Henan police arrest 234 suspects in rural bank case, a ‘major progress’ in recovering losses

Swift actions help prevent risks, ‘shore up confidence’

A counter for deposit and insurance at a bank in Zhengzhou, Central China's Henan Province File photo: VCG

Photo: GT

Public security authorities in Central China's Henan Province have arrested 234 criminal suspects involved in a closely followed rural bank case, and achieved a "major progress" in the recovery of money and other losses, the local public security bureau in Henan's Xuchang announced on Monday.

The sweeping action came about several months after the case was launched, and observers said that the swift actions will help prevent major financial risks and shore up market confidence in China's rural banking system, which is critical to lending in the nation's vast countryside.

In another major development regarding the case, starting at 9 am on Tuesday, individuals with deposits ranging from 400,000 yuan ($57892.16) to 500,000 yuan in the four rural banks in Henan and one in East China's Anhui Province will be repaid, according to a joint announcement by the Henan branch of the China Banking and Insurance Regulatory Commission (CBIRC) and the provincial financial bureau on Monday.

Those with savings above 500,000 yuan will be paid a maximum of 500,000 yuan. They will retain the rights to any amount over 500,000 yuan, and this will be addressed accordingly, based on the recovery of assets involved in the case.

Following the case that gained widespread attention, Chinese authorities have been stepping up regulatory oversight and closing loopholes in recent months, which will add to the soundness and resilience of the system, observers noted.

According to the police announcement, the investigation into the case is going forward in depth. It has been found that a criminal gang led by suspect Lü Yi, the actual controller of Henan New Wealth Group, illegally controlled four rural banks, including Yuzhou New Minsheng, and was involved in a series of serious crimes.

"The criminal gang tempted depositors with an annual return rate of 13-18 percent and paid by using illegally acquired capital. Some clients with large savings were paid an 'interest subsidy,' which was exploited by financial brokers at various levels," the announcement read.

"This is a swift development considering the complexity of the case, and it will inject confidence into the capital market and banking system," Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China, told the Global Times on Monday.

Dong also highlighted concrete efforts by Chinese financial regulators to repay depositors who had difficulty withdrawing funds from the rural banks, which offered a clue into the robustness of the banking system.

Monday's announcement of refund to depositors came after local financial authorities have already lunched several rounds of repayment.

"Judging from the current disposal progress, the rights and interests of the small depositors, who make up the largest base, have been effectively protected. That is, a large proportion of risks that may affect stability have been resolved," Li Junhui, a professor at the China University of Political Science and Law, told the Global Times on Monday.

As of August 13, Chinese financial regulators said they had paid 18.04 billion yuan in advance to depositors in four rural banks in Henan and one in neighboring East China's Anhui Province, who had been unable to access their funds since April 18.

Observers said that the scandal sped up Chinese regulators' push to stamp out potential financial risks and strengthen the oversight of financial institutions, especially small and medium-sized ones.

Li said that due to the high interest rates that were promised and other factors in some village bank cases, there are suspicions of illegal fund-raising crimes.

"This is an important lesson. Supervision should not only be based on the balance sheet, but also on inspections and spot checks," Dong said.

Some rural bank cases have exposed weak links or hidden risks, and stronger and more timely supervision of village banks and filing cases in suspected crimes in a timely manner have significant value in preventing and resolving risks in related fields, Li added.

At least three officials responsible for rural bank supervision in the CBIRC's Henan branch have been investigated so far this year, news website caixin.com reported in August.

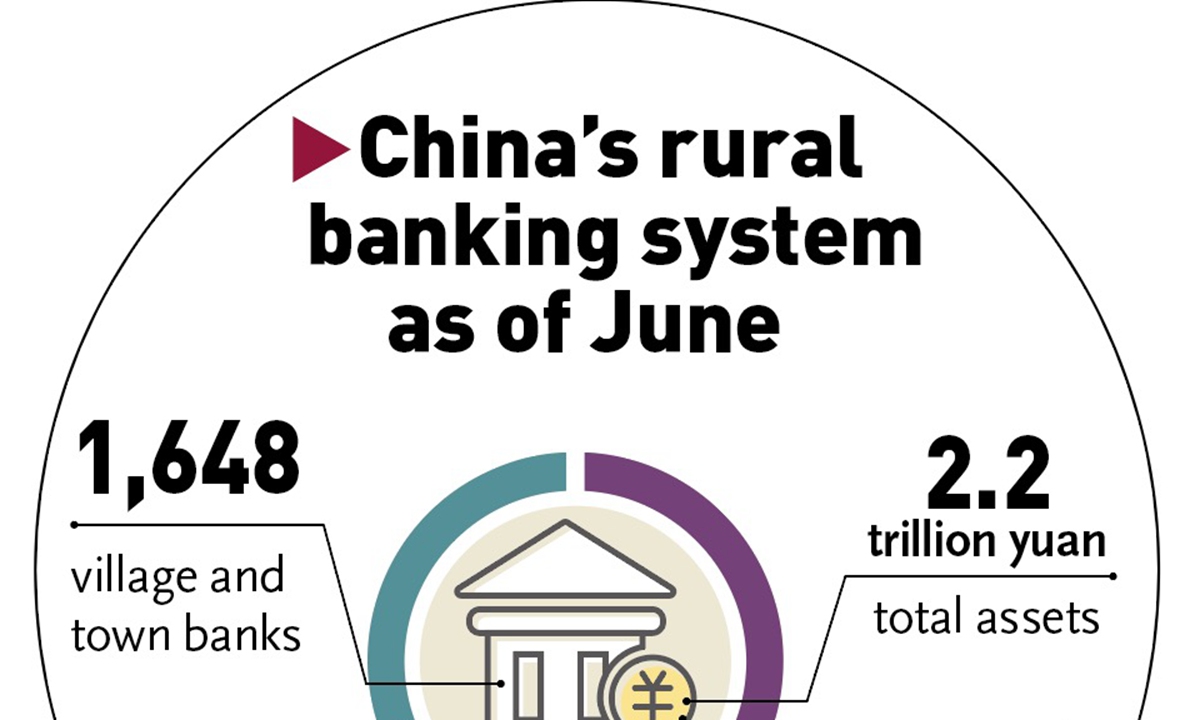

Data from the CBIRC showed that as of the end of June, there were 1,648 village and town banks in China, with total assets of 2.2 trillion yuan and total liabilities of 2 trillion yuan. The balance of outstanding loans was 1.4 trillion yuan, and that of deposits was 1.8 trillion yuan.

"The overall operation of China's rural banks is stable, the asset quality is slightly better than the national average for small and medium-sized banks. The liquidity is sufficient, and the risks are completely controllable," an official of the CBIRC said.