China's independent monetary policy offers buffer against risks from US rate hike: analysts

China's financial markets relatively stable after US rate hike

Lujiazui, a financial zone in Shanghai Photo: VCG

The Chinese mainland's financial markets remained relatively stable on Thursday in the wake of an overnight US interest rate hike that injected fresh volatility into global markets, thanks to the country's independent monetary policy and increasingly mature abilities to counter risks, analysts noted.

China's independent policy direction also offers a buffer for the global economy, which is suffering from the negative impact of dollar volatility, while China's own financial stability makes yuan assets safer for overseas investors, they said.

The US Federal Open Market Committee on Wednesday hiked its key interest rate by 75 basis points (bps) as it continued to fight soaring inflation. It was the Fed's fifth interest rate hike this year and the third time the Fed hiked rates by 75 bps.

China's stock markets slightly eased on Thursday. The Shanghai Composite Index slipped by 0.27 percent, the Shenzhen market was down 0.84 percent, and the tech-heavy ChiNext board edged down by 0.52 percent. In comparison, the Dow Jones Industrial Average slid 1.7 percent.

The Chinese yuan's central parity exchange rate weakened 262 bps to 6.9798 against the US dollar on Thursday, according to the China Foreign Exchange Trade System. The offshore yuan at one point dropped past 7.1 per dollar, and it stood at 7.08 per greenback as of press time.

The relative stability in the Chinese mainland markets reflected multiple factors, including the fact that market participants had already priced in the Fed's rate hike, and that China's counter-cyclical operations are increasingly mature, particularly against the greenback, experts said.

As global central banks are expected to follow the US Federal Reserve's footsteps in hiking interest rates, experts said China's monetary policy will remain independent, with the central bank not hiking but cutting interest rates to boost the economy.

"China is sure to adopt independent monetary policies, as the country's inflation rate is very moderate, while policy space exists for further interest rate cuts in order to lift the economy," Xi Junyang, a professor at the Shanghai University of Finance and Economics, told the Global Times on Thursday.

According to Xi, China might cut the loan prime rate by another 25 bps before the end of this year.

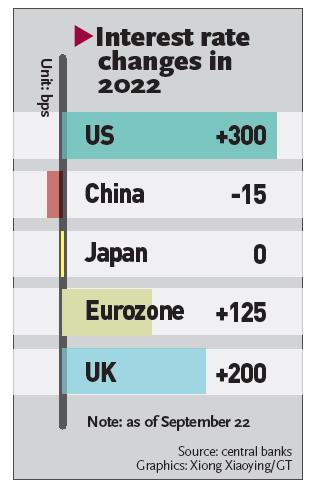

Interest rate changes in 2022 Graphic: GT

Chen Jia, an independent research fellow on international strategy, also said that China's monetary policy toolbox has "enough tools" counter pressure. For example, the People's Bank of China, the central bank, might restart the counter-cyclical factor if the US dollar surges too strongly under the Fed's excessive rate hikes. Also, it is possible that China would roll out more innovative monetary policy tools, he told the Global Times.

The government has already launched some of those tools, such as refinancing for scientific innovation industries.

"China's independent monetary policy and increasingly stable yuan system are offering new reserve options and policy thinking for other countries. More and more countries and regions are starting to choose the yuan for their reserves and use the yuan in settlements," Chen said.

Compared with the mainland, however, the impact of Fed rate hikes on Hong Kong and Macao is more direct, which means that the two special administrative regions are prone to adopt rate hikes to prevent capital outflows.

"In particular, Hong Kong is likely to synchronize with the US in terms of monetary policy, as the region is deeply integrated with global capital, given the large-scale presence of foreign companies in its real economy," Xi said.

Hong Kong on Thursday raised its base rate by 75 bps to 3.5 percent. The city's currency is pegged to the greenback in a tight range of 7.75-7.85 per dollar.