Central Bank seeks local currency settlements with ASEAN, neighboring countries as yuan globalization gains pace

More economies store Chinese assets, helping push de-dollarization

Renminbi Photo: VCG

China's central bank has set its sights on streamlining overseas investors' access to yuan-denominated financial assets while seeking local currency settlements with ASEAN economies and neighboring countries, as part of a broad push to globalize the Chinese currency, according to an official article on Sunday.

Reckoning advances in the yuan's gradual globalization as the Chinese economy has over the years risen to global prominence, experts noted that a more internationalized yuan resonates with a growing call for de-dollarization efforts in the world.

The Macro-prudential Policy Bureau of the People's Bank of China (PBC), the country's central bank, penned a post on the bank's WeChat account on Sunday, outlining the central bank's plans for a global yuan.

The central bank eyed pushing the financial market to shift toward a comprehensive and institutional opening and improving the liquidity of yuan-denominated financial assets, read the post.

The central bank will continue to streamline the process of overseas investors funneling capital into the Chinese market and enrich investable asset portfolios, facilitating the allocation and holding of yuan assets by global central banks, among other institutions.

Additionally, the central bank vowed to explore the possibilities of local currency settlements with ASEAN members and China's neighboring countries. The Chinese central bank revealed plans to push for the yuan's direct transactions with other currencies and support overseas economies in the development of local yuan foreign exchange markets.

Among the next moves is a continued effort to improve the supply mechanism for offshore yuan liquidity with enriched portfolios in Hong Kong and other offshore yuan markets.

Such plans build on the yuan's rising global clout over the past decades as the economy has grown to be the world's second largest. This, coupled with two-way deregulation of the capital market, is seen as paving the way for the greater use of the yuan in cross-border settlement and investment - and more importantly, for the yuan to be increasingly adopted as a global reserve currency, Dong Dengxin, director of the Finance and Securities Institute of the Wuhan University of Science and Technology, told the Global Times on Sunday.

As the Sunday post put it, the yuan's gradual move to be internationalized is a historically inevitable outcome of the country's growing strength and reform and opening-up. The yuan's rising global status also signals global optimism on China's economic development.

The central bank's latest remarks about the yuan's globalization, adding to its yuan-bolstering measures over the past month, could mitigate the depreciating pressure on the yuan, Tan Yaling, head of the China Forex Investment Research Institute, told the Global Times Sunday.

The PBC announced a cut in the amount of forex deposits that financial institutions are required to set aside as reserves and a subsequent increase in the risk reserve requirement for forward forex trading, in September.

On top of that, a clearer road map toward globalizing the yuan, as crystallized by the PBC, is envisioned to paint the Chinese currency as the linchpin of a global push for de-dollarization, Dong noted.

The unreasonable strength of the US dollar amid the US Federal Reserve's aggressive rate hikes pits the greenback against other currencies, stoking concerns over the US tilting toward an epicenter of global financial turmoil and prompting more countries to join the push to seek alternatives to the dollar, he said.

The PBC's unparalleled monetary independence, underpinned by the country's economic prowess, renders the yuan a more reliable choice for cross-border settlements and investments if the dollar is to be replaced, the professor opined.

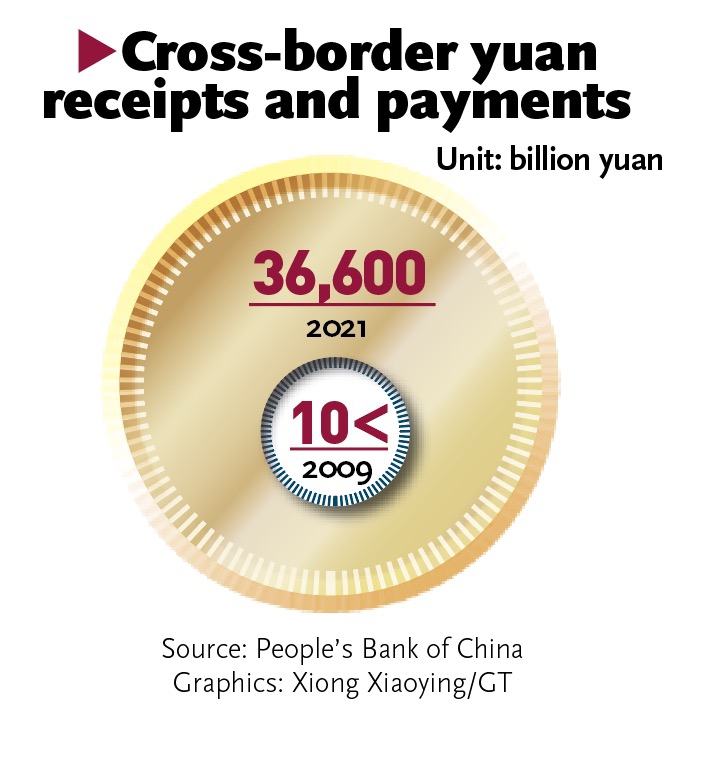

Last year, domestic banks handled cross-border yuan receipts and payments on behalf of clients totaling 36.6 trillion yuan ($5.14 trillion), an increase of 29 percent from the year before, accounting for 47.4 percent of total cross-border receipts and payments in local and foreign currencies, official data showed.

In the first eight months of the year, total cross-border yuan receipts and payments were up 15.2 percent year-on-year to 27.8 trillion yuan. Its percentage of total cross-border receipts and payments climbed to 49.4 percent.

Further, overseas economies that had cross-border yuan receipts and payments with Chinese domestic businesses or individuals hit 220 over the first eight months this year.

Cross-border yuan receipts and payments Graphic: GT

In another sign of the yuan's rising popularity, more than 80 overseas central banks or monetary authorities have included the yuan into their forex reserves to date.

As of the end of the second quarter, global central banks held yuan reserves worth $322.38 billion, or 2.88 percent of their total forex reserves, according to IMF statistics. This suggests an uptick of 1.8 percentage points from the level in 2016 when the yuan was added to the IMF's special drawing rights (SDR) basket.

In May, the IMF raised the yuan's weighting in the SDR basket to 12.28 percent from the 2016 reading of 10.92 percent.