A LNG tanker arrives at a port of Groningen, Holland on September 4, 2022. Photo: VCG

As spot prices of natural gas in Europe and the US dropped abnormally into negative territory, Chinese experts on Wednesday warned of lingering instability in the global energy market and the continuing energy crisis in Europe.

According to a Bloomberg report, gas for next-day delivery at the Waha Trading hub in west Texas dropped to around negative $2 per million British thermal units on Tuesday. That compared with about $5 a week earlier, and it was the first time that natural gas prices in the region dipped below zero since 2020.

The situation was triggered by the contradiction between surging gas production in the Permian Basin region and pipeline constraints, overseas media reports said. A Financial Times report, for example, cited an industry analyst as saying that there's "too much production" but not enough avenues to get the production out.

Europe also saw a slump in natural gas spot prices. On Monday, the spot price on the Dutch gas trading hub Title Transfer Facility plunged below zero, a record low.

Europe's rush to increase imports of liquefied natural gas (LNG) from around the world after supplies from Russia declined led storage to be filled up at a faster pace than usual, and Europe does not have too much extra space for the inflow of imported LNG, according to media outlets.

Also, the winter is turning out to be warmer than expected. Bloomberg on Tuesday cited a senior meteorologist as saying that the European gas glut is expected to last until at least December, and it's unlikely that the region will see a prolonged cold spell in November.

However, calling the recent gas price drop as an abnormal phenomenon, Chinese experts said that the development shows turbulence in the global energy market persists and Europe's energy problems are not over.

"The inventories of natural gas won't last very long, and the fact that its storage is full currently does not mean that Europe can resolve the issues related to natural gas supply in the long term," Gao Xinwei, a professor at the School of Economics and Management under the China University of Petroleum, told the Global Times on Wednesday.

Chen Jia, an independent research fellow on international strategy, said that negative natural gas prices in Europe and the US reflect the global logistics bottleneck. The suspension of the Nord Stream pipeline intensified the supply chain crisis and caused gas shipment costs to surge, and LNG storage costs also climbed as European inventory neared limitations.

"The negative prices reflect a market imbalance, not excessive supply. As Europe's winter season approaches, energy demand peaks including LNG will soon appear, and as long as Russian pipeline supplies can't be restored, Europe's demand for LNG can hardly be met," Chen said.

He said that inventories would soon decline and prices would turn positive again.

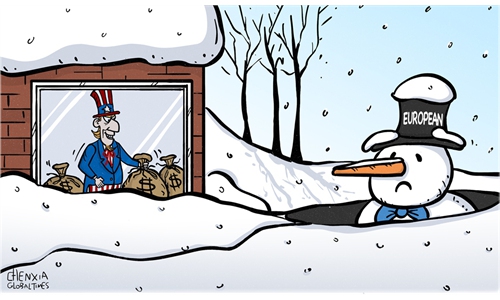

The US will be the big winner behind Europe's energy crisis, as it can enter the European gas market, which it used to have difficulty tapping.

"Because of changes in the global energy structure, Russia's influence on Europe will decline, and the US will increase its hold on the EU via energy cooperation, particularly natural gas exports," Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University, told the Global Times.