chip Photo:VCG

The US reportedly plans to organize the preliminary "Chip 4" meeting this week, and another science and technology meeting with the island of Taiwan in early November, to bring semiconductors manufacturing back to the US land, while try to exclude the Chinese mainland from the global supply chain.

The first meeting of the US-led "Chip 4" semiconductors alliance is expected to take place this week, the Korea Herald reported.

At the first meeting, working-level officials of the US, South Korea, Japan and the island of Taiwan are expected to participate remotely. They are expected to discuss setting the identity and trajectory of the envisioned chip alliance, according to the report.

Meanwhile, the island of Taiwan and the US are expected to have a meeting on science and technology issues in November with semiconductors as the focus, the China Times reported on Sunday. Other topics include biomedicine, telecom, artificial intelligence and space environment and technology, according to the report.

Participants from the island and the US will discuss ways to deepen research on semiconductors, Wu Tsung-tsong, an official of Taiwan's science authorities, said.

As the most-watched field in cooperation between the US and the island of Taiwan, the two sides may proceed with negotiations to have Taiwan chipmakers set up factories in the US, experts said.

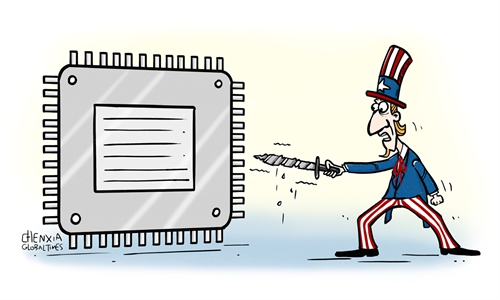

The US has been pushing to tighten control over the Taiwan semiconductor industry by asking leading chip makers to bring their advanced manufacturing capacity to the US, while excluding the Chinese mainland from the supplies, Xiang Ligang, an independent technology analyst, told the Global Times on Monday.

However, such moves will meet with strong resistance from Taiwan enterprises. From the perspective of the regional economy, if leading Taiwan manufacturers go to the US to set up factories, there will be inevitable problems such as a hollowing-out of high-end manufacturing in the island, Xiang said.

"It is estimated that the cost of building a factory in the US is 50 percent higher than in Taiwan, and it takes much longer, and operating costs are likely to double. There may also be a problem with recruiting and retaining talent," Xiang said.

The same applies to the formation of the so-called "chip alliance," which is aimed at containing China's growth in the industry, as the alliance still has big conflicts of interest, experts said.

While the US is a chip design powerhouse, the other three parties have edge in manufacturing and production of critical equipment and materials.

The US hopes to create a monopoly that will exclude other parties from the bloc, however, the idea is too big to come true, Zhang Xiaorong, director of the Beijing-based Cutting-Edge Technology Research Institute, told the Global Times on Monday.

"It is obvious both Japan and South Korea hope to find a win-win strategy between the China and the US, especially for South Korea, which has made a large investment in Chinese mainland," Zhang said.

Samsung's CEO recently said that the company is trying to seek a "common denominator" in the China-US chips tussle, Reuters reported.

"We're not riding on the conflict between the US and China, but we're trying to find a win-win solution," he said, adding that it is hard for Samsung to give up the Chinese mainland market.

For Japan, its main concern could be how the Japanese semiconductor industry chain will dominate the alliance and how the US will compensate the Japanese semiconductor industry for enforcing the US plan of decoupling from China, Chen Jia, an independent analyst, told the Global Times on Monday.

"The chip alliance remains a concept with little substantive progress, as the strategic interests of the four sides are varied," Chen said.

China's relatively complete chip industry chain makes it difficult to be replaced in the short term, experts said.

"The US' move to forcibly interfere with the division of labor in the chip industry will only increase market chaos and affect the development of the information industry," Zhang said.

The mainland's semiconductor equipment localization process is accelerating, which will consolidate the independence of the upstream of the industry.

China has set a goal of producing 70 percent of the semiconductors it uses by 2025.

Global Times