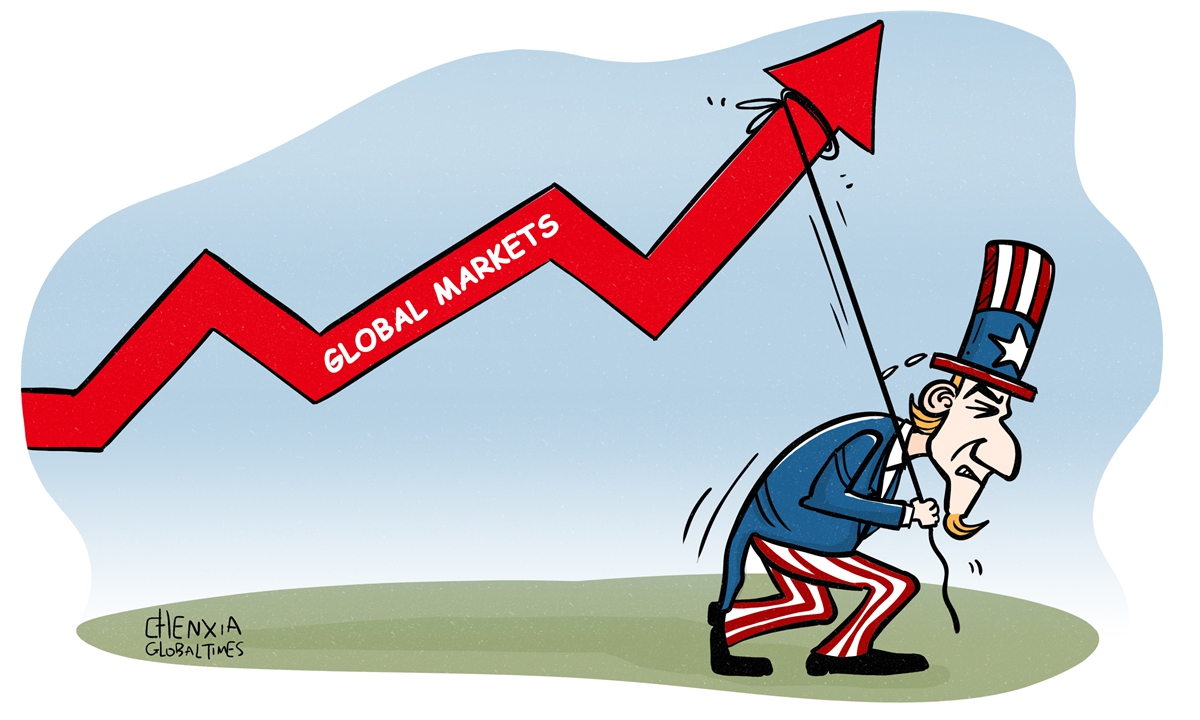

Illustration: Chen Xia/Global Times

Stock markets around the world dropped sharply last week amid growing expectations of hawkish interest rate hikes by the US Federal Reserve to tamp down the country's persistently elevated inflation. Investors are on edge as the US central bank gears up for its policy decision this week, with some starting to brace for a big surprise.

It is possible that the Fed could announce a full percentage point rate raise. The bank has hiked federal funds rates four times already since the beginning of 2022, but US inflation remains at 8.3 percent annualized growth for August, which is still nearing four-decade highs. Some economists have cautioned the Fed that it is getting late in the game, and the central bank needs to decide on a 100-basis-point raise to reinforce the agency's credibility.

But investors are always spooked by interest rate hikes, because higher rates often mean rising borrowing cost for companies, and correspondingly, lower corporate earnings and stock prices.

On Tuesday when US inflation numbers for August came out, higher than the broad market estimate at a 7.9 or 8 percent increase, Wall Street endured a frightening rout, with the Dow Jones Industrial Average diving 1,276 points, or 3.9 percent. The S&P 500 index declined 4.3 percent, while the Nasdaq Composite plunged 5.2 percent. The three indexes were all higher before the inflation data was announced, and they even posted gains for four straight sessions before Tuesday.

On Friday there came more bad news from corporate warnings that paint an increasingly dire outlook for the US economy. FedEx said it was closing offices and cut jobs to offset withering market demand, which exacerbated fears of an impending recession. Dow Jones index fell another 0.5 percent on Friday.

Stock investors are getting nervous that a very hot US inflation for August means that even drastic monetary policy tightening is in the pipeline, and their earlier expectation of easing price pressures in the summer has proved to be short-lived. This isn't time for the end of the tightening cycle by global central banks. The August inflation report now confirms that the US has a lot more work to do to squash consumer price rises and bring its annual inflation to the preferred 2-3 percent.

During a policy speech at the annual Jackson Hole meeting in Wyoming in late August, Fed Chairman Jerome Powell said the US monetary policymakers were highly focused on taming price rises.

"Reducing inflation is likely to require a sustained period of below-trend growth," Powell said then, adding that the bank must continue to raise interest rates to stop inflation from becoming a permanent aspect of the US economy. "While higher interest rates, slower growth and softer labor market conditions will bring down inflation, they will also bring some pain to household and businesses," he said.

Powell warned that a failure to restore price stability would mean "far greater pain" for Americans. He conceded that getting inflation under control would come at a cost to vast US households and businesses, but he argued that it was "a price worth paying."

Now, the stubbornly elevated inflation data foretells that the US central bank will become even more aggressive in tightening its policy. Last week's alarming figure was the last before the policymakers convene for their next decision on rates. Markets have already anticipated that in September, the Fed would lift the interest rate by at least three-quarters of a percentage point for the third straight time this year. There is a growing risk that the Fed won't pull its feet off the accelerator to fight inflation anytime soon, and it will take much longer than previously deemed for the bank to pause on rate hikes.

As the Fed keeps monetary tightening, other central banks from Europe to Asia-Pacific, Africa and South America will continue to raise their interest rates so as to curb their own inflation, and at the same time to prevent capital from being siphoned away to the US.

Lately, the value of the US dollar has been ramped up with the Fed's consecutive rate hikes. The Dollar Index, which measures the greenback against a basket of other major currencies, rose steadily to almost 110. As the US-dollar denominated assets rise in yields, other countries' capital is being drawn to the US - causing a wide range of very negative impacts on emerging market economies, like currency depreciation, equities market plunge and even government debt defaults.

The elevated US inflation data and the Fed's resolve to continue policy tightening by raise interest rates, plus the Chinese yuan's depreciation to break the psychologically important 7 versus the dollar, sent shockwaves across China's stock market last week. The Shanghai composite stock index plunged 73.5 points, or 2.3 percent, to close at 3126.4 points on Friday. The index has fallen by more than 15 percent so far this year.

Facing rising uncertainties overseas and a persisting housing market downturn at home, China's economy hasn't been fully activated yet. Housing prices continue to drop in most of China's 70 major cities except Beijing and Shanghai, according to latest official data. Bolder measures, including earmarking a sizeable fund to help debt-ridden developers finish stalled housing projects, which should help housing sales and prices to stabilize before the year end, are needed. After all, a revitalized property market will propel the economy to the healthy growth mode.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn