China’s new-energy industry sees a series of major projects, as US struggles in sector

Visitors view a new energy vehicle during the 2022 Chongqing International Auto Exhibition in southwest China's Chongqing Municipality, June 25, 2022.

China's new-energy sector has continued on a rapid rise despite intensifying US efforts to contain it, as several world-leading projects and other major developments have been launched in recent days, including the start of a $3 billion plant for crucial material for solar power on Thursday.

Chinese analysts said that the progress, which came as the US is reporting sagging growth in the sector, showed that the US' anti-market crackdown on the Chinese new-energy sector is doomed to fail.

The rapid progress by companies in the sector contrasts with the slow progress in the US, where, according to a report released by industry trade group the Solar Energy Industries Association and research firm Wood Mackenzie on Thursday, solar energy project developers are struggling to access equipment for at least the next year.

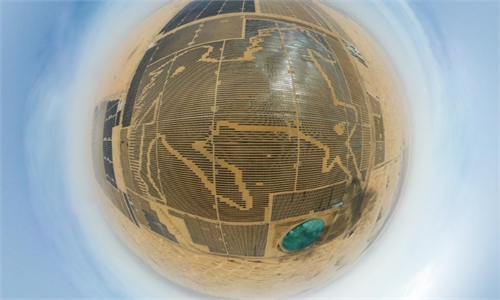

In Lianyungang, East China's Jiangsu Province, construction work for the world's largest production site for ethylene-vinyl acetate (EVA), an indispensable industrial material for the production of photovoltaic modules, started on Wednesday, according to media reports on Thursday.

The massive project, which is projected to cost 21.6 billion yuan ($3.11 billion), will lift the production capacity of EVA to 1 million tons a year when completed, and expand the global market share held by China by 20 percentage points from the current level, and effectively supply the demand of the domestic solar industry.

Besides serving the solar industry, EVA is also used in electronics and information, as well as vehicles and aerospace. The plant will supply the domestic market, which is 60 percent reliant on imports.

Data released by the China Passenger Car Association on Thursday showed that sales of new-energy vehicles (NEV) in August reached 529,000 units, up 111.2 percent year-on-year. Sales from January to August jumped by 119.7 percent year-on-year.

Cui Dongshu, secretary general of the China Passenger Car Association, revealed that China's share of global NEV sales rose to 68 percent as of July.

Last week, Chinese automaker BYD said in a stock exchange filing that its first-half net profit tripled year-on-year. BYD sold more NEVs than Tesla in the first half, according to media reports. The NEV champion announced on Thursday that it would set up a facility in Thailand, to start producing 150,000 passenger cars per year from 2024, Reuters reported.

Late on Wednesday, Chinese NEV maker Nio said that its second-quarter revenue increased by 21.8 percent year-on-year. Nio chairman Li Bin told investors in a teleconference that the company is prepared to cope with high output and deliveries in the fourth quarter, and said the company is eyeing annual deliveries of 150,000-200,000 units.

Nio's R&D expenditure in the quarter shot up by 143.2 percent to 2.15 billion yuan, which, along with quarterly revenue, was a single-quarter record.

Domestic financial news portal 21jingji.com reported on Tuesday that the Guangzhou Futures Exchange is expected to launch silicon futures before the end of 2022, in what is likely to be the first global listing of the vital feedstock that powers the new-energy industry.

Unlike many commodities that rely on imports, China is the world's largest producer, consumer and exporter of industrial silicon.

The exchange said the new futures will promote the pricing power of China in the global market and increase China's influence in the sector.

In 2021, China produced 4.98 million tons of industrial silicon, accounting for 75 percent of the world's total, according to 21jingji.com.

Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University, told the Global Times on Thursday that the nation's recent progress in the new-energy sector is building a foundation for the future.

"On account of the limited scale of the new-energy sector, the growth potential will be enormous and mechanisms such as silicon trading are being front-loaded to ensure China's leading position in the sector," Lin said.

China is the world's leader in new-energy products. About two-thirds of solar panels and lithium-ion batteries and about half of the world's wind turbines are made in China.

Reuters reported that US solar energy developers see their ability to tap generous new subsidies from the Inflation Reduction Act of 2022 (IRA) delayed, as panel imports are being stalled by a new law banning goods from China's Xinjiang region.

Experts said China's recent progress is a rebuttal to the US, which has tried hard to undermine the growth of the Chinese new-energy sector.

In August, US President Joe Biden signed into law the IRA, which has the obvious intention of curbing China's influence in the new-energy sector.

Lin said that the US moves are aimed at seeking dominance in the new-energy sector, but its approach is anti-market and serves only to disrupt the industrial chain.