Russia becomes 3rd-largest market for yuan payments in July as bilateral trade remains normal; may climb further: analyst

Photo: IC

China's yuan has retained its position as the fifth most active currency for global payments by value in July, signaling a stable internationalization pace; meanwhile, Russia has jumped to become the third-largest market using the yuan for global payments, a report from the global financial messaging firm Society for Worldwide Interbank Financial Telecommunication (SWIFT) showed on Friday.

Yuan's share stood at 2.2 percent in July, up from the 1.86 percent in June and was behind the US dollar, the euro, the British pound and Japanese yen. Among them, the US dollar and yuan were the two currencies that saw expansion of use in the month.

The share of US dollar expanded to 41.19 percent in July from the 38.77 percent in June, retaining its position as the most used global payment currency. Euro edged down to 35.49 percent in July from the 36.46 percent in June, and the pound dropped to 6.45 percent from the 7 percent a month ago. While the share of Japanese yen dipped to 2.82 percent from 3.46 percent.

In terms of international payments excluding payments within the Eurozone, the yuan ranked sixth with a share of 1.51 percent in July 2022.

"The increasing share is a vivid demonstration that yuan's recognition and acceptance has seen a steady growth worldwide backed by a relatively stable exchange rate compared with other major currencies despite global volatiles," Dong Dengxin, Director of the Finance and Securities Institute of the Wuhan University of Science and Technology, told the Global Times on Friday.

Dong noted that the share of yuan's use in global trade is even more if calculated in some border trade.

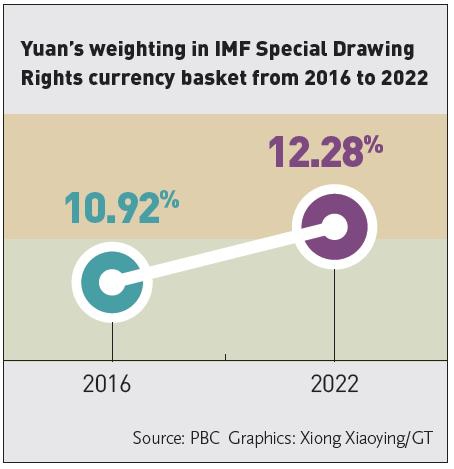

In a major show of growing global recognition of the Chinese currency, the IMF has lifted the Chinese yuan's weight in the Special Drawing Rights (SDR) currency basket to 12.28 percent from 10.92 percent in its first regular review of the SDR valuation since the Chinese currency was included in the basket in 2016, the People's Bank of China, the country's central bank, said in a statement in May.

Yuan's weighting in IMF Special Drawing Rights currency basket from 2016 to 2022 Graphic: GT

Zhou Maohua, a macroeconomic analyst at Everbright Bank told the Global Times on Friday that an increasing share demonstrates an accelerated pace of yuan's internationalization amid global uncertainties, while the proportion of yuan in global payments still does not match the size of China's economy and trade volume, indicating vast growth potential.

The proportion of payments still has a lot of room for development compared to the US dollar and the euro, Zhou said, predicting that the role of the yuan in international payments, investment and reserves will continue to increase with an improving domestic economy.

More worth noting is that Russia has jumped to become the third-largest market for yuan payments. The Hong Kong Special Administrative Region remains the top source of yuan transactions outside Chinese mainland with 73.8 percent of the total, followed by the UK which accounted for 6.4 percent.

Observers attributed the jumping share to a stable trade between China and Russia amid US-led Western sanctions. In July, the trade volume between China and Russia came in at $16.79 billion. Among them, China's exports to Russia amounted to $6.77 billion, while China's imports from Russia amounted to $10.02 billion, both expanding from June.

In the first seven months of 2022, China's trade with Russia rose 29 percent year-on-year to $97.71 billion, accelerating 1.8 percentage points from first half of the year.

The SWIFT report showed that Russian firms and banks were involved in almost 4 percent of international yuan payments by value in July. That was an increase from 1.42 percent the previous month and from zero in February when the Russia-Ukraine conflict began.

"If sanctions on Russia continue, the share will continue to increase in its use," Dong said.

Observers noted that pursuing of local currency settlements in trade between the two countries also provides more convenience for bilateral traders to stabilize foreign trade and avoid US dollar hegemony.

Wang Wentao, China's Commerce Minister said during a virtual meeting with Russian Economic Development Minister Maxim Reshetnikov in early August that since the beginning of the year, China-Russia trade has maintained strong growth momentum.

The two sides should continue consolidating trade in key commodities while tapping into new growth areas such as digital economy, green development, cross-border e-commerce and trade in services, and push for a steady growth of China-Russia economic and trade cooperation, Wang said.