Chinese stocks popular among South Korean retail investors as nation's economic prospect remains promising

Stock market File photo: VCG

Chinese stocks have now replaced Tesla shares as an increasingly popular choice for South Korean retail investors. For example, Tianqi Lithium, one of the largest producers of lithium compounds used in electric-vehicle batteries.

Chinese analysts said on Tuesday that the overall trend behind the trading choices of South Korean investors showed the growing attractiveness of Chinese stocks on the back of the country's promising economy.

Tianqi Lithium has topped foreign stocks list favored by South Korean retail investors, with "net purchases amounting to $152.29 million during the past month," Korea Bizwire reported on August 16.

South Korean investors have sold off Tesla stocks, while making large purchases of shares of Tianqi Lithium over the past month, the report said, citing data from the Korea Securities Depository.

The once widely sought-after Tesla stock has recorded mixed performance this year amid a frothy US stock market, with its stock price losing over 27 percent year-to-date from $1,199.78 on January 3 to $869.74 on August 22.

On the other side of the Pacific Ocean, the Shenzhen-listed Tianqi Lithium has reported over 20 percent year-to-date growth from 100.66 yuan ($14.72) on January 4 to 121.07 yuan on August 23.

Tianqi has become an industrial frontrunner in its major businesses of lithium resource investment, lithium concentrate extraction and the production of advanced lithium specialty compounds, according to the company's website.

The company's share price has tripled since the end of 2020 from 39.27 yuan on December 31, 2020. On August 12, Tianqi Lithium was included into the MSCI China Index.

According to local news reports, among 65 newly launched exchange traded funds (ETFs) in South Korea as of the end of July, only four have attracted over 10 billion won ($7.44 million) and three of them have positions in Chinese stocks.

The TIGER Synth-China STAR50 ETF managed by Mirae Asset reported impressive growth over the recent two months, rising from a recent low point of 6,515 won on April 27 to 8,705 won on August 23.

In the meantime, Tianqi is not the only one Chinese stock that has gained fame among South Korean and other foreign investors.

The amount of "Northbound capital" - foreign money flowing into China's A-share market through Hong Kong - has exceeded 80 billion yuan during the past two months. In addition to Tianqi Lithium, EVE Energy Co and Ganfeng Lithium are also among foreign investors favorites under the same classification.

Besides key materials like lithium, foreign investors are dipping into a range of Chinese stocks from e-commerce giants, commercial banks, dairy enterprises to advanced manufacturing companies, such as Chinese liquor giant Kweichow Moutai, battery-makers CATL, auto maker BYD, solar technology company LONGi Green Energy Technology Co amongst others.

Promising fundamentals

South Korean trading of Chinese stocks demonstrates global investors' confidence in the Chinese economy and Chinese firms, analysts and experts have claimed.

Though there remain challenges on the path of recovery and growth, the Chinese economy is still one of the top choices for global investors amid a turbulent global market, Dong Shaopeng, an expert advisor at the China Securities Regulatory Commission, told the Global Times.

China has developed great institutional advantages, under which the country can effectively coordinate resources in different places and sectors, so as to promote recovery and rapid growth, Dong said.

Eyeing the strong potential, South Korean investors have not only been pouring money into the Chinese stock market, they have been leading the growth of direct investment in China as well.

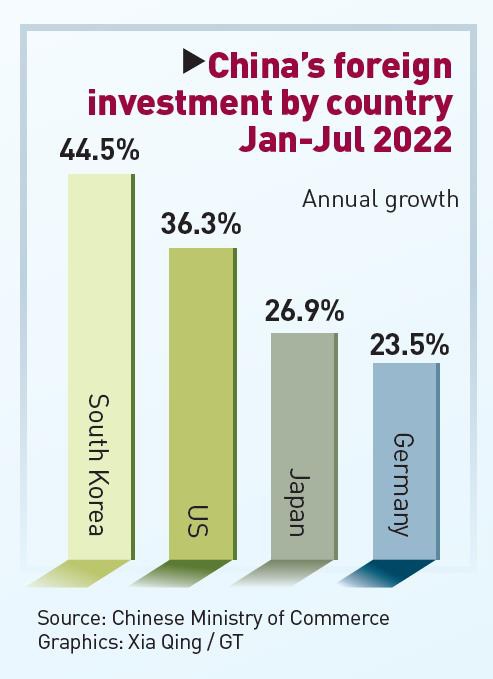

According to data from China's Ministry of Commerce, China's actual use of foreign capital rose 21.5 percent year-on-year to $123.9 billion in the first seven months of this year, with South Korea, the US and Japan the leading sources of investment.

South Korea topped the list with investment growth of 44.5 percent during the period.

China's foreign investment by country Jan-Jul 2022 Graphic:GT

Li Daxiao, chief economist at Shenzhen-based Yingda Securities, said that China has been contributing nearly 30 percent to the growth of the global economy each year over the past decade, and still offers great future potential. It is hard to find another market with as much upside as China anywhere else.

As for the specific stocks, though Tesla is no doubt a great company, the valuation of its stocks is relatively too high, a common feature of many US stocks. By comparison, Chinese stocks have no risk of being caught in a bubble, and many of the companies are frontrunners within their respective industries, Li told the Global Times.

Against the backdrop of global market volatility, especially when the US stock market is under downward pressure amid an interest-rate rise cycle, the Chinese share market is expected to welcome an increasing number of investors from both home and overseas, Dong noted.