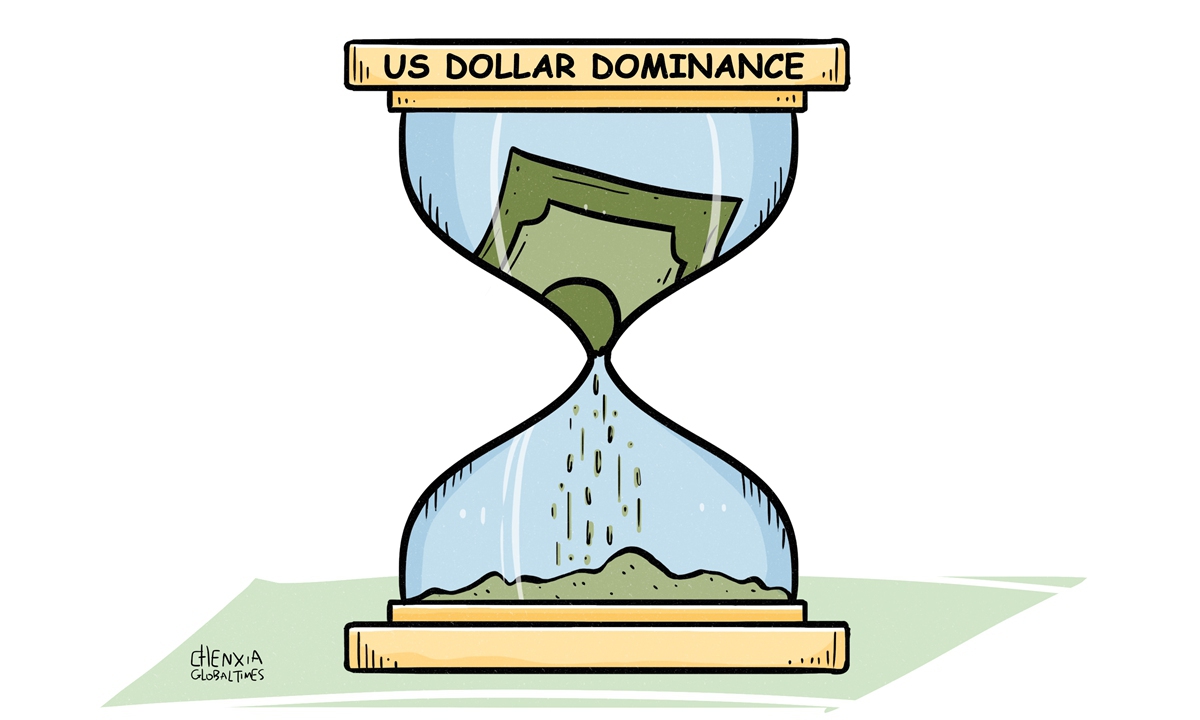

Illustration: Chen Xia/Global Times

Egypt will develop a new currency indicator partly to reframe the idea that the Egyptian pound should be pegged to the US dollar, the country's central bank governor said, according to Reuters.As a strong dollar has become a hazard for global economy, economies across the world have realized the urgency of de-dollarization. Many countries have started their own exploration according to their national condition to tackle the impact caused by the US' highly reckless and irresponsible financial policy.

The new currency indicator of Egypt is a helpful trial among countries aiming for de-dollarization.

In order to tackle the spillover impacts from the US' tightened monetary policy on other economies, many countries across the world have started their de-dollarization exploration in ways including using bilateral and multilateral currency agreements to settle transactions in international trade, promoting the diversification of foreign exchange reserves, and reducing US Treasury holdings.

De-dollarization is not a voluntary choice made by countries such as Egypt, but a forced response to the "weaponization" of the dollar. The strong US dollar policy is exacerbating serious inflation, currency devaluation and capital outflow in developing countries. To avoid being dragged into a crisis, de-dollarization has become an increasing priority for those nations.

Admittedly, it is not an easy task to avoid being pulled into a financial crisis caused by the strong dollar. There still remain uncertainties in their efforts to cope with current financial problems. They still face mounting challenges in how to maintain financial market and foreign trade stability and take proper measures and steps to avert a crisis.

Ending dollar hegemony is not an easy goal, but the process has already begun, and momentum will become more obvious and stronger over time. As more and more countries join, it is now necessary for the world to explore how different countries should work together to coordinate their efforts to address the common challenge of the US dollar hegemony and maintaining the stability of the world monetary system while de-dollarization gathers pace.

Now some countries and some international cooperation platforms have begun to coordinate attempts on de-dollarization, such as BRICS. In the context of the weakening US dollar hegemony, developing countries all over the world need a more stable type of financial mechanism as a new channel for conducting financial transactions. The BRICS and other international platforms are trying to work out solutions.

In June, Russia proposed at a BRICS-related meeting that it is advancing the development of a reserve currency based on the BRICS basket of currencies. As early as 2019, Germany, the UK, and France established the INSTEX system to help European companies bypass US dollar settlements, and now more and more countries have joined the system.

In Asia, the central bank of India launched a rupee settlement mechanism for international trade in July; five ASEAN economies reached a consensus in July to plan to establish a regional integrated payment network to bypass the US dollar for direct foreign exchange settlement.

However, this coordination is still in its early stages. It is worth exploring how all parties should strengthen global coordination. Strengthening global coordination for de-dollarization is fundamentally a political decision, not an economic one, for many economies. Facing the new geopolitical landscape and the impact of a strong dollar, countries across the world should take a longer-term view and strive to strengthen de-dollarization coordination.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn