Illustration: Chen Xia/Global Times

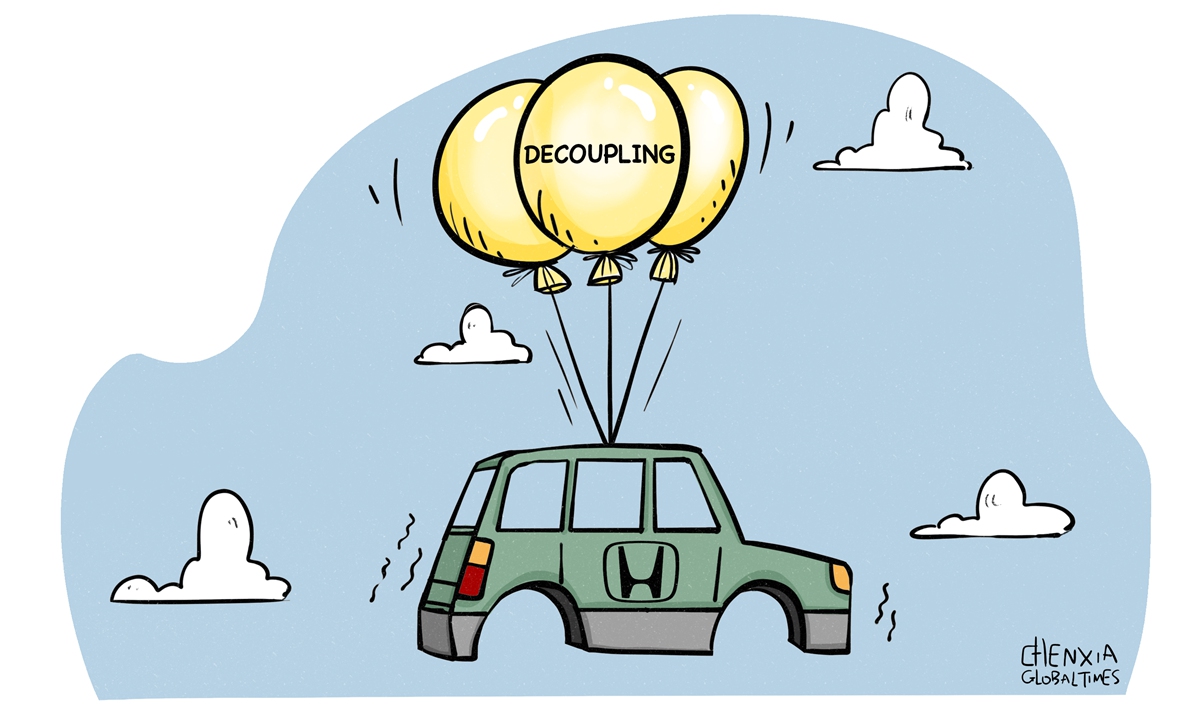

Japanese auto maker Honda is "considering decoupling supply chain from China," Reuters reported, citing Japanese newspaper the Sankei. Yet, a Honda spokesperson denied that the Sankei report is something announced by the company.Still, the Honda spokesperson admitted "the review of the supply chain from China and risk hedging are elements that need to be considered," while insisting that "it is not quite the same as the objective of decoupling," according to Reuters.

There are some contradictions in the reports, and the Honda spokesperson did not clarify that up. For example, the spokesperson did not offer details about the "review" or "risk hedging." What happens after the review? Would Honda actually try to decouple from China, as suggested by the news reports? Much remains unknown, but one thing is crystal clear: carmakers such as Honda are fully aware of the costs of trying to decouple from China.

What's also clear is that against the backdrop of escalating geopolitical tensions caused by the US-led attempt to decouple from China, some multinationals are facing serious risks and have serious concerns about their supply chains. It should be noted that the root cause of their anxiety is from the US and some of its allies that are trying to force companies and even regional countries to pick sides - not China.

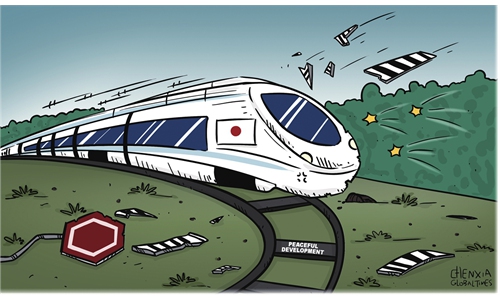

It's no secret that the US has been trying to drive a wedge through the close, decades-long industry chain cooperation among China, Japan and South Korea, and Japan is drifting toward the US in politicizing trade and investment. If Japanese companies are forced by Japan's unfriendly economic and trade policy toward China to lose the Chinese market, where they have benefited enormously over the years, it's the Japanese government to blame.

In terms of politicizing trade with China, Tokyo has been moving in lockstep with Washington. The Japanese parliament in May passed an economic security bill, which, Japanese media outlets said, is "primarily aimed at warding off risks from China." It is not difficult to imagine what impact such a law would have on the decision-making of Japanese companies once implemented.

Evidently, it is unrealistic for Japanese companies like Honda to decouple from China. Nearly 40 percent of Honda's automobile production took place in China in the last financial year, according to Reuters. The Japanese carmaker ranks third in China with a market share of 8.2 percent last year, according to industrial data.

As the manufacturing hub and the largest consumer market in the world, China is playing an increasingly important role in many multinationals' global distribution. At a time when the global economy is facing a serious risk of recession and many major economies are slipping into, or already in, recession, to abruptly decouple from China could mean fatal strike for many companies.

China has never created risk for companies from the US, Japan or any other region, even when their governments took moves that caused tensions with China. Instead, China has been keeping expanding opening its market, including the massive auto market, and improving business climate to support continuous growth of many multinationals. It's believed that any business leader with rational mind would not follow some country's dictation or political coercion to decouple from the Chinese market.

Although some ill-intentioned Western media outlets spare no effort to slander China's economy and market, the simple truth is that China has, actually, in the past two years consolidated its position as the world's dominant supplier of manufactured goods and the largest consumer market. The nation saw robust growth of foreign direct investment in the first half of the year, as it surged 17.4 percent on a yearly basis to 723.31 billion yuan ($107.41 billion), according to official data.

Admittedly, many multinationals are being caught up in the US' trade war and tech war against China. But the top priority of all companies across the world is to survive and keep growing in face of all economic headwinds. If their businesses fail, any geopolitical game will be totally meaningless to them.

To say the least, if a foreign company that has large presence in China really decides to "reduce dependence" on China or to build a supply chain excluding China under political interferences, it will have to pay an extremely high price.

For a long time, China and Japan have enjoyed highly complementary and close trading relationship. But Tokyo is increasingly moving in the wrong direction, when it comes to policies toward China. If the Japanese government continues to on that path, it will only be Japan's businesses and economy that will pay the economic price.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn