Chinese shipyards withstand severe challenges in H1; nation’s demand for commodities to support industry over next half: top shipbuilder

Shipyards withstand severe challenges in H1 2022; China’s demand for commodities to support industry, extend into H2: CSSC

A view of the Dalian base of Dalian Shipbuilding Industry Co in Northeast China's Liaoning Province Photo: Courtesy of CSSC

Boarding the giant 300-meter long, 300,000-ton very large crude carrier (VLCC)docking at a bay in Northeast China's Dalian city, with machines humming, steels piling up across the 7.74 million square-meter production base, visitors can easily catch a glimpse of the shipbuilding prowess of the world's largest manufacturing hub in the busy scene.

Made by a subsidiary of state-owned China State Shipbuilding Corp (CSSC), the nation's top shipbuilding giant, the 300,000-ton VLCC fleet it produces accounts for about 15 percent of the world's operating VLCCs, an onsite company representative told the Global Times.

While the VLCC only represents a small fraction of the group's business map - more than abilities in design and construction of commercial ships such as VLCC, LNG carriers and other super large bulk carriers, CSSC is also known as the cradle of China's most significant naval vessels including guided-missile destroyers, aircraft carriers as well as nuclear submarines.

CSSC, a super large defense industry enterprise, emerged from the merger of the country's two largest shipbuilders. The merger, completed in 2019, making it the largest shipbuilding group in the world, with a total number of employees reaching 347,000, and 106 subsidiaries located in 23 provinces, cities and regions in China.

To take a close look at the conglomerate, the Global Times paid a visit to several CSSC subsidiaries and research institutes in Huludao and Dalian in Northeast China's Liaoning Province and Qingdao in East China's Shandong Province over the weekend, to figure out how China has outperformed competitors, managed the impact of the epidemic, and the future direction of the group.

'Production orders are full'

In the first half of 2022, the industry managed to forge against headwinds amid a severe epidemic situation and a downward pressure on the domestic economy, company executives and frontline workers told the Global Times during the visit, believing it's also one of the main reasons that helped it outcompete competitors from countries such as South Korea.

Overcoming COVID-19 and supply chain impacts, more than 10 new merchant ships were delivered as planned in the first half of the year, a year-on-year increase of 67 percent, Yang Zhizhong, chairman of Dalian Shipbuilding Industry Co (DSIC), the largest ship assembly enterprise under CSSC, told the Global Times in a group interview over the weekend.

DSIC is the birth place of China's first 10,000-ton vessel, first export vessel, first VLCC, first 400-foot jack-up drilling platform, first 3,000-meter deepwater semi-submersible drilling platform, and also the nation's first intelligent VLCC.

"Production orders are full, piling up till 2025 to 2026," Yang said.

CSSC has withstood the "most severe test" since its establishment (merger) in the first half, the group said in a document it sent to the Global Times.

The group managed to launch a third aircraft carrier Fujian in June, and major shipbuilding indicators, including the amount of completed orders and new orders,all ranked amongst the world's leading firms. Moreover, the group's share of newly received LNG ships ranked first globally, and the number of merchant ships and marine engineering projects completed the annual target eight months ahead of schedule, CSSC said in the document.

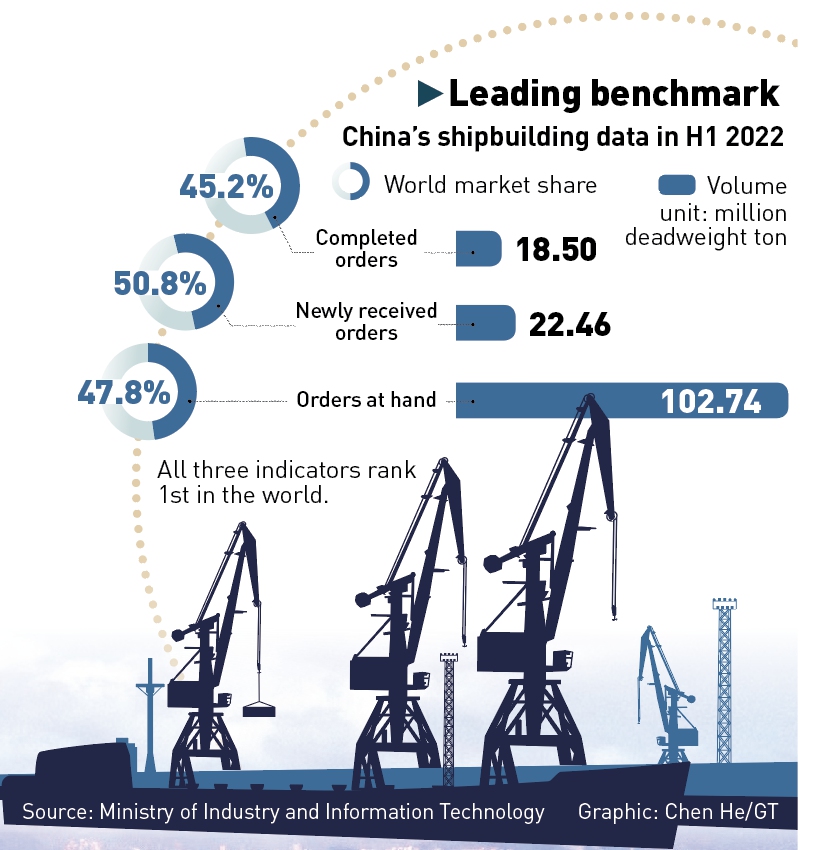

China's shipbuilidng industry completed 18.5 million deadweight tons (DWT) worth of orders, gaining 45.2 percent of the global market and maintaining an over-all lead, according to statistics released by the Ministry of Industry and Information Technology (MIIT).

China also ranked first in new orders, with a share of 50.8 percent, though new orders went down 41.3 percent year-on-year to 22.46 million DWT, according to the MIIT.

Yang predicted that the current boom in the market will continue until the end of the year, and may even last until the first quarter of next year.

Looking into the second half of 2022, Yang is also confident, saying that though uncertainties in domestic economy still exists, China's demand for commodities, the largest in the world supported by fundamentals and a recovering economic growth, will continue offering a pivot for the industry growth.

Graphic: Chen He/GT

'Historical intersection'

Despite major indicators already pointing to the global-leading place of China's shipbuilding strength, domestic industry players are now aiming for a further leap to climb to top spot of the whole industrial chain with "three transformations" on the agenda — high value-added transformation, digital transformation and "green" transformation.

The shipbuilding industry has "three pearls," namely the construction of aircraft carriers, large LNG carriers and luxury cruise ships. Shipyards that can make all of the three are widely believed to have attained top-level and comprehensive strength, Yang said.

Already being capable of constructing aircraft carrier, DSIC officially entered the large-scale LNG ship market this year, obtaining the second "pearl." "We have signed orders for several ships in the field, which are expected to be completed and delivered in the next three to five years," Yang said.

"We are coming to the window period of historical development, with both challenges and opportunities lying ahead. We positioned ourselves as reaching at a historical intersection," Yang said.

Efforts of other two transformations began long before. For instance, DSIC has developed and built China's first aerofoil-assisted VLCC and first dual-fuel VLCC, contributing to an early realization of its goals of carbon neutrality.

While visiting the firm's factories, the Global Times found robots are built into most production lines across the factories to increase efficiency and reduce labor costs in the traditional labor-intensive industry.

SunRui Marine Environment Engineering Co, another CSSC subsidiary that engages in ship-related products, is also aiming for an increasing share in the high-end sector. "We are striving for an expanded footprint in the Europe and US markets, hoping that market share of our products can exceed those of European brands in the European and the US," a company executive told the Global Times on Saturday.

SunRui is the first enterprise to carry out corrosion control research in China, also well-known for ship ballast water management system.