry was not earnings, but the opportunity to build a complete advanced industry chain, Ma said. "Japan has a number of high-tech products, but no complete industry chain due to the US' activities," he noted.

"Even if South Korea joins the US alliance, it will not be able to obtain any newer technology from the US, but will only be regarded as a tool to contain China," Ma said.

"The US will have a bite of the Chinese market, which once belonged to South Korea, if Seoul yields to Washington's pressuring," Wang Peng, a research fellow at the Beijing Academy of Social Sciences said.

Photo taken on Nov 8, 2021 shows the booth of Amore Pacific of South Korea at the 4th China International Import Expo (CIIE) in east China's Shanghai. Photo:Xinhua

Bigger picture

Experts said that soaring bilateral trade with China is another important reason for Yoon's hesitation, as South Korea attaches more importance to the Chinese market, which is geographically closer than the US.

China has been South Korea's largest trading partner for 18 consecutive years, and bilateral trade is roughly the same as that of South Korea with the US, Japan and the EU combined.

In 2021, bilateral trade exceeded $360 billion, more than 60 times the level recorded 30 years ago when the two established diplomatic ties.

China's Ministry of Commerce said on Thursday that China and South Korea have made substantial progress in second-phase China-South Korea Free Trade Agreement talks.

The two sides have held nine rounds of formal negotiations. They have carried out negotiations on high-level liberalization of trade in services and investment through a negative list model, and the negotiations made substantial progress.

Since the China-South Korea FTA was signed in 2015, the two sides have cut tariffs eight times, and China has eliminated tariffs on more than 40 percent of imported goods from South Korea.

China and South Korea have achieved a high degree of complementarity over the past 30 years, and their industry and supply chains are deeply intertwined, Chinese Ambassador to South Korea Xing Haiming said in a forum on Thursday, highlighting industrial cooperation.

Market watchers said the South Korean economy has been hit hard by the global supply chain crisis, and how to boost its economy is also an important agenda for the government. The government has introduced policies to stabilize the supply chain, which have achieved certain results. However, the global supply chain situation has not seen a fundamental improvement this year.

In addition, the outbreak of the conflict between Russia and Ukraine has put South Korean economy to another test. Also, a recent general strike in the South Korean freight sector has brought huge losses to the nation's industries and aggravated the supply chain crisis.

Although China's semiconductor industry lags behind the US in terms of patents and behind South Korea in manufacturing, it hopes to leapfrog its rivals by adopting revolutionary new chip design techniques.

Bloomberg reported on Friday that China's Semiconductor Manufacturing International Corp (SMIC) has likely advanced its production technology by two generations, defying US sanctions intended to halt the rise of China's largest chipmaker.

The Shanghai-based manufacturer is shipping bitcoin-mining semiconductors produced using 7-nanometer (nm) technology, industry watcher TechInsights wrote in a blog post on Tuesday. That's well ahead of SMIC's established 14nm technology.

Exporting 7nm chips is a big advance for the country's chip industry, meaning that its chip manufacturing has broken the US blockade to some extent, Ma said. If the chips can be mass-produced, China will embark on a chip rise.