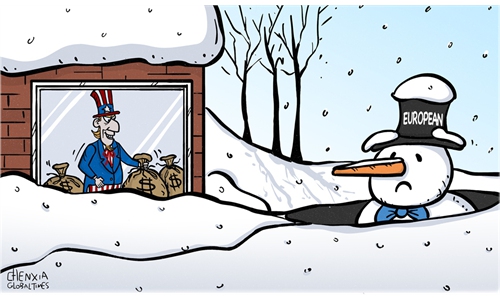

Illustration: Chen Xia/Global Times

As winter looms, energy woes in Europe are expected to escalate into an economic, societal and political storm. Residents in some European cities are now taking to the streets protesting against skyrocketing energy prices, while some metals makers and industrial manufacturers are forced to restrict or halt production due to exorbitant energy costs.Facing multiple challenges such as a persisting inflation, the risk of economic recession, the aftermath of the COVID-19 pandemic and the ongoing Ukraine military conflict, European leaders are not seeking cooperative or conciliatory approach to mending their fraught relations with Russia, a major energy provider for Europe for decades. Instead, they are bent on enlarging the largely aggressive and bellicose military organization, NATO, to the doorstep of Moscow.

European leaders naively embraced the deceptive narrative spun by American politicians who have claimed that Europe should blame Moscow for their current predicament. Everybody knows Russia used to be a reliable energy source and business partner for Europe - building the strategically vital Nord Stream I and II. As a matter of fact, it is Washington that considers Moscow to be an adversary of the US and NATO, and has used all means at its disposal to divide EU countries and Russia.

Why? Because Russia and EU countries, if placed at loggerheads and clenching each other's throats, will ultimately weaken each other - a scenario that best serves the US' national interests.

There has been growing evidence pointing to the success of Washington's politically selfish strategy. The EU economy is now teetering on meltdown, which has led to a sharply devalued euro against the dollar, bleeding European equities and other assets. European stocks, already off 14 percent since the beginning of 2022, are likely to fall another 10-20 percent this year. Withdrawals from European markets, including exchange-traded funds, hit their highest level in August since the Brexit induced panic of 2016. The increasingly bleak and chaotic prospects facing Europe will only frighten away investments, which will likely be lured back to Wall Street.

Meanwhile, American oil and gas drillers and traders are now reaping billions of dollars of profits from selling energy to European countries. There are news reports claiming that a single American tank ship shipping liquefied natural gas to Europe generates a staggering $100 million in net profit. It explains why American drillers have recently ramped up gas drilling.

Some investment banks project that Europeans are likely to witness their monthly electricity bills triple this winter. The continent's domestic metals industry is facing a "life or death winter" after electricity and gas costs soar to more than 10 times last year's levels. With gas prices haywire, more European generators are facing a cash crunch as utilities from Vienna to Dusseldorf are seeking government bailouts.

To cope with the energy crisis and prevent social upheaval, European governments are doling out hundreds of billions of euros in government support to soften the blow of high prices. For example, Germany moved to authorize 65 billion euros to help battered families. However, government handouts are not going to resolve dwindling gas supplies, there is now real fear that European leaders will have to decide on politically tricky energy rationing as the colder months rapidly approach.

Europe's energy crisis is still unfolding, and it could get a lot worse and more tumultuous, as EU countries, instigated by the US, are tightening economic sanctions on Moscow.

Lately, the US-led West moved to set a ceiling on Russian oil and natural gas exports - a policy blunder which immediately drew the ire of Moscow. The announcement from Russia's state-owned gas giant Gazprom that Nord Stream I needed maintenance and will not come back online as expected is merely the latest big blow to Europe. Analysts think the pipeline is likely to remain turned off through the upcoming winter.

Obviously, Russia is not happy with EU leaders blindly following the heels of Washington in cracking down on Russia. With EU countries dependent on Russia for approximately 40 percent of its gas needs, 46 percent for coal and 27 percent for oil, Moscow actually has a lot of leverage.

Now, the prospect of a cold, dark winter is hitting home across the continent. At the same time, the European Central Bank is being forced to raise interest rates to arrest the non-stop depreciation of the euro, which has tumbled nearly 20 percent against the dollar this year. Economists have cautioned that steep rate hikes will likely cause Europe to slide into an imminent recession.

As some world affairs watchers have observed, Europe is entering its most treacherous phase in its history. Will the US rush to its help, and provide all the energy the continent needs and provide Europeans warmth during the winter? EU leaders would be better not to overly rely on America. What the politicians in Washington care about most is to help American companies extract egregious profits from the Europe energy crisis, while weakening Moscow.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn