Three executives at Chinese IC investment fund management firm the target of anti-graft probes

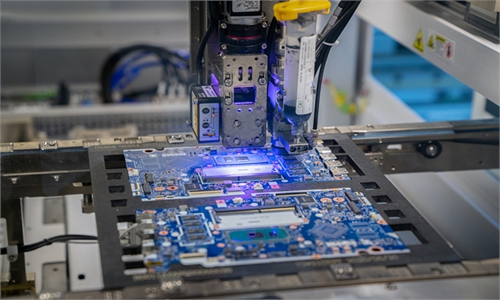

Photo: VCG

Three executives at Sino IC Capital Co, which manages the National Integrated Circuit Industry Investment Fund, have been revealed to be subject to disciplinary and supervisory probes for suspected serious discipline and law violations, the Central Commission for Discipline Inspection (CCID), the top disciplinary agency of the Communist Party of China, said on Tuesday.

Du Yang, a former director at Sino IC Capital and Yang Zhengfan, currently deputy general manager of the firm's No.3 investment division, are suspected of serious discipline and law violations and are now under disciplinary and supervisory investigations, read the Tuesday announcement.

Additionally, Liu Yang, the former general manager of the firm's No.2 investment division who is not a Party member, is under supervisory investigation for suspected serious violation of laws.

In a filing with the Shenzhen Stock Exchange late Tuesday, Chinese semiconductor heavyweight Naura Technology Group said that it learned about the investigation into Yang from the CCDI website. Yang was a director of Naura's board and a member of the company's strategic committee but had already been considered unable to perform his duties, according to the stock filing.

Sino IC Capital, funded 45 percent by CDB Capital, an investment arm of the China Development Bank, is the sole manager of the National Integrated Circuit Industry Investment Fund, also known as the "Big Fund." The investment firm is also one of the managers of the second phase of this fund, according to a China Fund News report on Tuesday. News began to break on Thursday that Yang had been placed under arrest.

The Tuesday announcement continued an anti-graft campaign targeting China's chip sector as the country aims to lay a healthier groundwork for its chip push by rooting out bad actors in the industry.

In late July, Ding Wenwu, general manager of the Big Fund was placed under investigation for alleged serious violation of discipline and law. Furthermore, several top industry executives have also been investigated over the past month.