Rising US dollar boomerangs on world economy by ballooning import costs and increasing global debt burden

Emerging economies feel the sting for soaring import costs, difficulties in paying down debt: experts

A stock trader works in the New York Stock Exchange. Photo: VCG

Ahead of the US Federal Reserve's upcoming meeting this week, during which market observers generally believe that a fifth interest rate hike this year will be announced, discussions flared up again as to how the strengthening dollar is boomeranging on the US and throwing the world into fears of recession.

Almost all economic zones in the world are affected by the Fed's interest rate hike cycle in 2022 with the sting particularly felt by emerging economies like Latin America's Brazil and Argentina, developing economies in Asia like Thailand, Indonesia and Sri Lanka, experts said. Their problems include rising import costs, capital outflow and disrupted supply chains.

As the US Fed is expected to hike the interest rate to as high as 4.25 percent, there seems to be no short-term end to the economic woes faced by global economy, but the Chinese yuan, which is also depreciating under pressure exerted by the US dollar, but to a lesser extent, is increasingly becoming a safe haven for global investors.

According to a report of the CNBC, the Fed will likely hike interest rates by another 75 basis points this week. So far, the US central bank has raised interest rates four times this year at a total of 2.25 percentage points.

The US Dollar Index stood at 109.61 as of press time, compared with 96 on January 3.

World feels the sting

The economic trouble inflicted by the strengthening dollar in emerging economies is being felt by business and experts alike, who criticized the US for "harming the rest of the world."

"At this juncture, the US decision to increase interest rates is seen as a selfish decision. That's because a US rate rise can have a negative effect on developing countries in particular," said Maya Majueran, a director of the Belt&Road Initiative (BRI) Sri Lanka, a Sri Lanka-based organization that specializes in BRI cooperation.

According to the economist, one negative impact triggered by the strengthening dollar is the rising import cost of fuel, food, medicine and raw materials, which is driving inflation higher in Sri Lanka and causing severe hardship to the people at a time when supply chain bottlenecks and the Ukraine crisis is already driving up food and fuel prices worldwide.

The Sri Lankan Rupee has been sliding against the US dollar since early-March. As of press time, it stood at 363 against the dollar, weakening more than 80 percent compared with the beginning of this March.

In August, the consumer prices in Sri Lanka's capital Colombo rose 64.3 percent from a year earlier, with transport costs and food prices nearly doubling, the country's statistics department reported.

According to Maya Majueran, the increasing dollar interest rates make it harder for Sri Lanka to pay back its US dollar-denominated debt as the country needs to pull together an excessive amount of local currency to service the debts.

"Because of this Sri Lanka must increase the tax or borrow at a higher cost to service the debts," the economist said.

Maya Majueran also stressed that an increase in US interest rates and the rising value of the dollar has made it harder for Sri Lanka to borrow on the open market to finance its budget deficits.

Likewise, Argentina's inflation soared to 78.5 percent in the 12 months through August, compared with 54 percent in 2019.

According to Wang Dongwei, chairman of Zhongtai Capital Investment Management Co, emerging economies generally rely on exports to stimulate growth, and many of them haven't adopted foreign exchange control policies. Therefore, in a cycle of Fed interest rate hikes, it's inevitable that foreign capital flees to more favorable markets.

"Considering that those countries often lack scientific innovative capabilities, they are almost in God's hands in the storm of Fed interest rate hikes," he told the Global Times.

Emerging economies aside, other regions in the world are not safe from the repercussions of a rising dollar. This year, the euro has depreciated by about 12 percent against the dollar, reaching near parity; the British pound is down to its lowest level since mid-1980s; the Japanese yen depreciated by about 20 percent, while the Indian rupee slid by about 7 percent.

According to a report by thehill.com, the strengthening dollar is increasingly seen "as a problem in Europe," where there are worries about a recession as currencies lose power to the greenback.

Chen Jia, an independent research fellow on international strategy, said that the first-stage signs of global currency system's fluctuations are already being manifested by the hiking dollar index and plunging global currencies, but the overflow effect of Fed's interest rate hikes will only grow more intense, with repercussions like sharpening pressure on US dollar financing costs, and negative effects on both supply chains and global market liquidity.

"In short, the overflow effect of Fed's interest rate hikes is like a butterfly effect, which will trigger deep-level problems across the global economy and likely drag global economy into a period of stagnation," Chen told the Global Times.

He also noted that a byproduct of Fed's increasing lack of monetary policy independence is the rise of crypto tokens in the US as people try to remove themselves from the dollar system using scientific means.

"If the US government can't face up to its economic structural contradictions, control over inflation will be nowhere in sight, and domestic investors' dedollarization efforts will continue," Chen said.

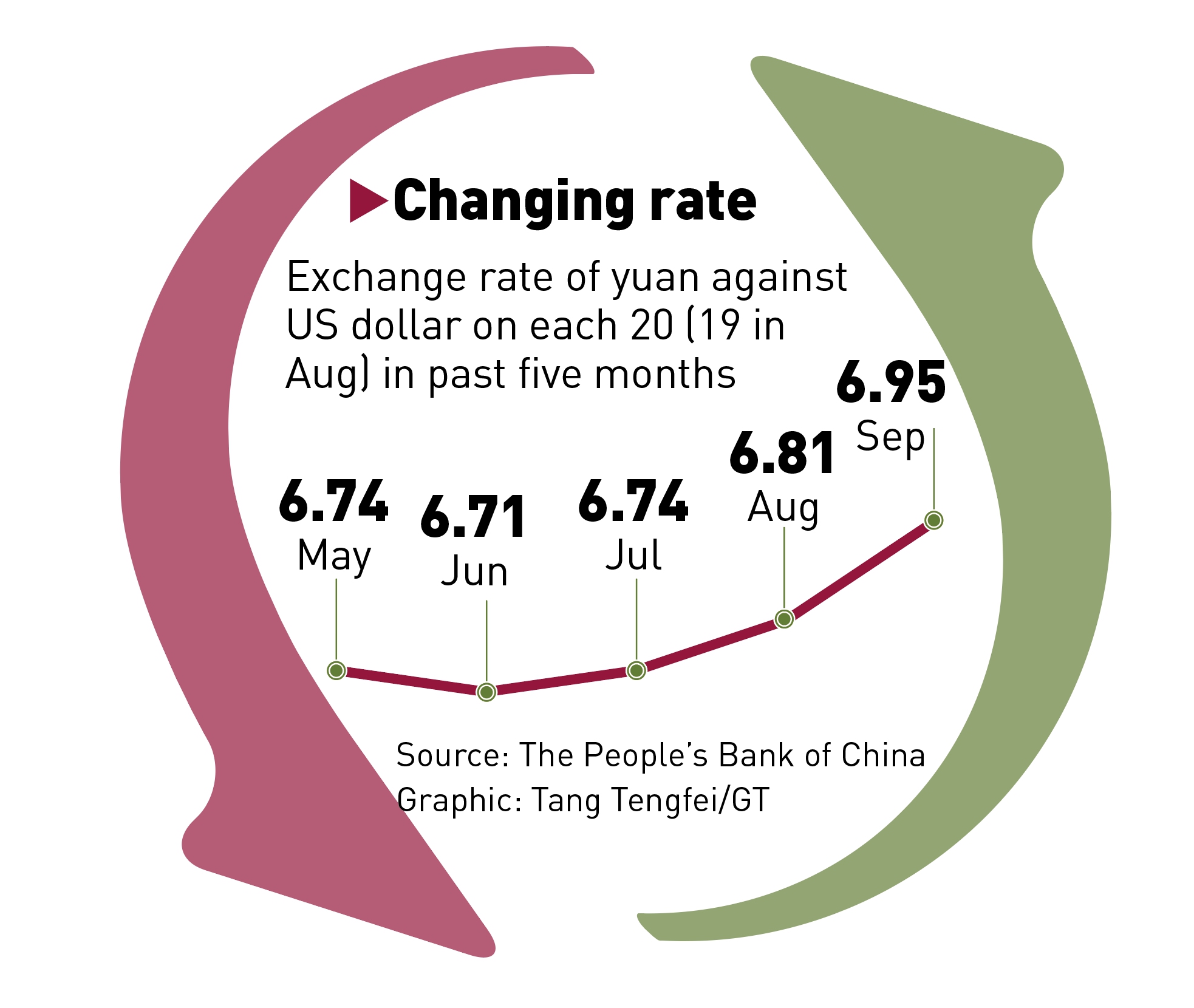

Graphic: Tang Tengfei/GT

The yuan's stability

As the US dollar climbs to near record levels, countries are using different methods to offset the influence of the dollar rise on their currency market and economy.

According to a Bloomberg report, the Bank of Korea has asked foreign-exchange traders to provide hourly reports on the demand for dollars, as authorities ramp up oversight of the currency markets to help stem a slide in the won.

Europe intends to react with similar interest rate hikes. The European Central Bank raised interest rates 75 basis points on September 8 to tackle record inflation.

The response from Chinese authorities was generally calm, as China's currency market was less affected by the greenback rise compared with many other economies, although there was broad public discussion when the yuan's exchange rate broke the psychological barrier of 7 per dollar. On Tuesday, China kept its benchmark lending rates unchanged.

Offshore yuan stood at 7.02 against the greenback as of press time, compared with 6.38 on April 15. The yuan depreciated by 10 percent during the period.

Experts noted that it's an inevitable trend that countries will strengthen efforts to lower their reliance on the US dollar, but will differ in pace in different regions.

According to Wang, EU's dedollarization push will be relatively slow because of the US' strengthening control. Latin American and Asian countries' campaign for dedollarization will be much stronger, but they might not dare to challenge the hegemony of the dollar with their limited strength.

"I think they will pay close attention to strength changes among powerhouses and wait for opportunities to get rid of the financial harvest of the United States," Wang said.

On the other hand, more and more countries are turning to yuan denominated assets not only to reduce reliance on the dollar but also to favor the yuan's stability. According to media reports, Saudi Arabia is considering settling its oil trade with China in yuan.

"The historic opportunity for the yuan's internationalization has come, but the actual process depends on China's strength," Wang said, adding that officials should consider propping up the yuan if the yuan slides to 7.2 against the greenback.

Chen also said that the disruption on global markets following multiple Fed rate hikes would stimulate the dedollarization process, which in turn creates further importance for the yuan to go global.