Metaverse land price collapse underscores importance of virtual world being tied with the real economy, facilitating digital upgrade: analysts

Price collapse underscores importance of synergy with the real economy: analysts

Metaverse Photo: VCG

Last year, buying prime real estate in the metaverse was a luxury for a 28-year-old investor surnamed Huang, as the craze over the novel and revolutionary technology prompted a host of investors with deep pocket ranging from tech titans, celebrities to entrepreneurs to jump in, shedding limelight on the booming market and making headlines with record-high transaction price.

However, the fanfare surrounding metaverse land has been on the slide since March this year, against the backdrop of a plunging crypto market and a slow infrastructure technological development.

According to data from metaverse analysis site WeMeta, the average virtual land price has dived by over 80 percent to date, and the trade volume of virtual properties also plummeted by over 90 percent compared with highs in November 2021, industry website cryptoslate.com reported.

The burst of metaverse land has left many individual investors nursing heavy losses, including Singaporean singer JJ Lin, who announced in November 2021 on social media that he had purchased three pieces of virtual real estate in Decentraland, one of the largest virtual property marketplaces, at a reported cost of about $123,000. The purchase has already incurred an 84-percent loss based on current pricing data.

Huang, who had previously pondered pooling a big proportion of his savings into virtual land assets, has given up on the idea after witnessing the downturn.

"Now, there is a popular phrase in the industry: we would rather purchase a tiled ceiling in the real world than owning a property in the virtual world. And that is a vivid display of how our views on metaverse land evolve," Huang explained.

A bubble ready to burst?

According to Huang, it is very hard for an individual investor like him to justify investing in the metaverse at the current stage, as it is a purchase "not only risky but also of low valuation."

"The land in the metaverse is conspicuously oversupplied. There are multiple digital platforms that have either been making inroads into the market or are planning to do so, creating unlimited parcels of lands. It is no longer a scarce resource like last year," a manager of a US-based blockchain company surnamed Zheng told the Global Times on Wednesday.

In May, Yuga Labs, the creator of the Bored Ape Yacht Club, the most well-known and highly-valued NFT collection - launched the highly-anticipated metaverse project, Otherside, with reported 200,000 parcels of lands on sale.

The launch has become an immediate market hit, making Yuga Labs a rising star in par with the top two players - Decentraland and The Sandbox - in metaverse property projects.

"It is extremely difficult to tell which firm will be the champion at the end. Selecting land which reflects authentic value out of millions of parcels is like gambling. All these factors sparked the debate on whether the frenzy surrounding metaverse is about to burst," Zheng explained.

However, global companies and institutions seem to disregard this debate, as they're relatively immune to what they called "short-term fluctuations."

From last year, retail and electronic brands including Samsung, Nike and Gucci, have been embarking on a virtual real estate shopping spree. In February, JP Morgan also announced that it has opened a lounge in Decentraland, marking it the first bank to establish a presence in the metaverse, which it predicted could pose a market opportunity of $1 trillion in annual revenue.

Lorne Sugarman, the CEO of Metaverse Group, a virtual real estate company, was quoted as saying in a Forbes report that he "isn't concerned about falling prices, as his company expects to hold properties for years to come as utility increases with adoption."

"Most purchases serve companies' long-term goals, either to expand market exposure in the digital world and attract tech-savvy young consumers, or to pave way for future metaverse business strategies. That means those global big names could sustain periodical losses," Zheng said.

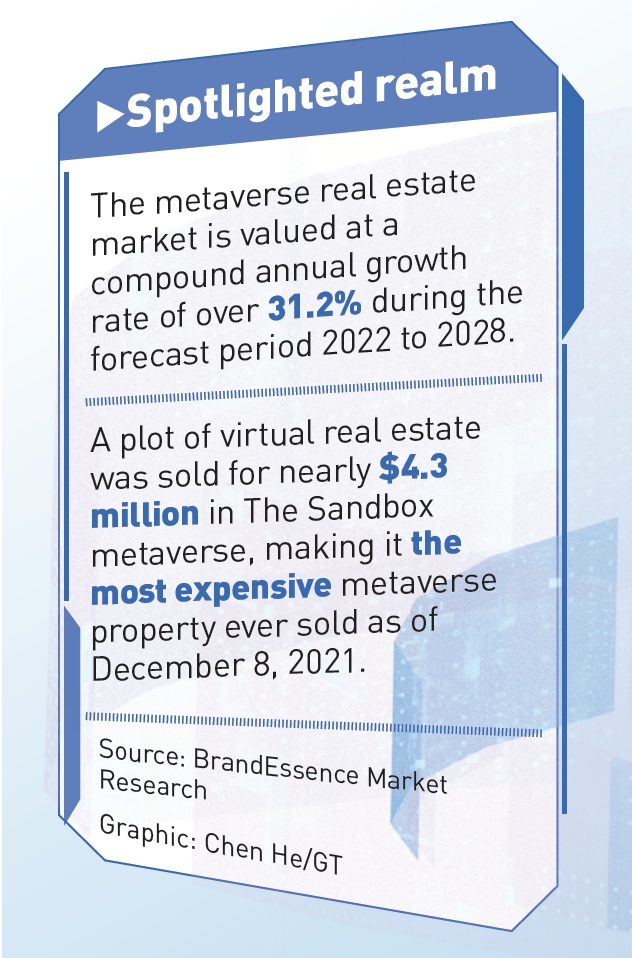

Graphic: Chen He/GT

Tapping the potential

Despite the companies' splurge in the virtual world, most metaverse-based businesses remain primitive to date, such as opening a virtual version of brick-mortar stores, issuing NFTs, as well as hosting virtual gallery and fashion week, according to the Global Times' observation.

In August, Mark Zuckerberg shared a selfie of himself in Meta's Horizon Worlds, a metaverse project the company has spent $18 billion since 2020. The infrastructure of the metaverse, as shown in the picture, is very rough and outdated, which then has been mocked by gamers and consumers. Zuckerberg later uploaded another image, with more vivid scenario portrayal to quell the online mockery.

"This shows the industry, as well as the underlying technologies, is still developing and far from maturing. It requires not only a large sum of money, but also technological breakthroughs in graphic computing ability, algorithm and rendering," Zheng explained.

China has been an active player in fast tracking the development of the metaverse industry. A number of cities, including Beijing, Shanghai and Shenzhen in South China's Guangdong Province, have rolled out muscular measures, building industrial park, setting up funds, and attracting talents and enterprises to give the metaverse industry a boost in growth.

Wang Peng, an assistant professor at the Gaoling School of Artificial Intelligence at the Renmin University of China, told the Global Times on Wednesday that the development of metaverse, once potential being further tapped, could play a constructive role in China's digital economy and social-economic upgrade over the long term.

"The biggest valuation of metaverse is to synergize with the real economy, such as facilitating the digital transformation of medical, industrial internet, cultural tourism, and gaming sector, and helping them saving cost while improving efficiency," Wang said.