China's July economic data show continued recovery, lingering pressure

Q3 growth to ‘rebound strongly’ with policy support

An automated production line at a car factory in Shenyang, Northeast China's Liaoning Province. Photo: IC

Photo:cnsphoto

China released a set of main economic indicators for July on Monday, with industrial profits and retail sales maintaining growth but the growth rate slowing down from June, indicating continued recovery in the world's second-largest economy as well as lingering downward pressure from both global and domestic factors.

The slower-than-expected pace of expansion in certain areas suggested headwinds linked to global uncertainty and sporadic COVID-19 flare-ups, analysts said, calling for stronger consumption stimulus to help accelerate the recovery.

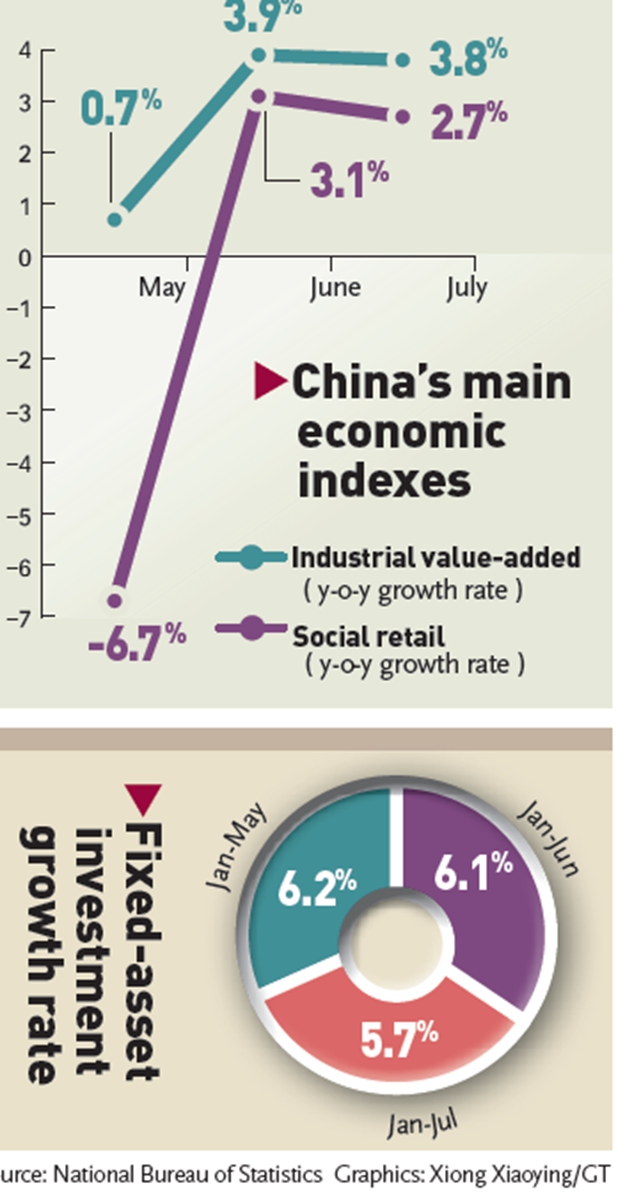

In July, industrial profits rose by 3.8 percent from a year earlier, and retail sales stood at 3.58 trillion yuan ($530 billion), up 2.7 percent. Both picked up momentum in June when activity began to recover from the COVID-19's shadow, data from the National Bureau of Statistics (NBS) showed on Monday.

Industrial profits' growth rate was a decline from the 3.9-percent increase in June and missed market expectations of 4.6-percent growth. Retail sales growth was down from 3.1 percent in June, and below the 5-percent pace forecast by a Reuters poll.

Fixed-asset investment for the first seven months of the year increased by 5.7 percent from a year earlier, a drop from the 6.1 percent rate in the January-June period, NBS data showed.

The unemployment rate came in at 5.4 percent in July, a decline of 0.1 percentage points from June, indicating stabilization in the job market.

"The national economy maintained a recovery momentum," NBS spokesperson Fu Linghui said on Monday. But Fu warned of rising stagflation risks globally and said "the foundation for the recovery of the domestic economy has yet to be consolidated."

"Looking forward, we will seize the critical period of economic recovery, focus on expanding domestic demand, stabilizing employment and consumer prices, and effectively guaranteeing and improving people's livelihoods," Fu said.

Due to factors such as the resurgence of the virus in some parts of the country and seasonal factors, the recovery of various economic statistics in July came at a slower pace and below market expectations, but there were positive signs, Luo Huanjie, senior researcher with the Zhixin Investment Research Institute, told the Global Times on Monday.

For instance, although industrial profits' growth slowed down slightly by 0.1 percentage points to 3.8 percent in July, the equipment manufacturing, high-tech manufacturing and vehicle industries still maintained rapid growth rates of 8.4 percent, 5.9 percent and 22.5 percent, indicating that the upgrading of China's industrial structure is still advancing.

The recovery in the industrial sector has "entered a normal track," Tian Yun, former vice director of the Beijing Economic Operation Association, told the Global Times on Monday, noting that the speed of industrial production growth will see a further increase later when shortages of power resulting from high temperatures ease and the downturn in the real estate market improves.

"At the moment, weak demand in the domestic market is the most prominent barrier to faster economic growth, which can be observed from weak retail sales," Li Chang'an, a professor at the Academy of China Open Economy Studies of the University of International Business and Economics, told the Global Times on Monday.

Falling sales in the catering sector contributed significantly to slower retail sales growth for the month, while the property market also had some impact. According to the NBS, catering revenue stood at 369.4 billion yuan in July, down 1.5 percent year-on-year.

Retail sales of home appliances dropped 6.3 percent year-on-year, while construction and decoration fell 7.8 percent year-on-year.

Now people are "afraid of spending money and investing" due to weaker expectations, so stimulus moves can be more "precise" to go to the private sector, Li noted, calling for stronger efforts to narrow income gaps and increase residents' incomes.

The Chinese government has unveiled a series of stimulus moves to prompt growth. In a fresh move, China's central bank on Monday lowered interest rates on key lending facilities for the second time this year.

The People's Bank of China (PBC) said it was lowering the rate on 400 billion yuan ($59.33 billion) of one-year medium-term lending facility (MLF) loans to some financial institutions by 10 basis points to 2.75 percent, from 2.85 percent.

On the consumption end, authorities have been organizing consumption exhibitions and handing out vouchers to bolster consumer spending prior to the traditional peak season of September and October.

NBS official Fu cautioned that the domestic economy is still in the process of recovery, with "many difficulties" affecting business operations and "relatively large constraints" on market demand.

Despite these difficulties and challenges, the fundamentals for long-term growth have not changed, Fu said, noting that China's economy, with strong resilience and great potential, will gradually recover, and it is expected to operate in a reasonable range backed by anti-epidemic and pro-growth economic policies and measures.

Tian forecast that with stimulus policies in effect, third-quarter GDP growth will recover strongly, probably at around 5 percent. Annual GDP growth is expected to be around 4-4.5 percent.