Rising e-commerce business drives a fast recovery of Chinese air-cargo business

China’s e-commerce to drive up express logistics 4.9% on average annually: expert

A cargo aircraft at Changzhou Benniu International Airport, East China's Jiangsu Province Photo: VCG

With the amount of parcels expected to surge during China's biggest annual online shopping festival, e-commerce platforms and couriers are ramping up efforts to improve delivery efficiency and quality.Industry insiders project that the total amount of parcels will maintain growth compared with last year's Double 11 shopping festival, despite the impact of COVID-19, with the sector expected to expand by around five percent for the whole year. The overall parcel volume during 2021 Double 11 shopping festival reached 696 million, up 18.2 percent year-on-year, according to the State Bureau of China.

Behind the robust growth, it is the fast recovery of China's air cargo market, which is also playing an important role in the fast growing business.

Taking Shanghai Pudong International Airport as an example, the number of inbound and outbound cargo flights at the airport reached 17,800 in the third quarter of this year, an increase of about 34.8 percent over the second quarter and an increase of about 6.6 percent over the same period last year.

Hangzhou Xiaoshan International Airport completed air cargo throughput of 478,000 tons from January to July this year, including 78,300 tons of air cargo in international and Hong Kong, Macao and Taiwan regions.

DHL Express told the Global Times on Monday that a series of initiatives linked to their facilities and air capacity have been put into operation at DHL Express Guangzhou gateway in October, including the establishment of a dedicated area for air express cargo handling at Guangzhou Baiyun International Airport, the expansion of landside freight area warehouses, and the additional cargo route linking Guangzhou to the Americas.

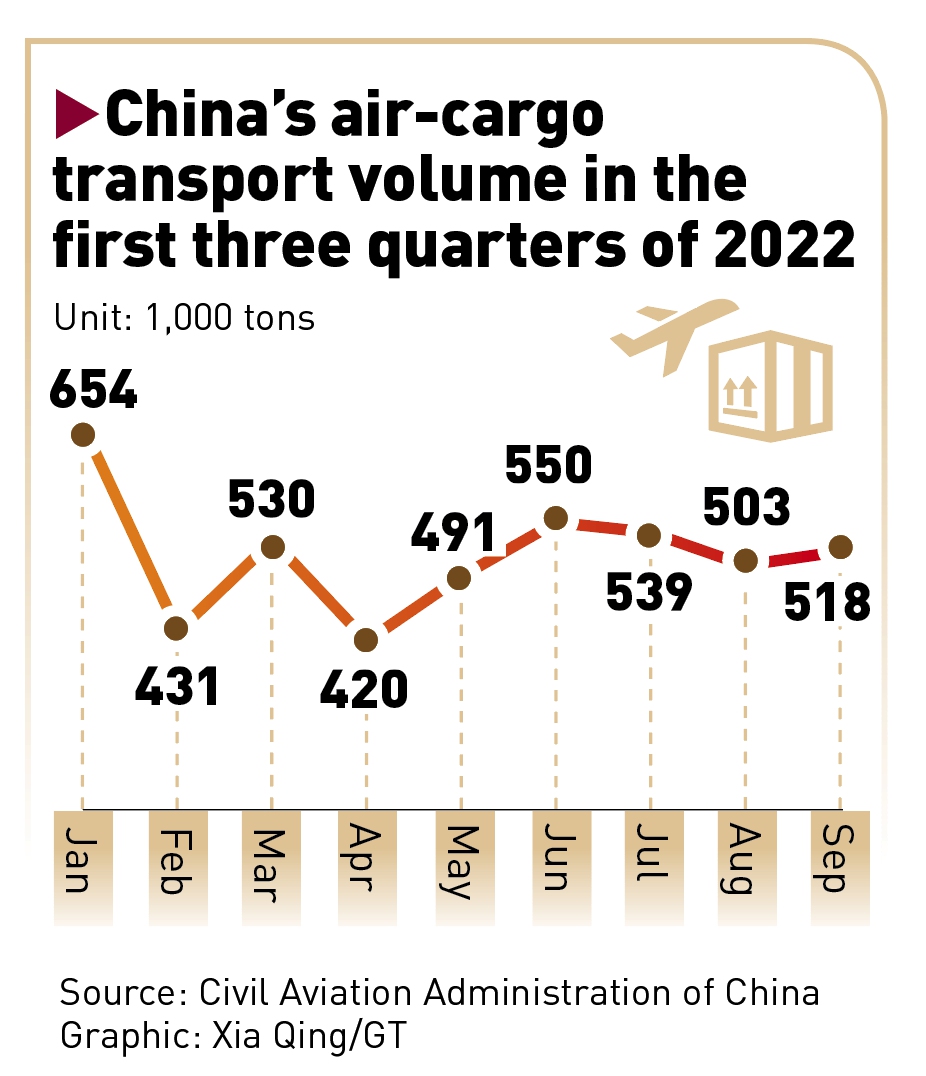

The air cargo transportation volume declined at the beginning of 2022 compared with the same period in 2019, but the volume has shown an increasing trend since April, Zhong Shan, an economist at China Academy of Civil Aviation Science and Technology told the Global Times on Friday.

Air cargo has two different delivery models, one is passenger aircraft belly cargo and the other is all-cargo aircraft.

The passenger aircraft belly transport has always been the main method for China's air cargo before the epidemic, with the ratio of all-cargo aircraft to belly-hold capacity being 3:7, according to Zhong, but in 2020, all-cargo aircraft transported 2.223 million tons of cargo, compared with 1.758 million tons of belly cargo, meaning all cargo business accounted for more than half of cargo transport.

In response to the impact of the epidemic, major airlines have tried to expand their air cargo businesses and increase revenue by introducing all-cargo aircraft or "passenger-to-cargo."

Sichuan Airlines said that its logistics arm has introduced three A330-200F freighters, and the 4th A330-300P2F freighter will be ready soon.

Graphic: Xia Qing/GT

Rising e-commerce businessAccording to the 2022-2041 air cargo market forecast made by Airbus, the e-commerce business will drive express logistics to grow at an average annual rate of 4.9 percent, becoming one of the most important new growth streams in the air cargo market, according to Zhang Hanguang, a senior airline marketing analyst for Airbus China.

Zhang added that the growth of international trade has provided strong demand for air cargo, which in turn has driven the demand for freighter aircraft.

Data from China Customs showed that China's cross-border e-commerce import and export scale has increased nearly 10 times in the past five years. The proportion of cross-border e-commerce in foreign trade increased from less than one percent in 2015 to 4.9 percent in 2021.

After the outbreak of the epidemic, in response to the impact of the epidemic, online demand of consumers in various countries and regions has continued to grow, providing opportunities for the development of cross-border e-commerce.

Data from Ministry of Commerce showed that in 2021, China's cross-border e-commerce import and export scale stood at 1.92 trillion yuan ($263 billion), an increase of 18.6 percent year-on-year, maintaining rapid growth for two consecutive years.

Driven by a surge in online sales, e-commerce platforms and logistics companies have been making full preparations for the delivery of a growing number of parcels.

David Liu, southern area gateway director at DHL Express China told the Global Times that their gateway facility at Guangzhou airport has been expanded five times since it was put into use in 2006, and the area and cargo handling capacity is four and 20 times respectively than that of the time.

Cainiao, Alibaba's logistics branch, said that it has reserved additional warehousing facilities of over four million square meters in more than 20 cities across China, including "COVID backup warehouses," to support seven-day emergency storage allocation for the coming double 11 shopping fever.

The Asia-Pacific region will replace Europe as the world's largest regional market for international trade in the future, and China will undoubtedly be one of the most important markets driving the growth of the Asia-Pacific region," Zhang said.

The global fleet of freighter aircraft in service will reach 3,070 by 2041, of which 2,440 freighters will be gradually delivered to the market over the next 20 years to replace older models. Of the 2,440 freighters, 1,550 will be converted from passenger aircraft, and the other 890 will be new factory-built freighters, according to Airbus.

As far as the Chinese market is concerned, airlines' all-cargo aircraft currently only accounts for about 10 percent of the global total. With the growth of the market, the number of domestic freighter fleets will reach 690 by 2041, accounting for more than 20 percent of the global market. Of these, 630 will be new freighters, accounting for more than 25 percent of the world's new freighter fleet, according to Su Jing, Airbus China Commercial Aircraft Sales Director.