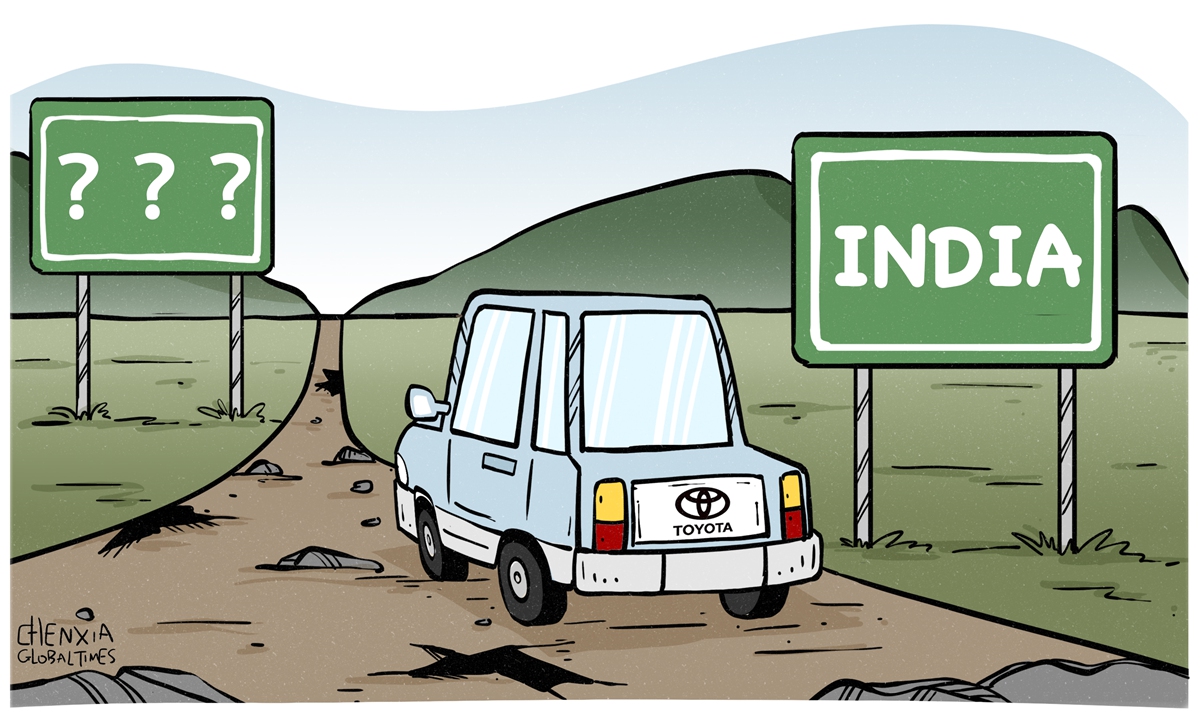

Illustration: Chen Xia/Global Times

Toyota is rebooting its strategy for India. This time, the Japanese carmaker is expected to focus more on lower-cost hybrids, instead of its flagship sedan in India - the Camry Hybrid, which is relatively expensive, Reuters reported on Monday. Central to Toyota's new strategy is a drive to cut the cost of full hybrid powertrains by carrying out localized production in India, the report said.In recent years, India's consumer market has developed soundly, especially in sectors such as auto and smartphone. Chinese multinationals have also over the past few years launched high-quality, low-cost products for the Indian market, and some of them have achieved good results with decent market share.

As India doubles down on local manufacturing, the country's high tariffs increase production costs and force multinationals, including Chinese enterprises, to localize the production. Some Indian economists believe India should take protectionist measures to limit imports by raising tariffs and promote foreign manufacturers to set up plants in India, if those companies want to tap the country's growing middle and affluent classes.

As China tries to move up the value chain, some low-end Chinese manufacturers have begun to shift production to India. However, a series of challenges, such as a high illiteracy rate, a lack of skilled workers and weak industrial infrastructure, constrain the development of India's manufacturing sector. Multinationals may face a dilemma in the Indian market. On the one hand, protectionist measures force them to localize the production in India to avoid tariffs, and on the other hand, it will also not be easy to build local production lines due to the shackles of manufacturing development.

Although India's huge market, growing middle class, cheap labor and relatively robust economic growth have led many multinational companies to have high hopes for the emerging market economy, some of them have chosen to withdraw from the Indian market or reduce their investment and production footprint in the country.

Why did Toyota choose to reboot its strategy for India when some other multinationals considered pulling out of India, and will its new strategy succeed? Toyota's investment may provide references for some Chinese companies taking a wait-and-see attitude.

In the electric vehicles (EV) sector, India is still a largely untapped market and faces great prospects. In 2021, India's EV sales account for only 0.5 percent of India's total annual vehicle sales, lower than the global average level. The Indian government's climate pledges also provide vast policy and investment space for the growth of the EV industry. The Indian government plans to increase the proportion of sales of EVs to 30 percent by 2030. In addition, New Delhi has repeatedly said that it will provide subsidies for EV manufacturers.

According to estimates by relevant departments in India, if the country wants to achieve its ambitious goals for EV sector, it needs to invest $266 billion from 2020 to 2030 to boost production of EVs and build charging facilities across the country. This rapidly expanding market has attracted relevant manufacturers in India and abroad all eagerly.

Although foreign auto companies such as Ford from the US have quit production in India in recent years due to severe losses, some automakers have announced strategies to deploy electric and hybrid vehicle production in India. However, against the backdrop of rising protectionism in India in recent years, India's vast EV market may become even more challenging for foreign investors.

For the past couple of years, India and Tesla have been at loggerheads over market access and the terms under which Tesla is considering making cars in India. Tesla CEO Musk in late May suggested that Tesla may hold off on entering the Indian market. The Wall Street Journal said India's reluctance to compromise on market barriers was a sign of lack of foresight.

If Chinese manufacturers choose to invest and set up factories to achieve localized production, they should be fully prepared for India's policy environment and be prepared to deal with risks. Currently, opportunities and challenges coexist in the India market.

China already has a complete set of EV ecosystem from electric vehicle R&D, production, maintenance to charging infrastructure R&D and construction. Practical technology and affordable price have always been the international competitiveness of Chinese products. The Indian market may be best suited. But if India restricts imports from China with tariffs and non-tariff barriers, and uses lengthy political review procedures to slow down the pace of Chinese companies investing in India, its decoupling approaches may scare some Chinese companies away and hinder its own progress.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn