File photo

Since March, the US Federal Reserve has raised interest rates by 300 basis points, entering a radical interest hike cycle. Yet, the US' stubborn hawkish monetary policy will not have an obvious impact on China's foreign trade as the market is concerned.In fact, US interest hikes may boost China's exports. The series of US' rate hike has driven the US dollar up against the Chinese yuan, strengthening the competitiveness of China's exports. Meanwhile, the US' interest hike is not likely to have much impact on China's imports as China's imports are mostly commodity and raw materials.

China's foreign trade reached 27.3 trillion yuan ($3.8 trillion) in the first eight months of 2022, up 10.1 percent year-on-year. China's foreign trade in August was 3.71 trillion yuan. The growth rate in August was 7.9 percentage points lower than July, which is within a normal range and mainly due to three reasons.

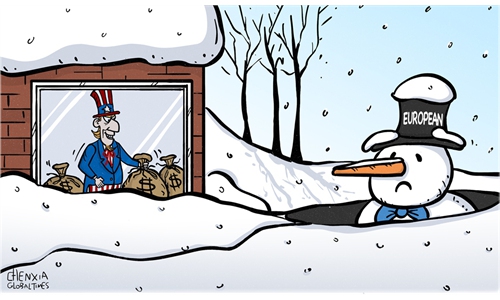

First, factories usually do not place orders in June-August period, resulting in a drop in demand. Second, since the outbreak of the Russia-Ukraine conflict, many European factories, including those in Germany, France, and Austria, have been shut down due to shortages of natural gas and crude oil, further dragging down demand. Third, the overall European economy underperformed in July and August, dragging down production demand.

However, there is no reason for unwarranted panic, as the next few months is a critical period. The Christmas holiday arrives in December, usually orders are placed in September, goods will be sent in October, arrive in November, and hit the market in December, which is a critical period for foreign trade.

The Russia-Ukraine conflict has sparked a natural gas and energy shortage. All the winter essentials, including heaters, blankets and snowplows, will likely experience rising demand. This may also spill over into demand for labor intensive products such as electronics and consumer products.

Whether in the US or Europe, transport costs have risen due to rising ocean freight rates, port strikes and other factors. The original inventory of goods has been reduced and needs to be replenished.

For instance, US retail giant Walmart, which has more than 600 warehouses in the US, is importing goods to replenish its local inventory. The freight cost from Chinese ports to the east coast of the US has decreased by 80 percent, and 70 percent to the west coast. Freight will further decrease, and retailers and importers will import in large quantities to replenish inventories.

In general, China's trade will reach two-digit growth in the fourth quarter and is expected to hit new highs.

At present, the economic growth of major economies such as Europe and the US is slowing, and the demand of developed markets is correspondingly weak. Therefore, there is a view in the market that it may affect China's export trade data in the fourth quarter. In fact, on the contrary, from the current global situation, the world needs more Chinese goods.

First, China can supply the US with cost-effective goods. China is the only country that can meet urgent needs and complete deliveries. China has the most complete production and supply chain in the world.

Second, despite the sluggish performance of the European and US economies, spending on daily necessities remains strong.

Third, Chinese products, regardless of quality or price, have gained global recognition. Whether developed countries or developing countries, the more difficult the time is, the more they hope to obtain products with good quality, durability and low price. After decades of reform and opening up, many Chinese products have won recognition in the world.

In general, this year, the world needs more Chinese products. The more difficult the time is, the worse the economy is, the more orders will be placed.

The author is a former Chinese vice minister of commerce and executive deputy director of the China Center for International Economic Exchanges. bizopinion@globaltimes.com.cn